[ISC] Q. 25 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 25 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

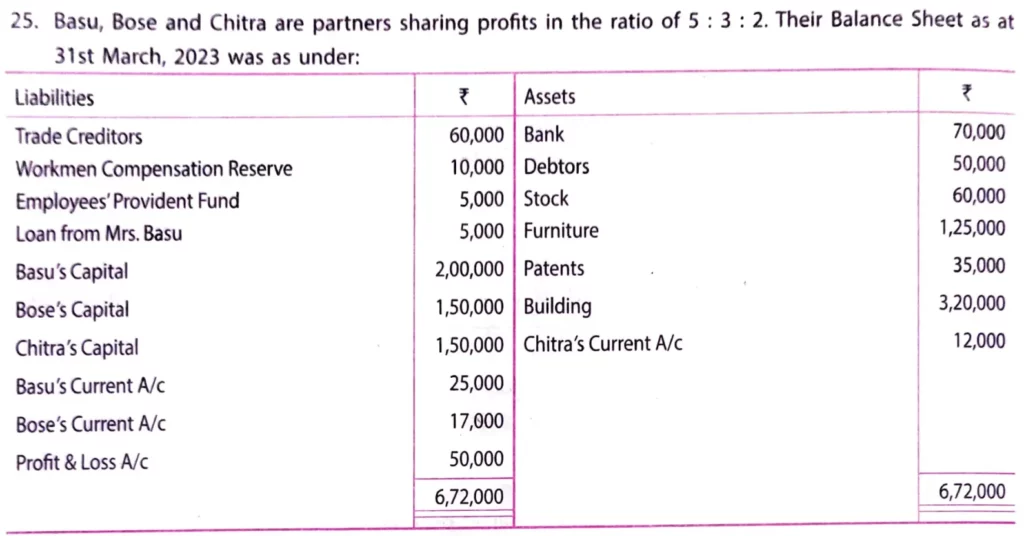

Basu, Bose and Chitra are partners sharing profits in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2022 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors Workmen Compensation Reserve Employees’ Provident Fund Loan from Mrs. Basu Basu’s Capital Bose’s Capital Chitra’s Capital Basu’s Current A/c Bose’s Current A/c Profit and Loss A/c | 60,000 10,000 5,000 5,000 2,00,000 1,50,000 1,50,000 25,00 17,000 50,000 | Bank Debtors Stock Furniture Patents Building Chitra’s Current A/c | 70,000 50,000 60,000 1,25,000 35,000 3,20,000 12,000 |

| 6,72,000 | 6,72,000 |

The firm was dissolved on the above mentioned date.

Following transactions took place at the time of dissolution:

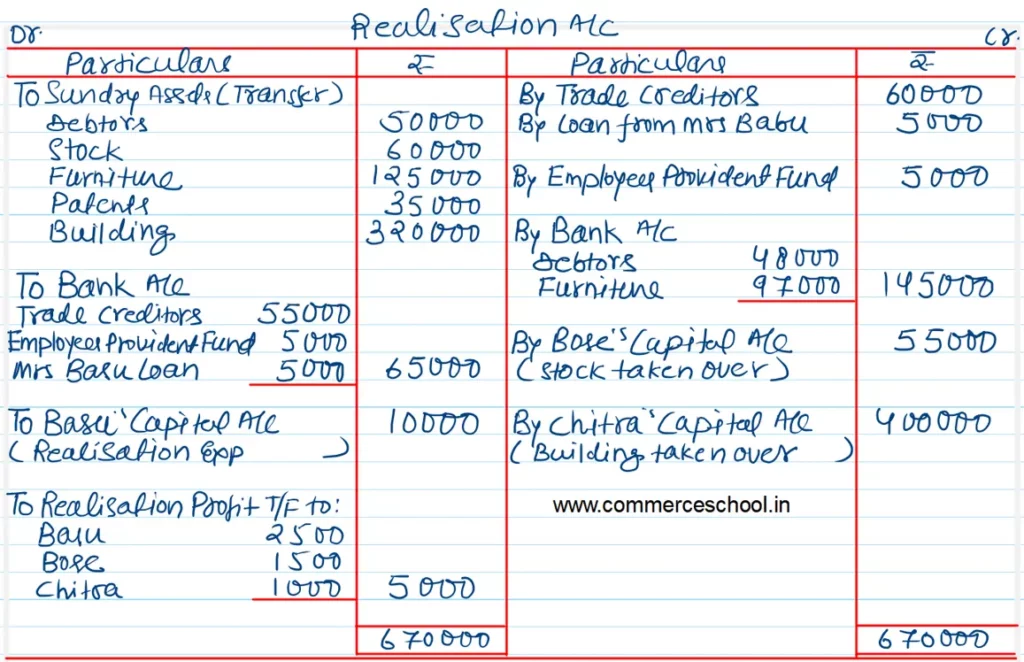

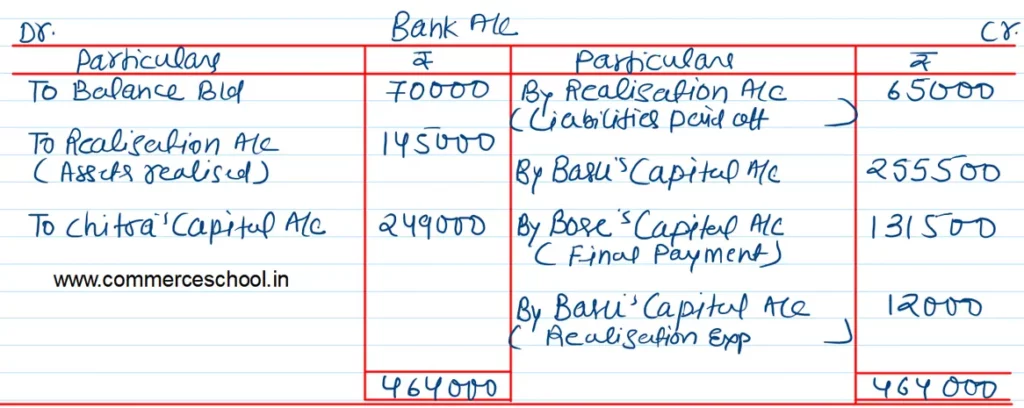

(i) Realisation Expenses were to be borne by Basu for which he was to get ₹ 10,000. Realisation Expenses of ₹ 12,000 were paid out of firm’s Bank Account.

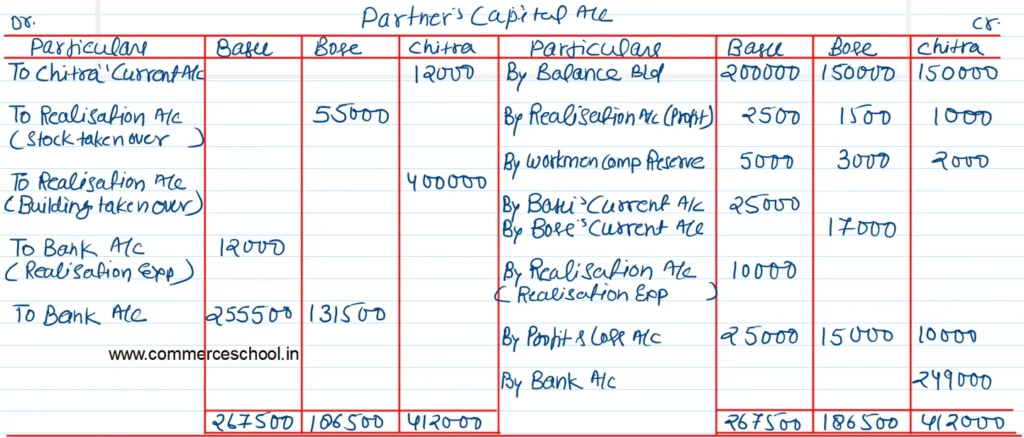

(ii) Bose took stock for ₹ 55,000 and Chitra took Building for ₹ 4,00,000.

(iii) Other assets realised as follows: Debtors ₹ 48,000; Furniture ₹ 97,000.

(iv) Trade Creditors were settled by paying ₹ 55,000.

(v) Accounts of partners were settled after realising assets and paying outside liabilities.

Prepare Realisation Account, Partner’s Current Accounts, Partner’s Capital Accounts and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |