[ISC] Q. 22 Retirement of Partner TS Grewal Solution Class 12 (2023-24)

Solution to Question number 22 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2023 – 24 session?

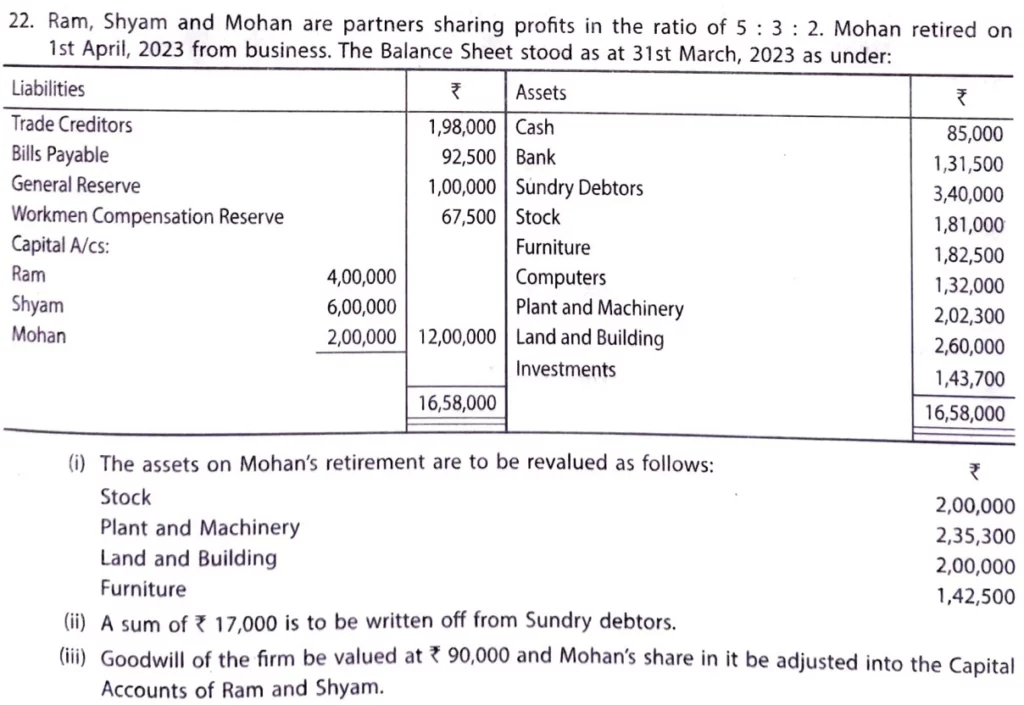

Ram, Shyam and Mohan are partners sharing profits in the ratio of 5 : 3 : 2. Mohan retired on 1st April, 2023 from business. The Balance Sheet stood as at 31st March, 2023 as under:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors Bills Payable General Reserve Workmen Compensation Reserve Capital A/cs: Ram Shyam Mohan | 1,98,000 92,500 1,00,000 67,500 4,00,000 6,00,000 2,00,000 | Cash Bank Sundry Debtors Stock Furniture Computers Plant and Machinery Land and Building Investments | 85,000 1,31,500 3,40,000 1,81,000 1,82,500 1,32,000 2,02,300 2,60,000 1,43,700 |

| 16,58,000 | 16,58,000 |

(i) The assets on Mohan’s retirement are to be revalued as follows:

| Stock | 2,00,000 |

| Plant and Machinery | 2,35,300 |

| Land and Building | 2,00,000 |

| Furniture | 1,42,500 |

(ii) A sum of ₹ 17,000 is to be written off from Sundry Debtors.

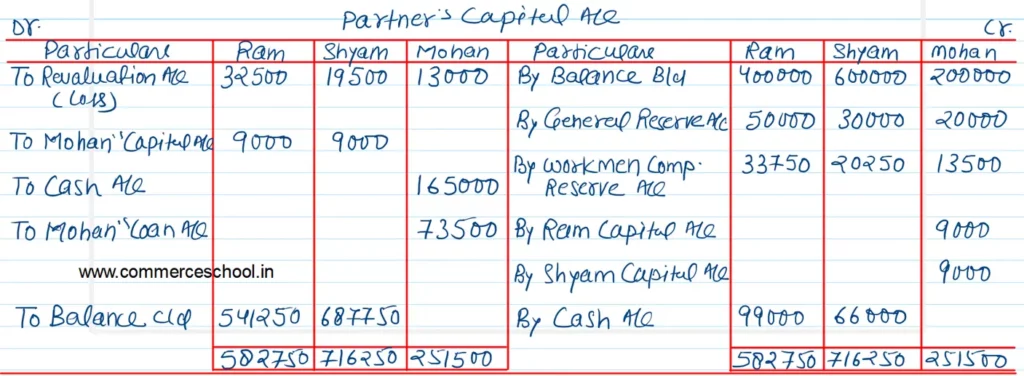

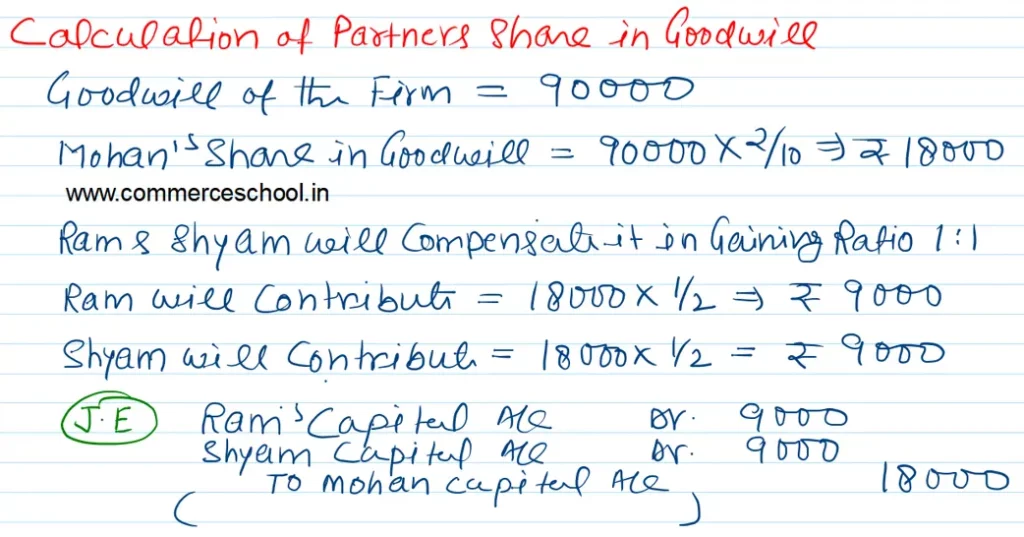

(iii) Goodwill of the firm be valued t ₹ 90,000 and Mohan’s share in it be adjusted into the Capital Accounts of Ram and Shyam.

The continuing partners agreed to pay ₹ 1,65,000 on retirement of Mohan, to be contributed by the continuing partners in their new profit sharing ratio which is 3 : 2. The balance in the Capital Account of Mohan is to be taken as Loan.

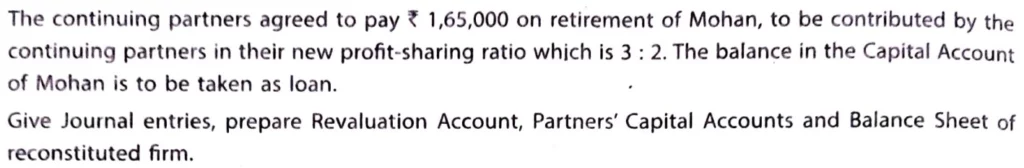

Give Journal entries, prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of reconstituted firm.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2023 – 24)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |