[ISC] Q. 30 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 30 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

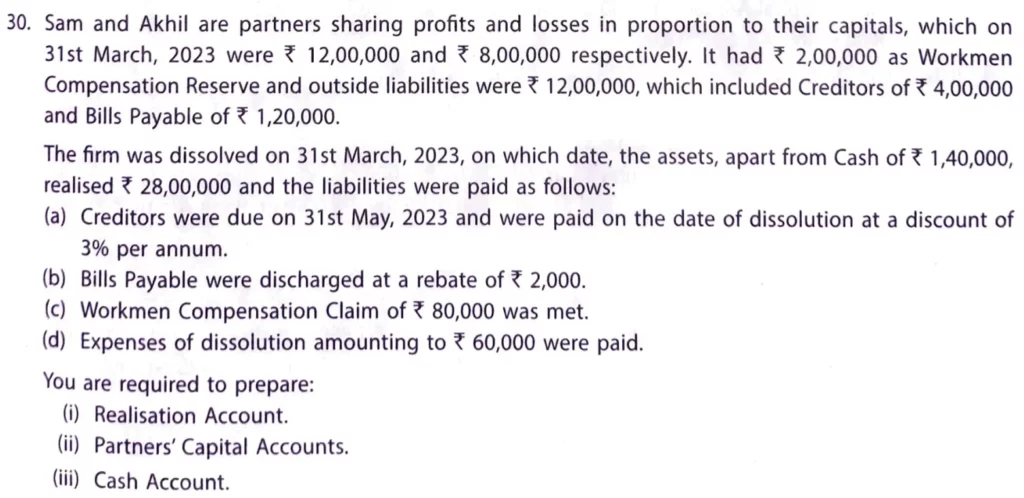

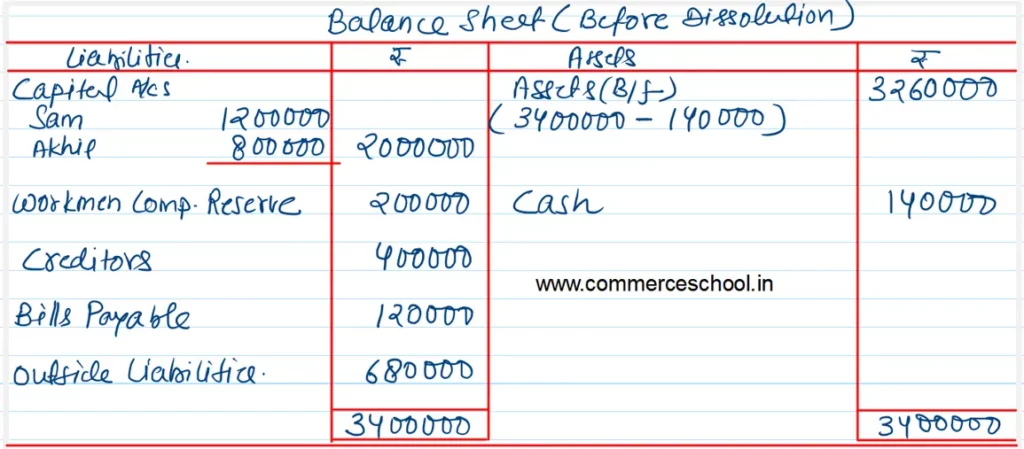

Sam and Akhil are partners sharing profits and losses in proportion to their capitals, which on 31st March, 2023 were ₹ 12,00,000 and ₹ 8,00,000 respectively. It had ₹ 2,00,000 as Workmen Compensation Reserve and outside liabilities were ₹ 12,00,000, which included Creditors of ₹ 4,00,000 and Bills Payable of ₹ 1,20,000.

The firm was dissolved on 31st March, 2023, on which date, the assets, aprt from cash of ₹ 1,40,000, realised ₹ 28,00,000 and the liabilities were paid as follows:

(a) Creditors were due on 31st May, 2023 and were paid on the date of dissolution at a discount of 3% per annum.

(b) Bills Payable were discharged at a rebate of ₹ 2,000.

(c) Workmen Compensation Claim of ₹ 80,000 was met.

(d) Expenses of dissolution amounting to ₹ 60,000 were paid.

You are required to prepare:

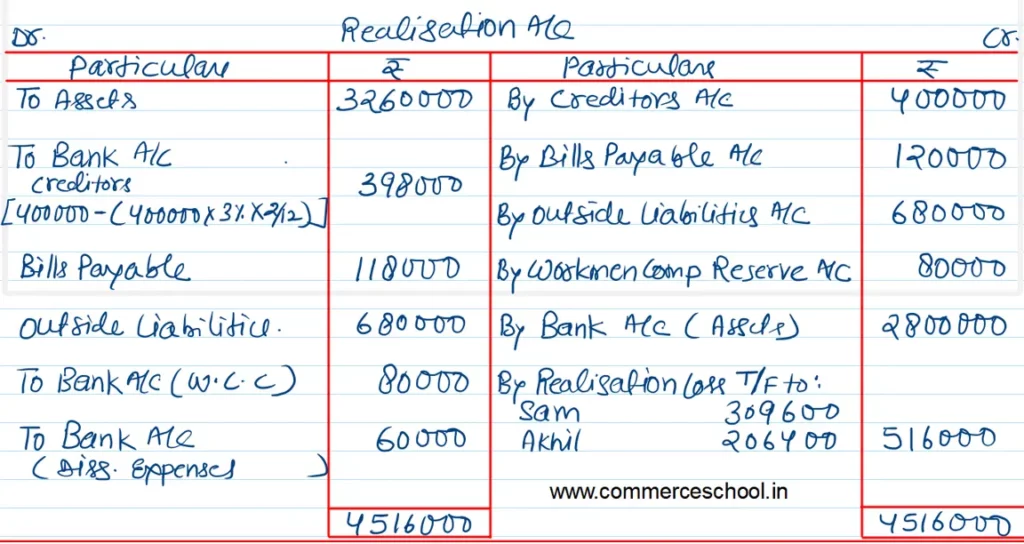

(i) Realisation Account.

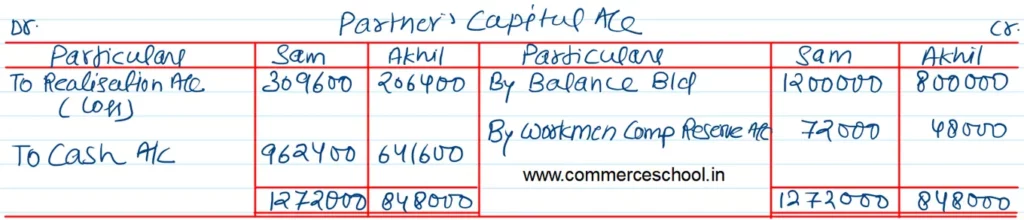

(ii) Partner’s Capital Accounts.

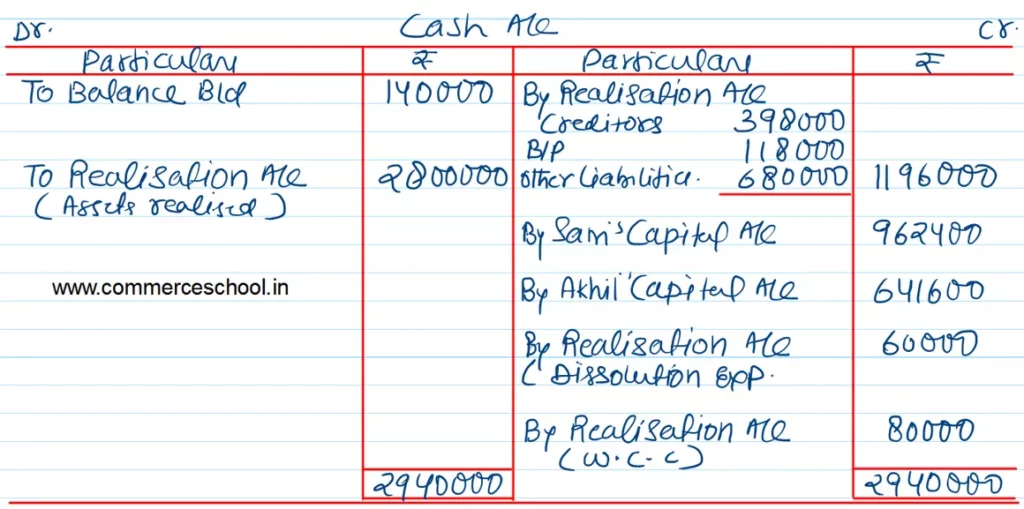

(iii) Cash Account.

Solution:-

Working Notes:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |