[ISC] Q 39 Non Trading Organisation Solution TS Grewal (2022-23) Class 11

Are you looking for the solution of Question number 39 Non Trading Organisation Chapter TS Grewal class 11 ISC Board for 2022-23 Session?

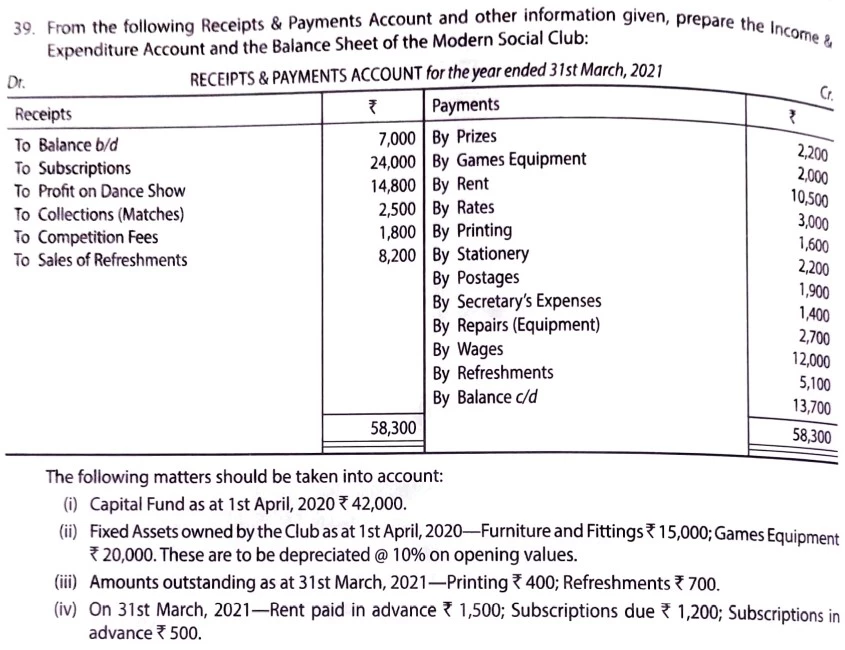

From the following Receipts & Payments Account and other information given, prepare the Income & Expenditure Account and the Balance Sheet of the Modern Social Club:

Receipts & Payments Account for the year ended 31st March, 2021

| Receipts | ₹ | Payments | ₹ |

| To Balance b/d To Subscriptions To Profit on Dance Show To Collections (Matches) To Competition Fees To Sales of Refreshements | 7,000 24,000 14,800 2,500 1,800 8,200 | By Prizes By Games Equipment By Rent By Rates By Printing By Stationery By Postages By Secretary’s Expenses By Repairs (Equipment) By Wages By Refreshments By Balance c/d | 2,200 2,000 10,500 3,00 1,600 2,200 1,900 1,400 2,700 12,000 5,100 13,700 |

| 58,300 | 58,300 |

The following matters should be taken into account:

(i) Capital Fund as at 1st April, 2020 ₹ 42,000.

(ii) Fixed Assets owned by the Club as at 1st April, 2020 – Furniture and Fittings ₹ 15,000; Games Equipment ₹ 20,000. These are to be depreciated @ 10% on opening values.

(iii) Amounts outstanding as at 31st March, 2021 – Printing ₹ 400; Refreshments ₹ 700.

(iv) On 31st March, 2021 – Rent paid in advance ₹ 1,500; Subscriptions due ₹ 1,200; Subscriptions in advance ₹ 500.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |