[ISC] Q. 24 Retirement of Partner TS Grewal Solution Class 12 (2024-25)

Solution to Question number 24 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2024-25 session.

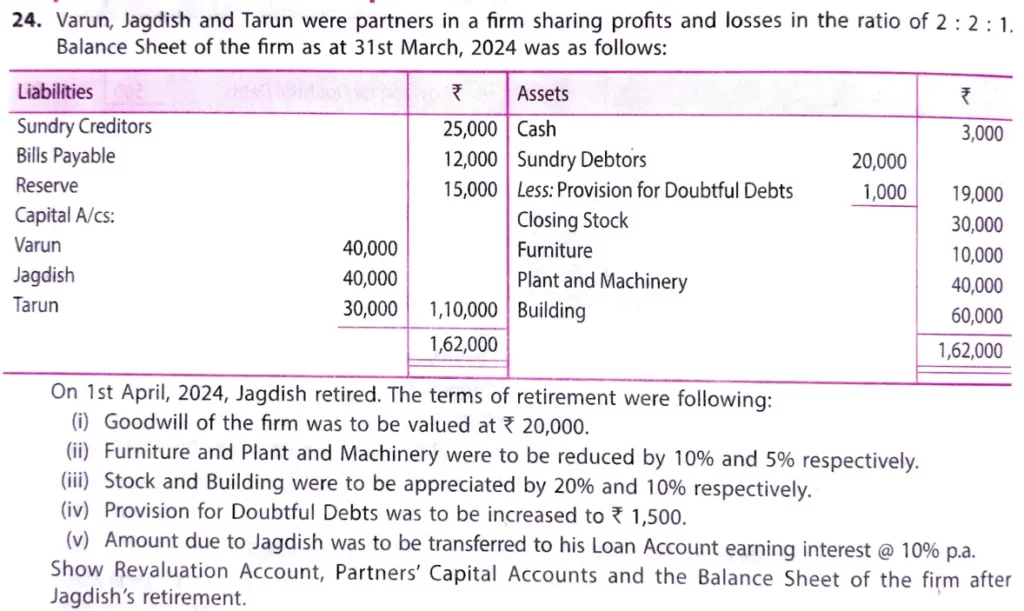

Varun, Jagdish and Tarun were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1 Balance Sheet of the firm as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors Bills Payable Reserve Capital A/cs: Varun Jagdish Tarun | 25,000 12,000 15,000 40,000 40,000 30,000 | Cash Sundry Debtors Less: PDD Closing Stock Furniture Plant and Machinery Building | 20,000 1,000 | 3,000 19,000 30,000 10,000 40,000 60,000 |

| 1,62,000 | 1,62,000 |

On 1st April, 2023, Jagdish retired. The terms of retirement were following:

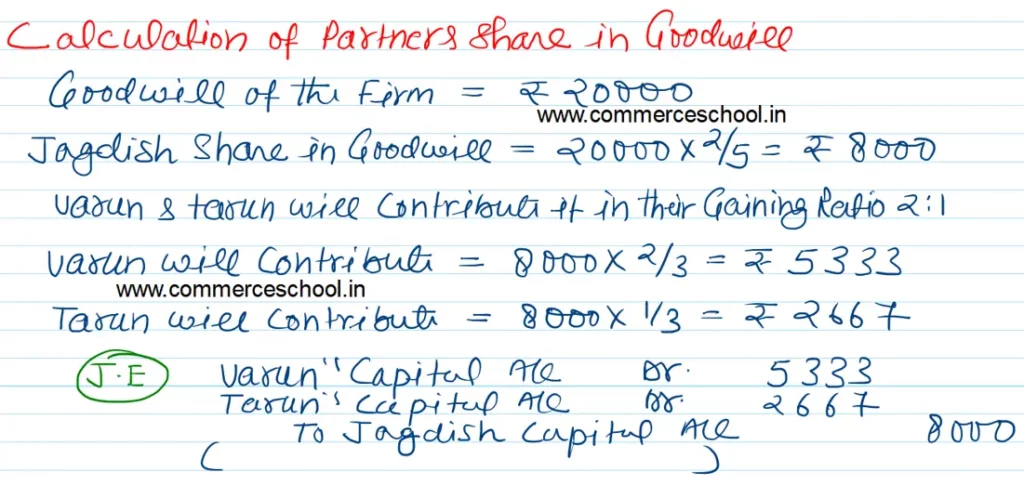

(i) Goodwill of the firm was to be valued at ₹ 20,000.

(ii) Furniture and Plant and Machinery were to be reduced by 10% and 5% respectively.

(iii) Stock and Building were to be appreciated by 20% and 10% respectively.

(iv) Provision for Doubtful Debts was to be increased to ₹ 1,500.

(v) Amount due to Jagdish was to be transferred to his Loan Account earning interest @ 10% p.a.

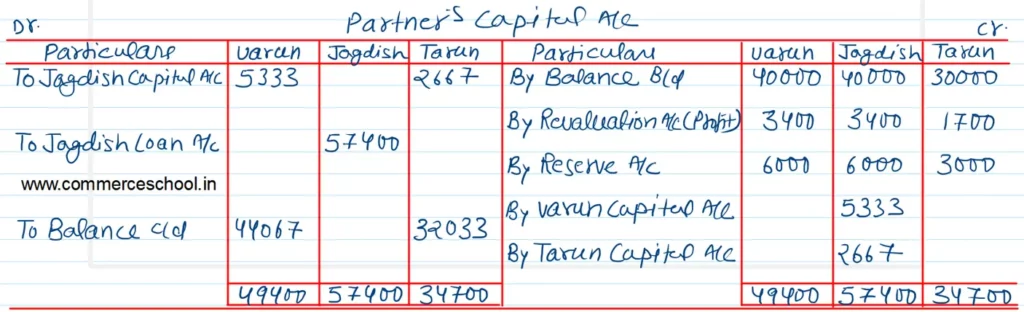

Show Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the firm after Jagdish’s retirement.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2024-25)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |