[ISC] Q. 24 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 24 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

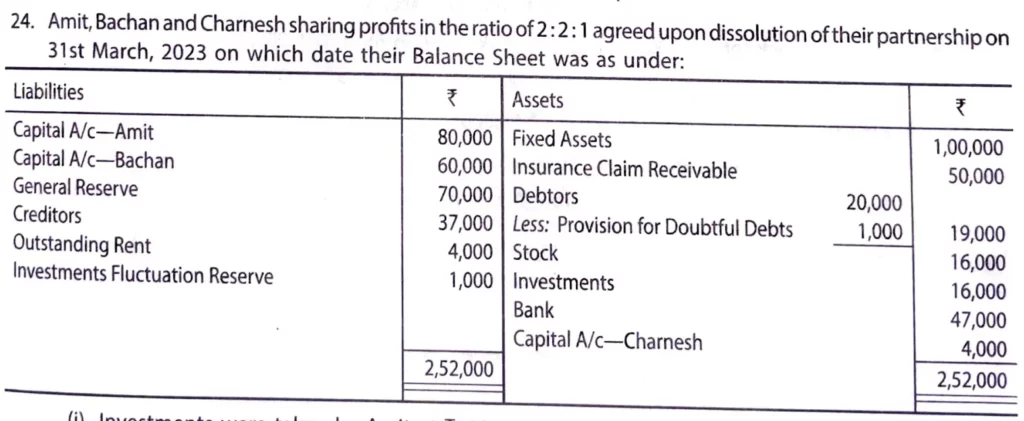

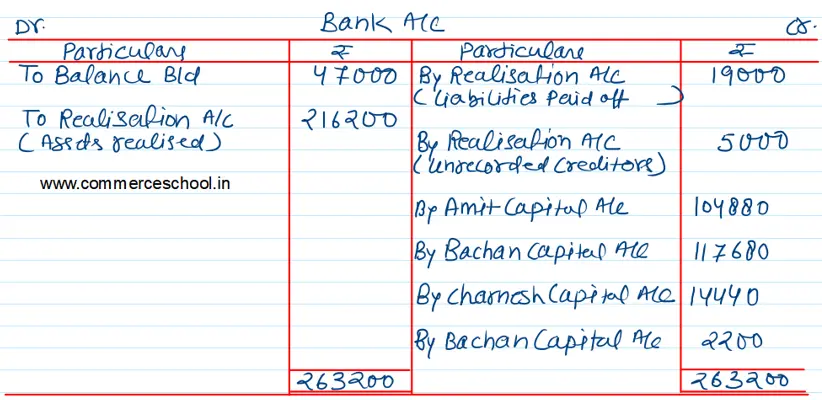

Amit, Bachan and Charnesh sharing profits in the ratio of 2 : 2 : 1 agreed upon dissolution of their partnership on 31st March, 2022 on which date their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/c – Amit Capital A/c – Bachan General Reserve Creditors Outstanding Rent Investments Fluctuation Reserve | 80,000 60,000 70,000 37,000 4,000 1,000 | Fixed Assets Insurance Claim Receivable Debtors Less: PDD Stock Investments Bank Capital A/c – Charnesh | 20,000 1,000 | 1,00,000 50,000 19,000 16,000 16,000 47,000 4,000 |

| 2,52,000 | 2,52,000 |

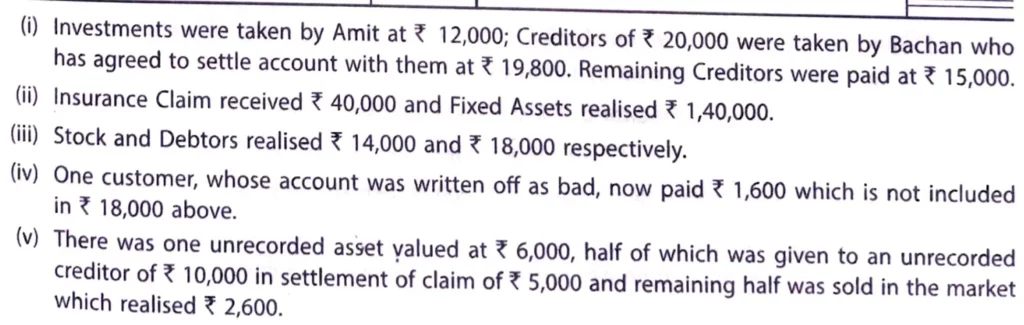

(i) Investments were taken by Amit at ₹ 12,000; Creditors of ₹ 20,000 were taken by Bachan who has agreed to settle account with them at ₹ 19,800. Remaining Creditors were paid at ₹ 15,000.

(ii) Insurance Claim received ₹ 40,000 and Fixed Assets realised ₹ 1,40,000.

(iii) Stock and Debtors realised ₹ 14,000 and ₹ 18,000 respectively.

(iv) One customer, whose account was written off as bad, now paid ₹ 1,600 which is not included in ₹ 18,000 above.

(v) There was one unrecorded asset valued at ₹ 6,000, half of which was given to an unrecorded creditor of ₹ 10,000 in settlement of claim of ₹ 5,000 and remaining half was sold in the market which realised ₹ 2,600.

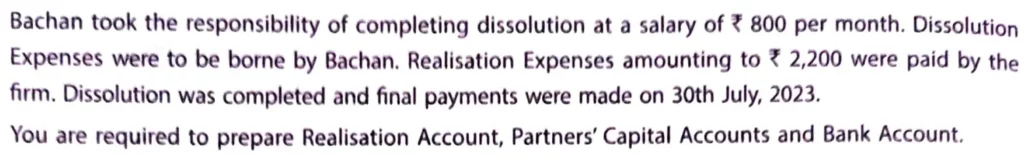

Bachan took the responsibility of completing dissolution at a salary of ₹ 800 per month. Dissolution Expenses were to be borne by Bachan. Realisation Expenses amounting to ₹ 2,200 were paid by the firm. Dissolution was completed and final payments were made on 30th July, 2022.

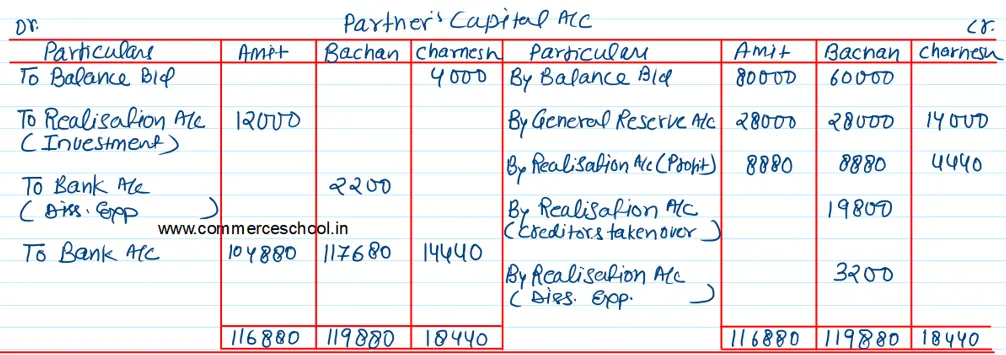

You are required to prepare Realisation Account, Partner’s Capital Accounts

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |