[ISC] Q. 27 solution of Retirement of Partner TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 27 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2022-23 session?

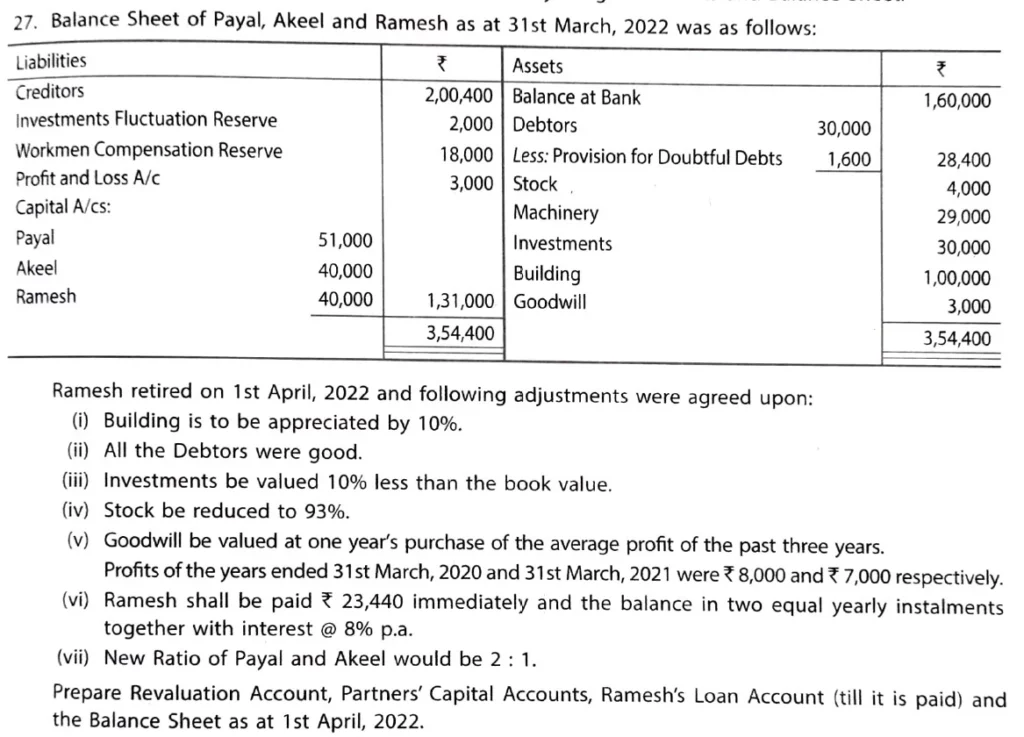

Balance Sheet of Payal, Akeel and Ramesh as at 31st March, 2022 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Investments Fluctuation Reserve Workmen Compensation Reserve Profit and Loss A/c Capital A/cs: Payal Akeel Ramesh | 2,00,000 2,000 18,000 3,000 51,000 40,000 40,000 | Balance at Bank Debtors Less: PDD Stock Machinery Investments Building Goodwill | 30,000 1,600 | 1,60,000 28,400 4,000 29,000 30,000 1,00,000 3,000 |

| 3,54,400 | 3,54,400 |

Ramesh retired on 1st April, 2022 and following adjustments were agreed upon:

(i) Building is to be appreciated by 10%.

(ii) All the Debtors were good.

(iii) Investments be valued 10% less than the book value

(iv) Stock be reduced to 93%.

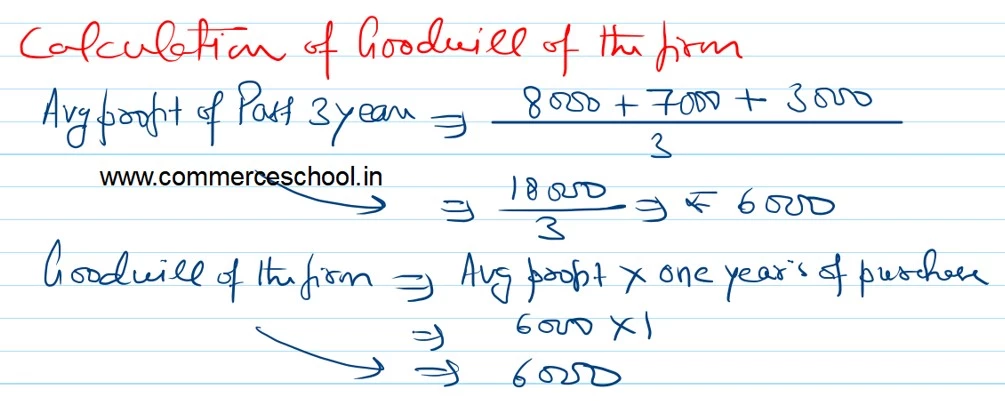

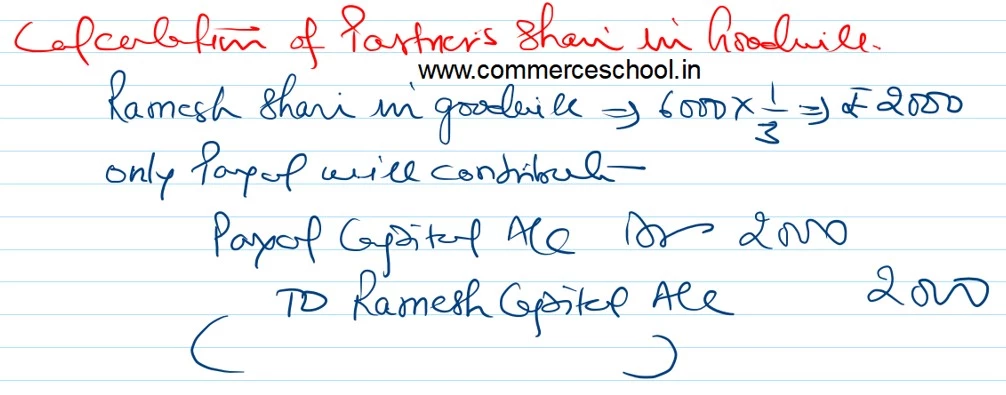

(v) Goodwill be valued at one year’s purchase of the average profit of the past three years. Profits of the years ended 31st March, 2020 and 31st March, 2021 were ₹ 8,000 and ₹ 7,000 respectively.

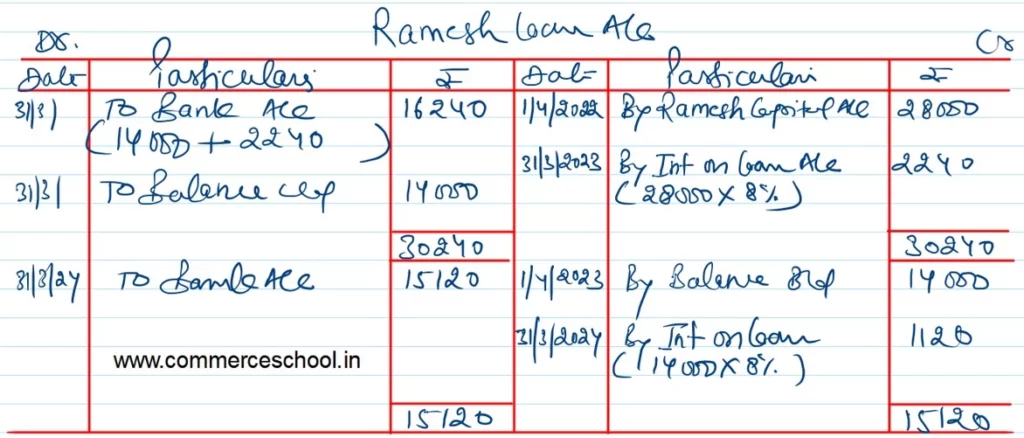

(vi) Ramesh shall be paid ₹ 23,440 immediately and the balance in two equal yearly instalments together with interest @ 8% p.a.

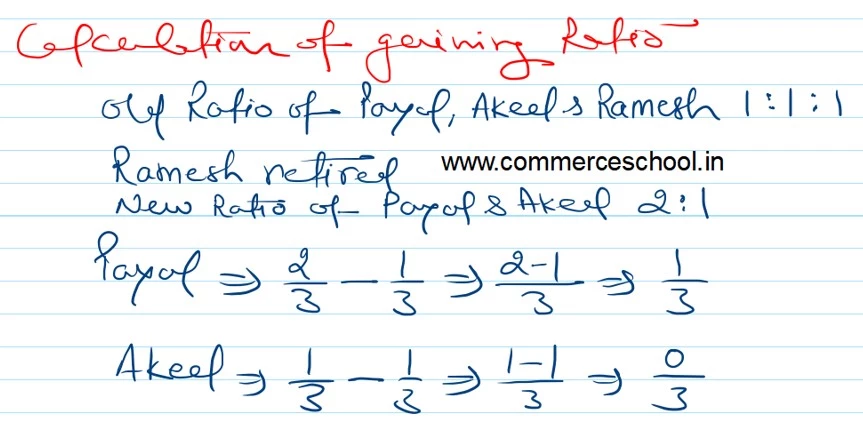

(vii) New Ratio of Payal and Akeel would be 2 : 1.

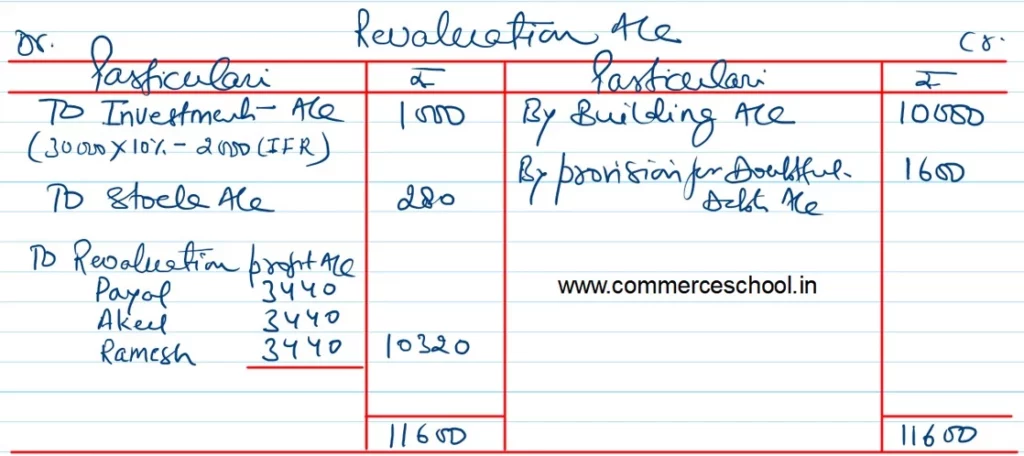

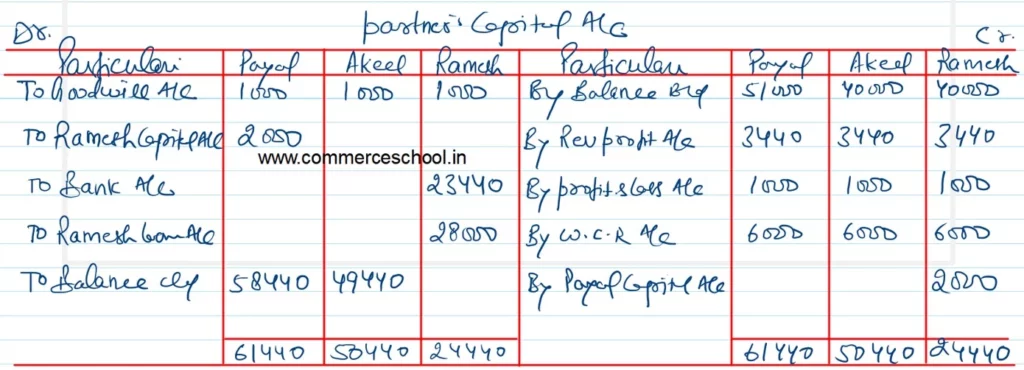

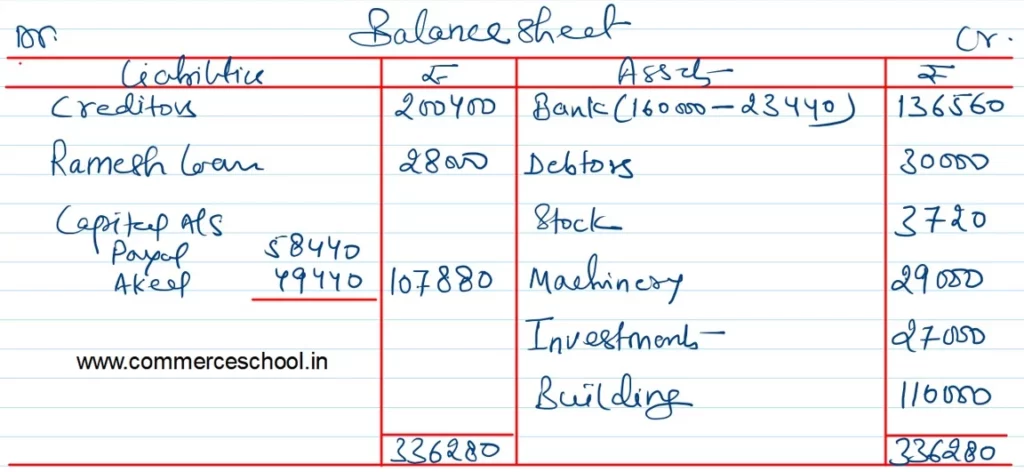

Prepare Revaluation Account, Partner’s Capital Accounts, Ramesh’s Loan Account (till it is paid) and the Balance Sheet as at 1st April, 2022.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2022-23)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |