[ISC] Q. 29 solution of Retirement of Partner TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 29 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2022-23 session?

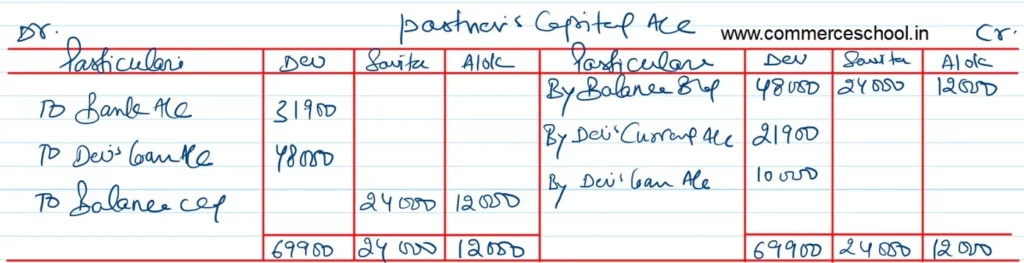

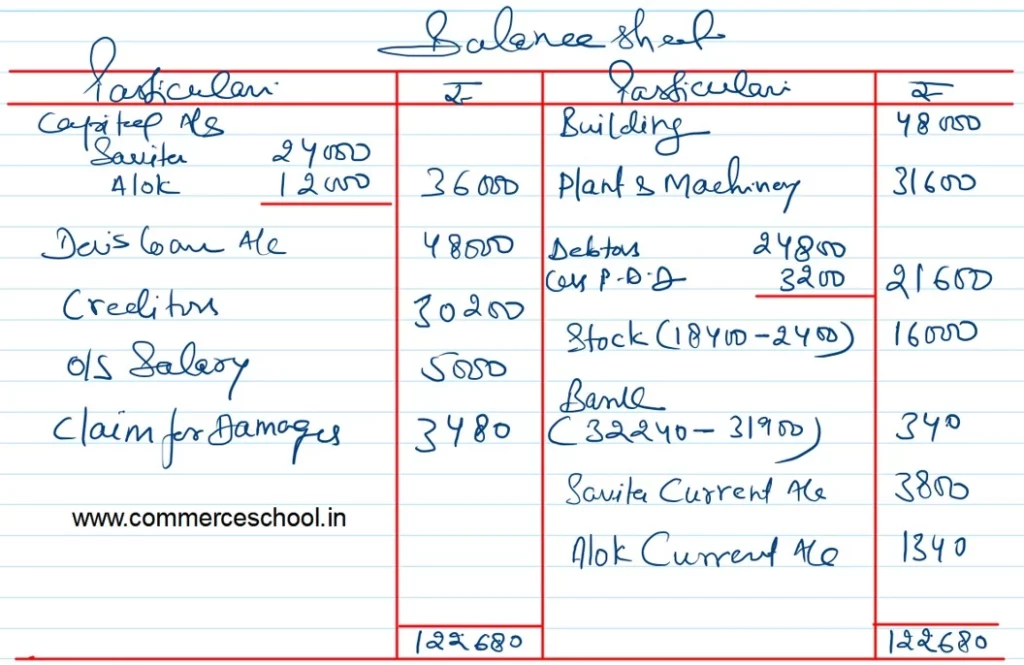

Dev, Savita and Alok were in partnership sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2022 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Dev Savita Alok Current A/cs: Dev Savita Alok Loan – Dev Creditors | 48,000 24,000 12,000 3,840 3,360 2,240 10,000 31,200 | Building Plant and Equipment Stock Debtors Less: PDD Balance at Bank | 24,000 37,600 18,400 22,400 32,240 |

| 1,34,640 | 1,34,640 |

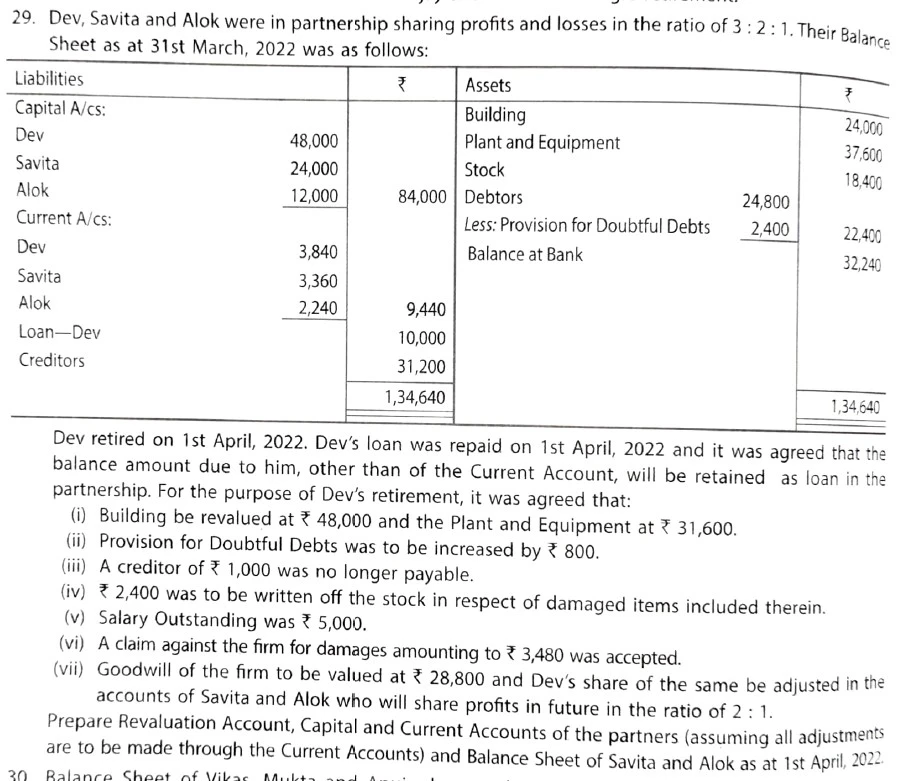

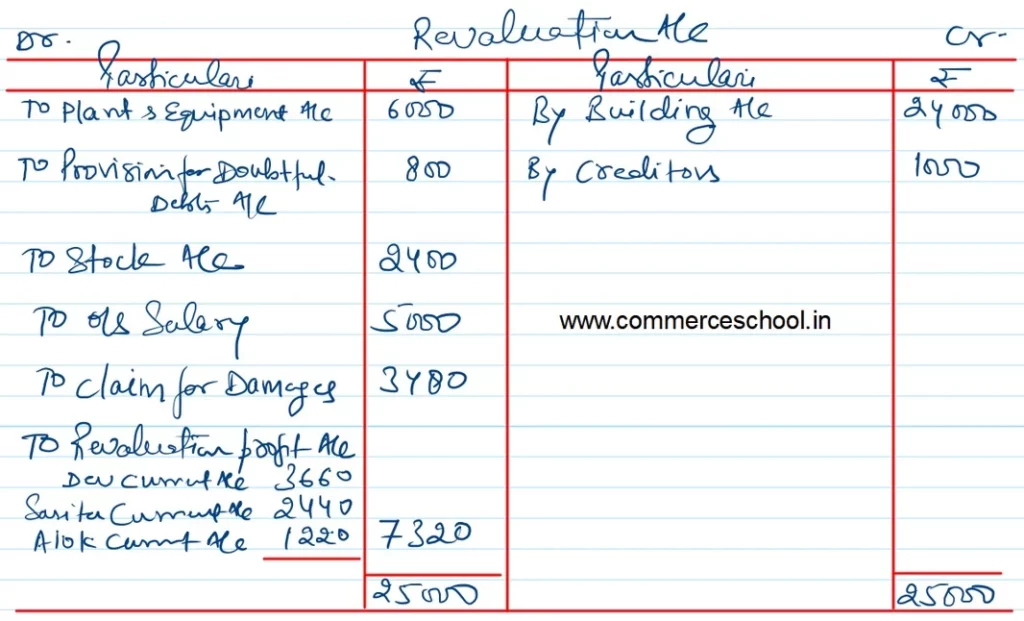

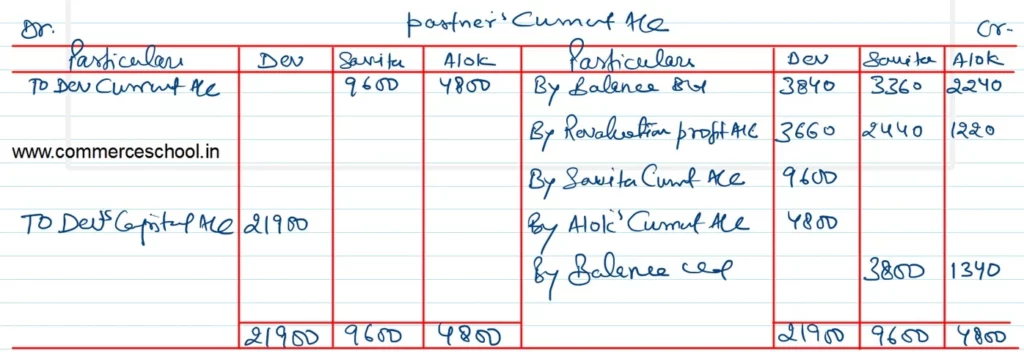

Dev retired on 1st April, 2022, Dev’s loan was repaid on 1st April, 2022 and it was agreed that the balance amount due to him, other than of the Current Account, will be retained as loan in the partnership. For the purpose of Dev’s retirement, it was agreed that:

(i) Building be revalued at ₹ 48,000 and the Plant and Equipment at ₹ 31,600.

(ii) Provision for Doubtful Debts was to be increased by ₹ 800.

(iii) A creditor of ₹ 1,000 was no longer payable.

(iv) ₹ 2,400 was to be written off the stock in respect of damaged items included therein.

(v) Salary outstanding was ₹ 5,000.

(vi) A claim against the firm for damages amounting to ₹ 3,480 was accepted.

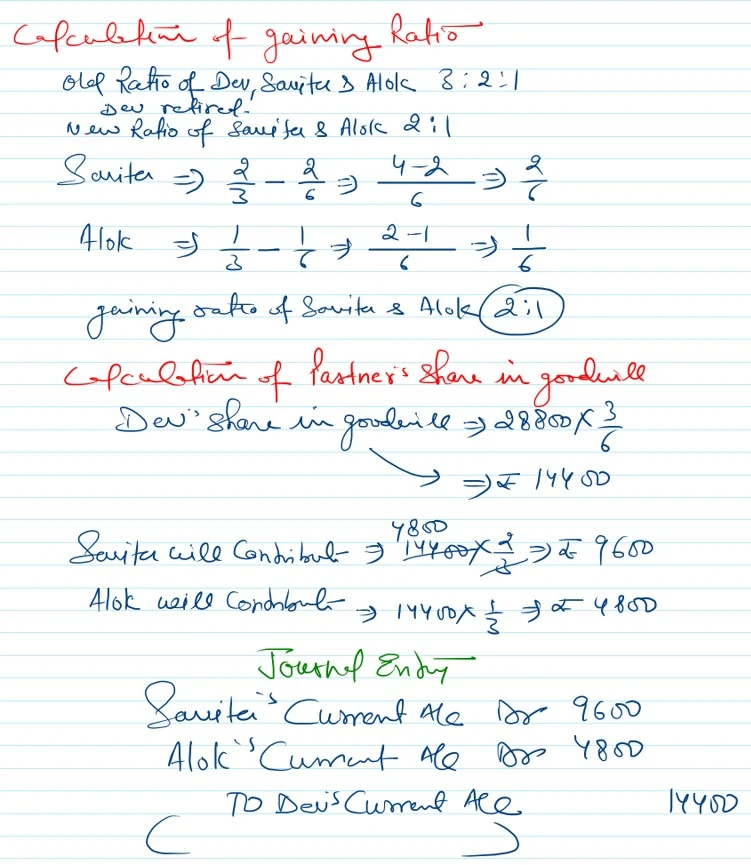

(vii) Goodwill of the firm to be valued at ₹ 28,800 and Dev’s share of the same be adjusted in the accounts of Savita and Alok who will share profits in future in the ratio of 2 : 1.

Prepare Revaluation Account, Capital and Current Accounts of the partners (assuming all adjustements) are to be made through the Current Accounts) and Balance Sheet of Savita and Alok as at 1st April, 2022.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2022-23)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |