[ISC] Q. 23 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 23 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

Arnab, Ragini and Dhrupad are partners sharing profits in the ratio of 3 : 1 : 1. On 31st March, 2023, they decided to dissolve their firm. On that date their Balance Sheet was as under:

Balance Sheet of Arnab, Ragini and Dhrupad as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Loan by Pronoy (Arnab’s Brother) Loan by Dhrupad workmen Compensation Reserve Investment Fluctuation Reserve Capital A/cs: Arnab Ragini Dhrupad | 60,000 95,000 1,00,000 50,000 50,000 2,75,000 2,00,000 1,70,000 | Bank Debtors Less: PDD Stock Investments Building Profit and Loss A/c Advertisement Suspense A/c | 1,70,000 20,000 | 50,000 1,50,000 1,50,000 2,50,000 3,00,000 50,000 50,000 |

| 10,00,000 | 10,00,000 |

The assets were realised and the liabilities were paid as under:

(i) Arnab agreed to pay his brother Pronoy’s loan

(ii) Investments realised 20% less.

(iii) Creditors were paid at 10% less.

(iv) Building was sold for ₹ 3,55,000. Commission paid was ₹ 5,000.

(v) 50% of the stock was taken by Ragini at market price which was 20% less than the book value and the remaining was sold at market price.

(vi) Dissolution expenses were ₹ 8,000, ₹ 3,000 were to be borne by the firm and the balance by Dhrupad. The expenses were paid by him.

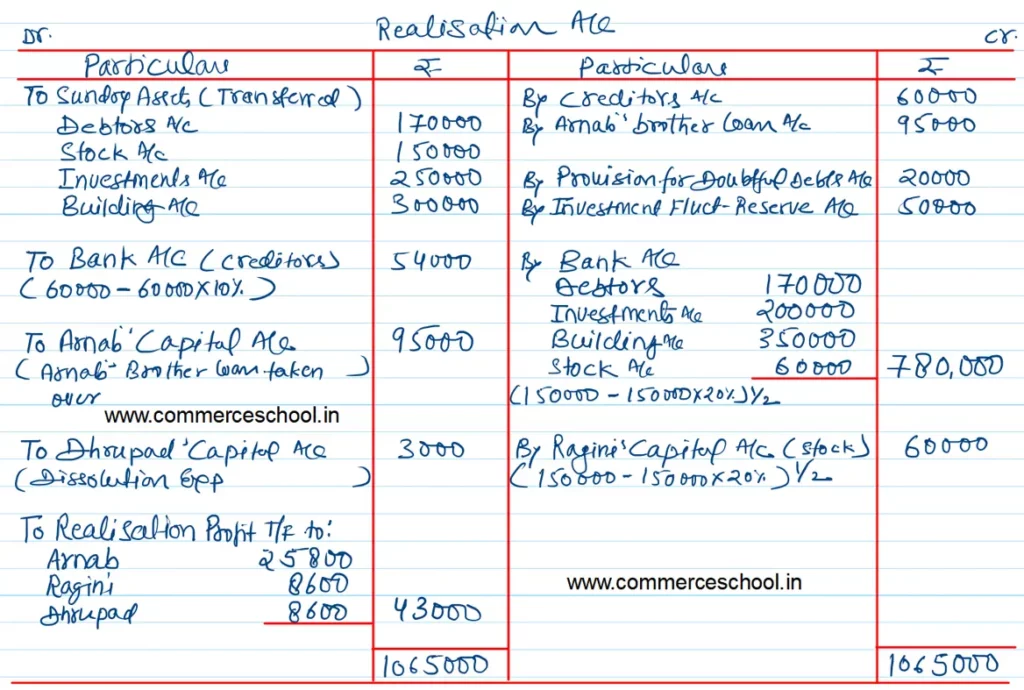

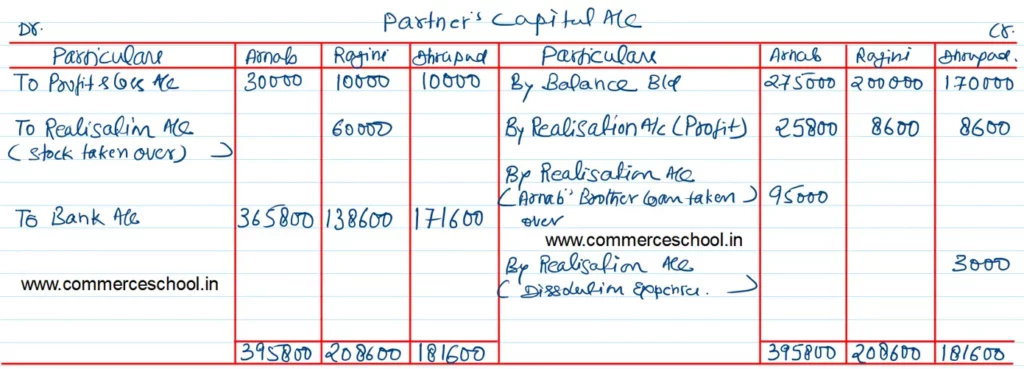

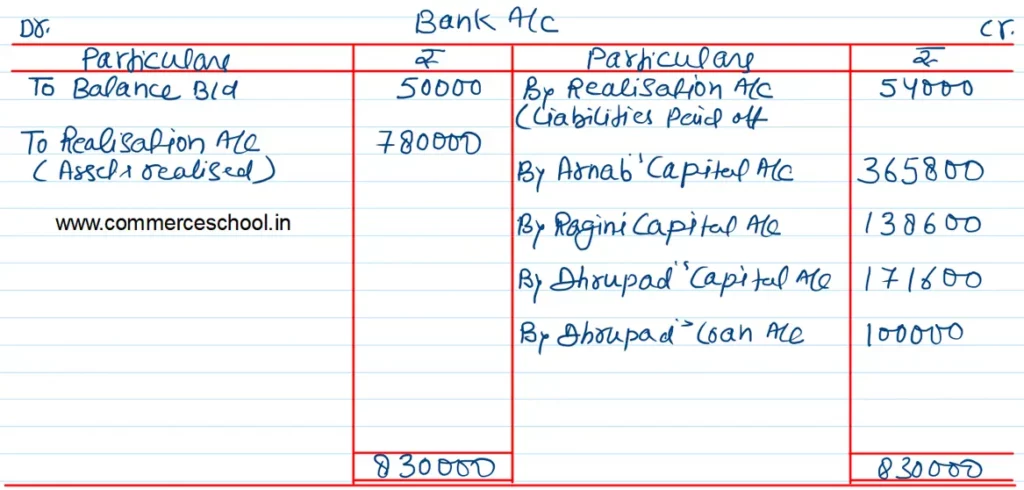

Prepare Realisation Account, Bank Account and Partner’s Capital Accounts.

Solution:-

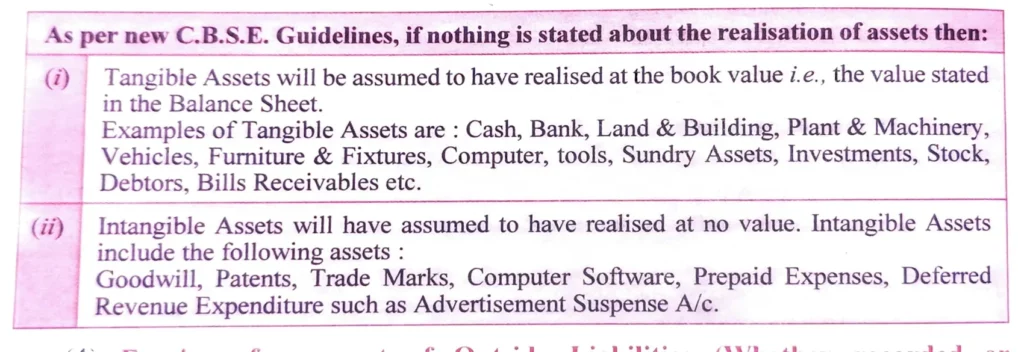

In this question Debtors would be realised, it is the tangible current assets. the answer given in the book is wrong.

Below is the Screenshot of D.K Goyal’s book in this regard.

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |