[ISC] Q 23 Solution Depreciation TS Grewal Class 11 (2023-24)

Solution of Question number 23 Depreciation TS Grewal class 11 ISC 2023-24?

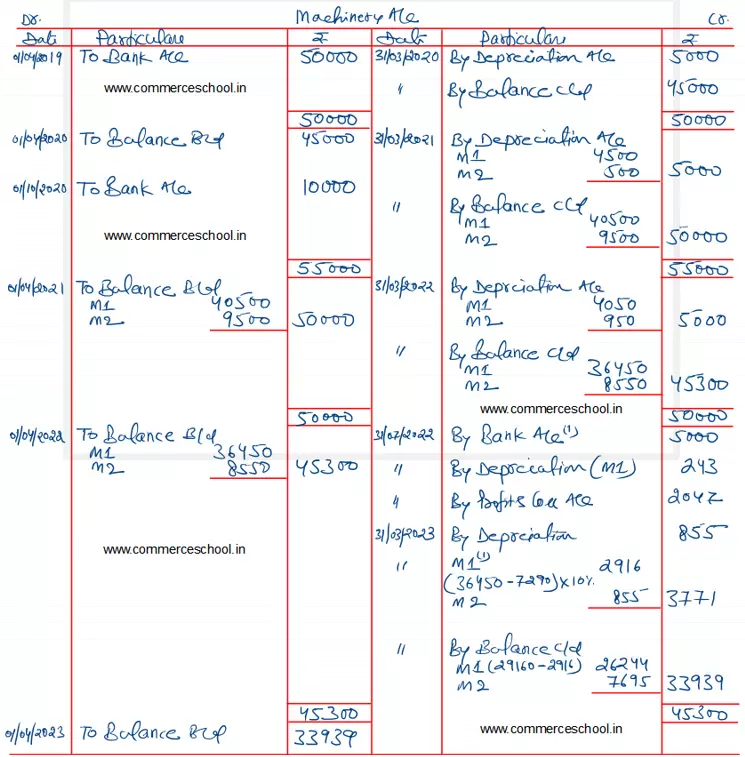

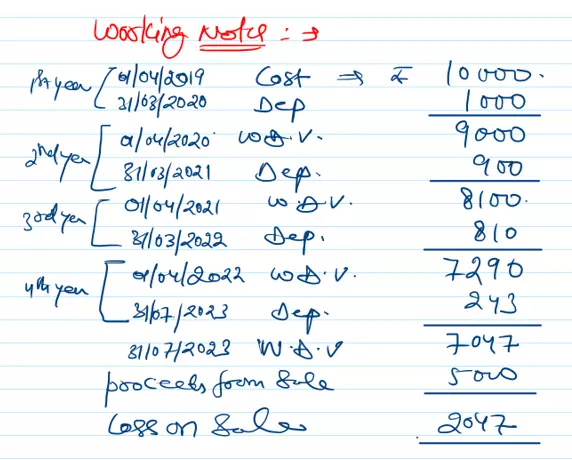

A firm whose books are closed on 31st March each year, purchased a machinery for ₹ 50,000 on 1st April, 2019. Additional machinery was acquired for ₹ 10,000 on 1st October, 2020. An item of machinery purchased for ₹ 10,000 on 1st April, 2019 was sold for ₹ 5,000 on 31st July, 2022.

Prepare the Machinery Account for 4 years ending 31st March, 2023, write off depreciation @ 10% p.a. by Written Down Value Method.

Solution:-