[ISC] Q. 26 Cash Flow Statement Solution TS Grewal Class 12 (2023-24)

Solution of Question number 26 of the Cash Flow Statement of TS Grewal Book 2023-24 session ISC Board?

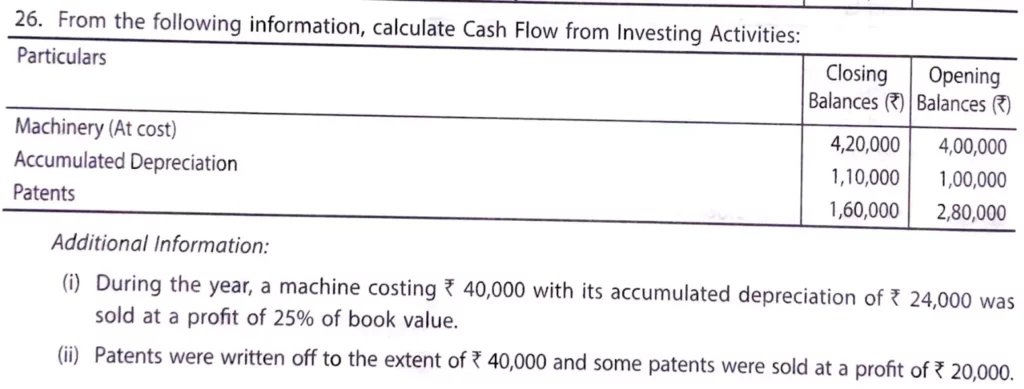

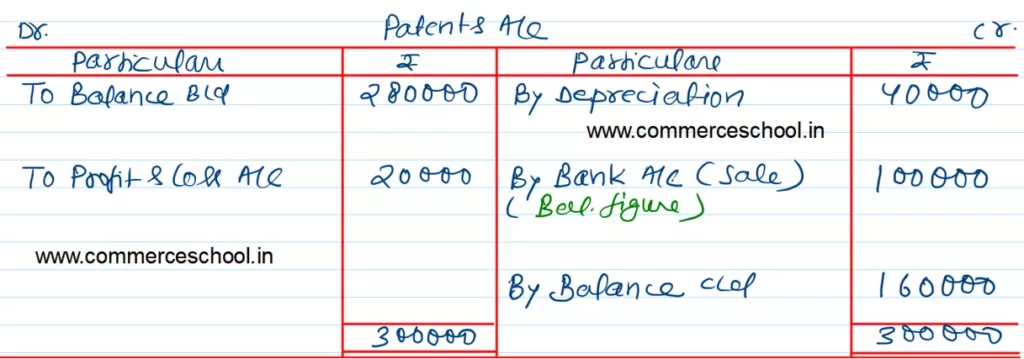

From the following information, Calculate Cash Flow from Investing Activities:

| Closing Balance (₹) | Opening Balances (₹) | |

| Machinery (At Cost) Accumulated Depreciation Patents | 4,20,000 1,10,000 1,60,000 | 4,00,000 1,00,000 2,80,000 |

Additional Information:

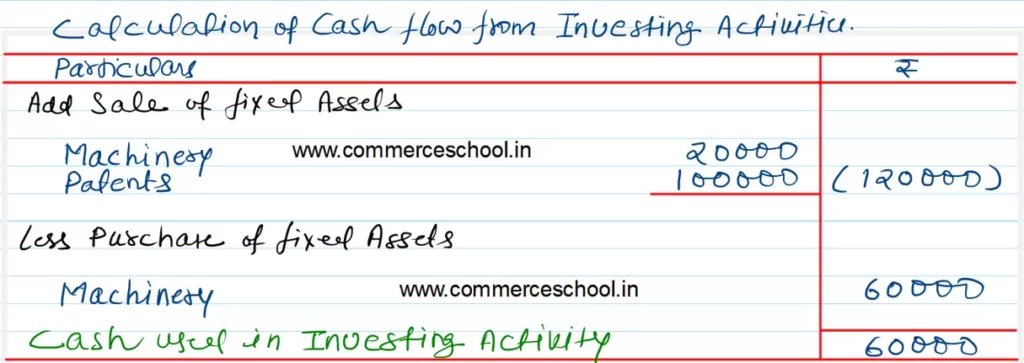

(i) During the year, a machine costing ₹ 40,000 with its accumulated depreciation of ₹ 24,000 was sold at a profit of 25% of book value.

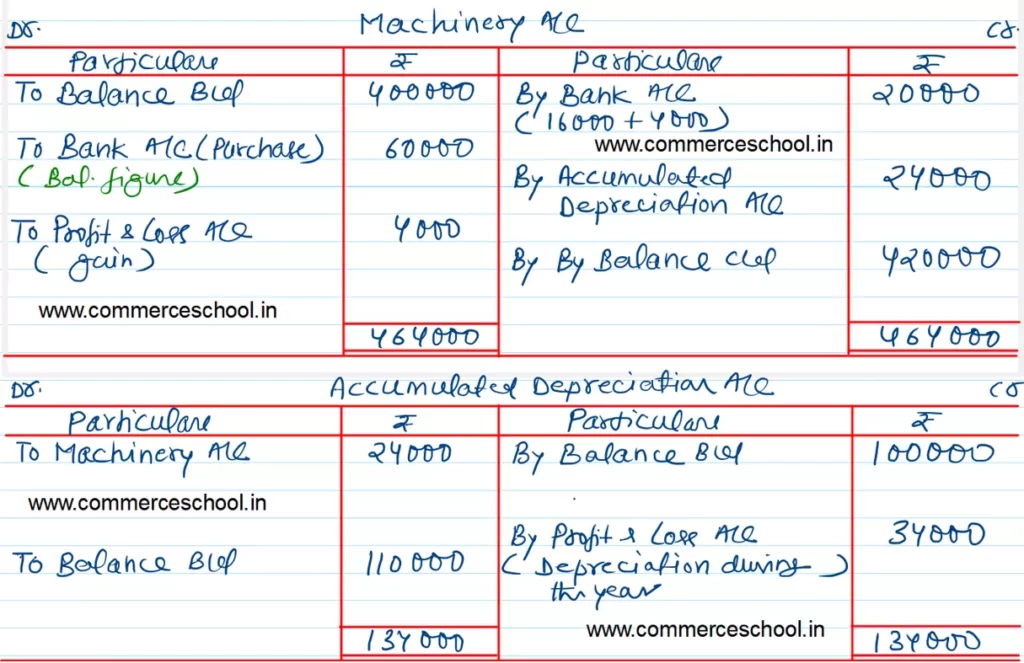

(ii) Patents were written off to the extent of ₹ 40,000 and some patents were sold at a profit of ₹ 20,000.

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |