[ISC] Q. 19 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 19 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

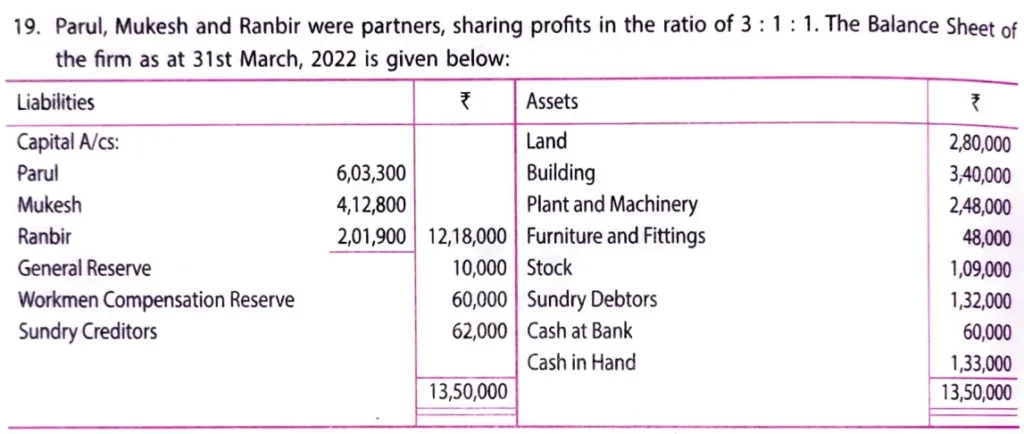

Parul, Mukesh and Ranbir were partners, sharing profits in the ratio of 3 : 1 : 1. The Balance Sheet of the firm as at 31st March, 2022 is given below:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Parul Mukesh Ranbir General Reserve workmen Compensation Reserve Sundry Creditors | 6,03,300 4,12,800 2,01,900 10,000 60,000 62,000 | Land Building Plant and Machinery Furniture and Fittings Stock Sundry Debtors Cash at Bank Cash in Hand | 2,80,000 3,40,000 2,48,000 48,000 1,09,000 1,32,000 60,000 1,33,000 |

| 13,50,000 | 13,50,000 |

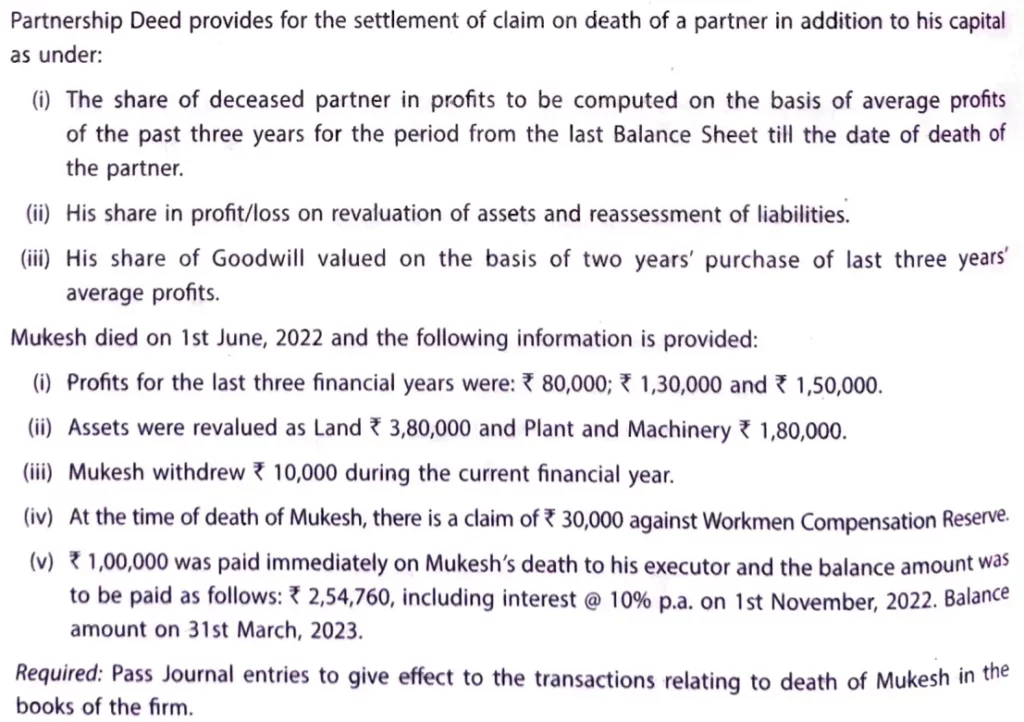

Partnership Deed provides for the settlement of claim on death of a partner in addition to his capital as under:

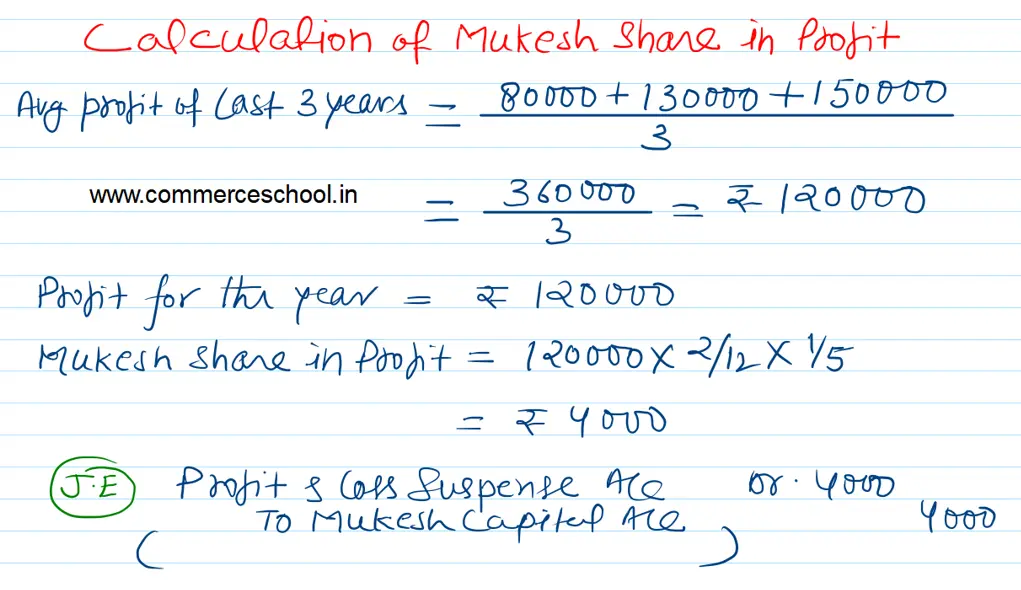

(i) The share of deceased partner in profits to be computed on the basis of average profits of the past three years for the period from the last Balance sheet till the date of death of the partner.

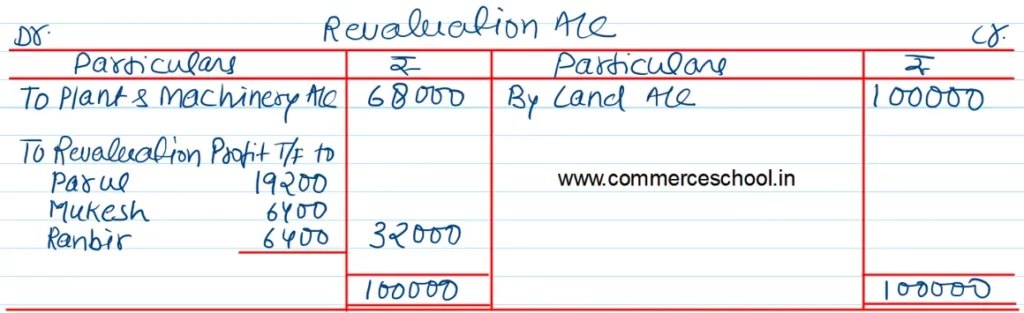

(ii) His share in profit/loss on revaluation of assets and reassessment of liabilities.

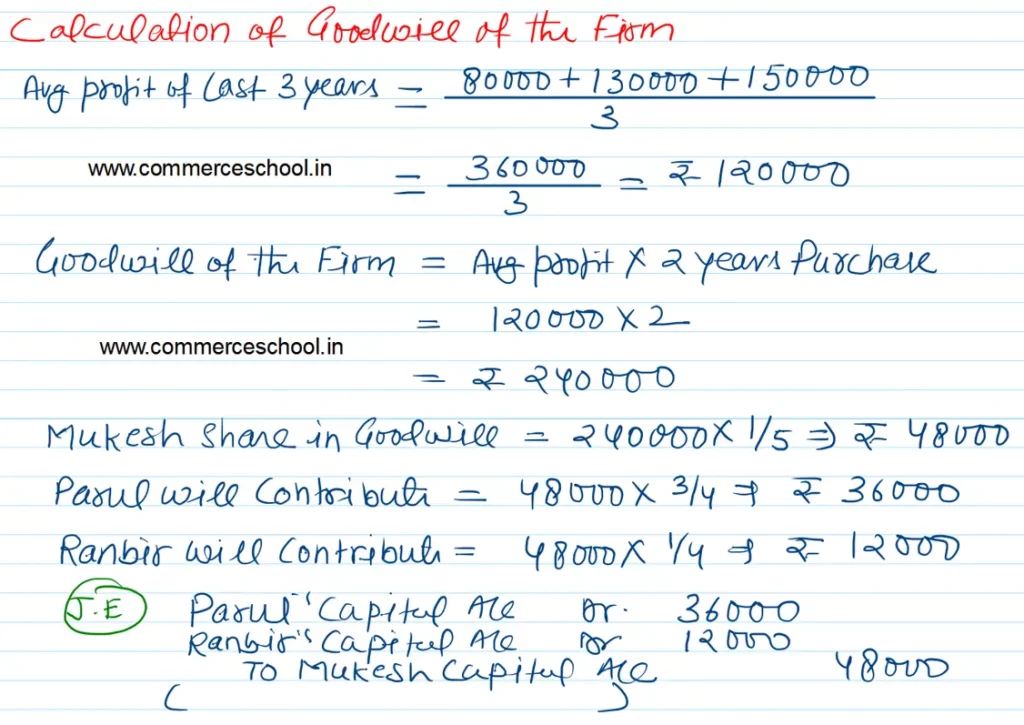

(iii) His share of Goodwill valued on the basis of two year’s purchase of the last three years’ average profits.

Mukesh died on 1st June 2021 and the following information is provided:

(i) Profits for the last three financial years were: ₹ 80,000; ₹ 1,30,000 and ₹ 1,50,000.

(ii) Assets were revalued as Land ₹ 3,80,000 and Plant and Machinery ₹ 1,80,000.

(iii) Mukesh withdrew ₹ 10,000 during the current financial year.

(iv) At the time of death of Mukesh, there is a claim of ₹ 30,000 against Workmen Compensation Reserve.

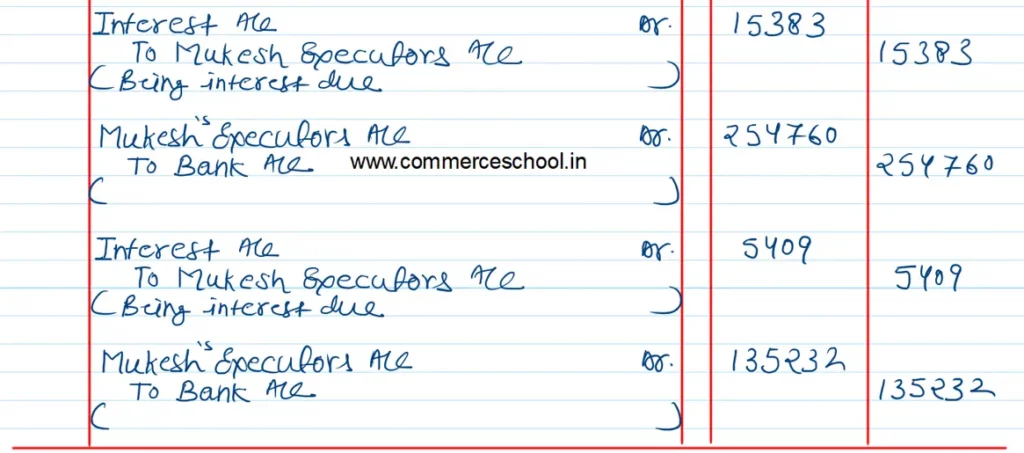

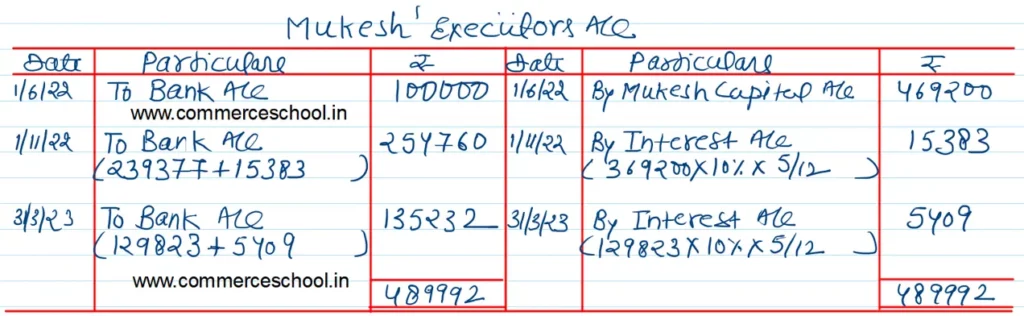

(v) ₹ 1,00,000 was paid immediately on Mukesh’s death to his executor and the balance amount was to be paid as follows: ₹ 2,54,760, including interest @ 10% p.a. on 1st November 2022. Balance amount on 31st March, 2023.

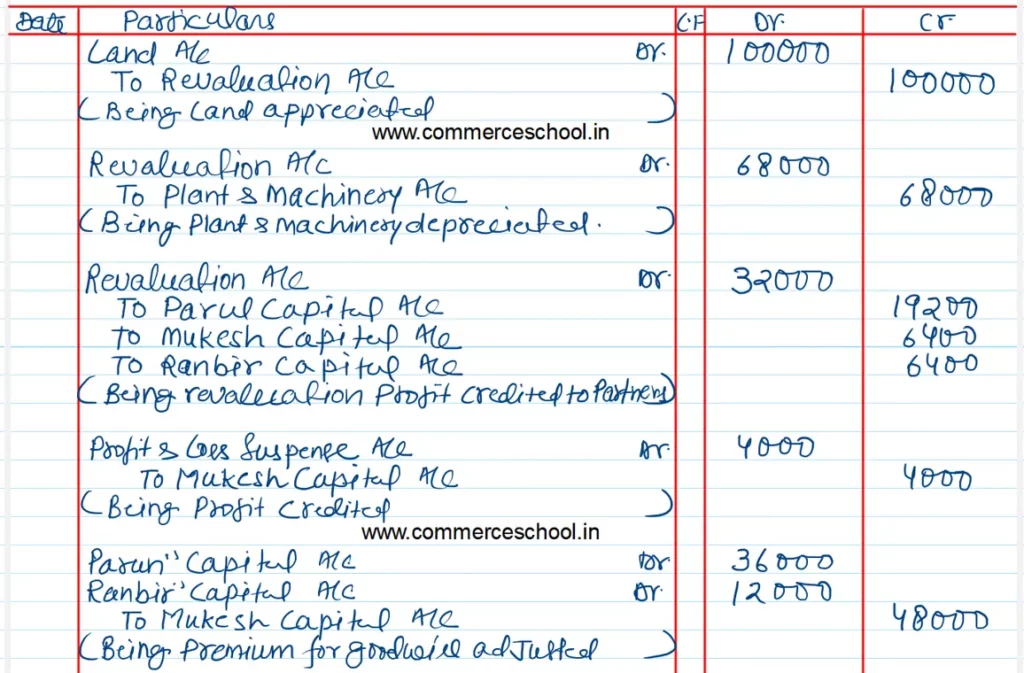

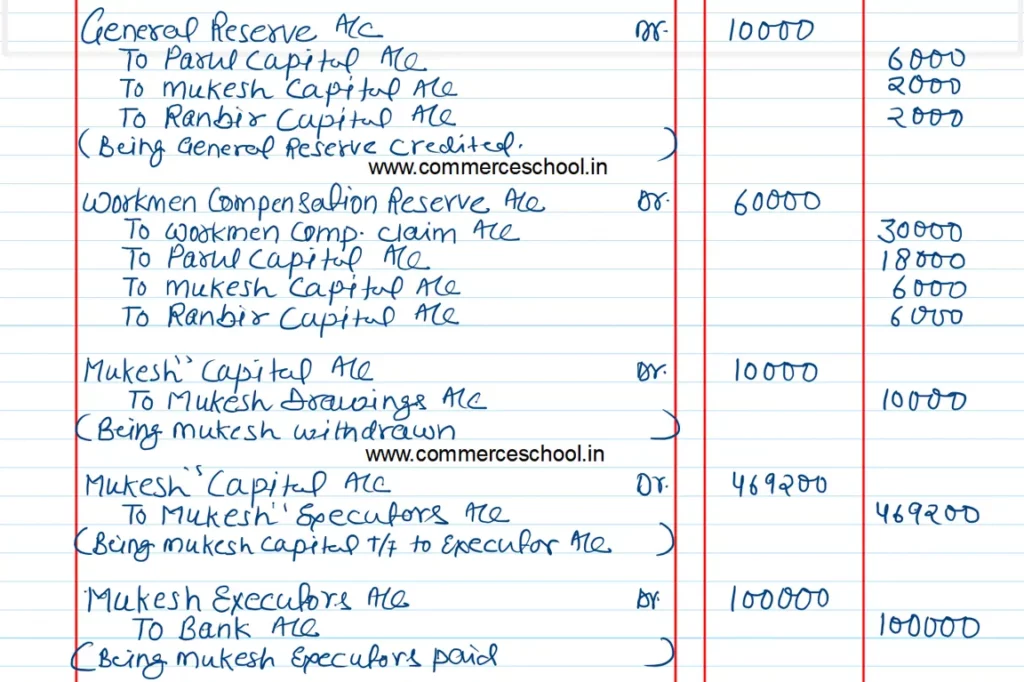

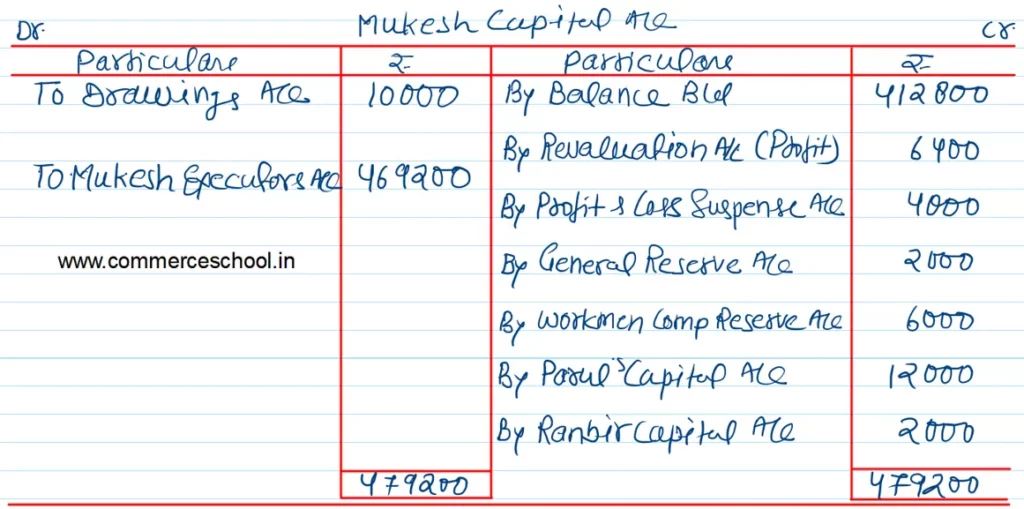

Required: Pass Journal entries to give effect to the transactions relating to death of Mukesh in the books of the firm.

Solution:-