[ISC] Q 40 Solution Depreciation TS Grewal Class 11 (2023-24)

Solution of Question number 40 Depreciation TS Grewal class 11 ISC 2023-24?

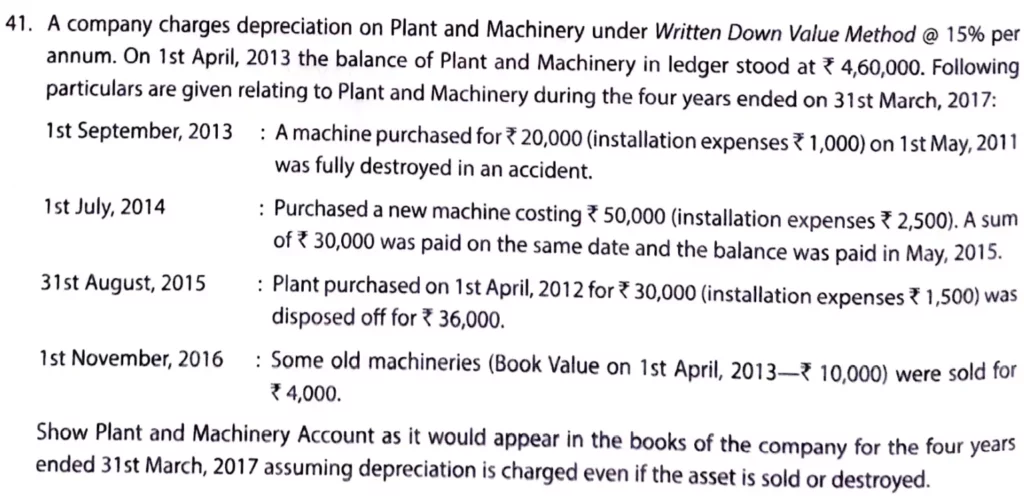

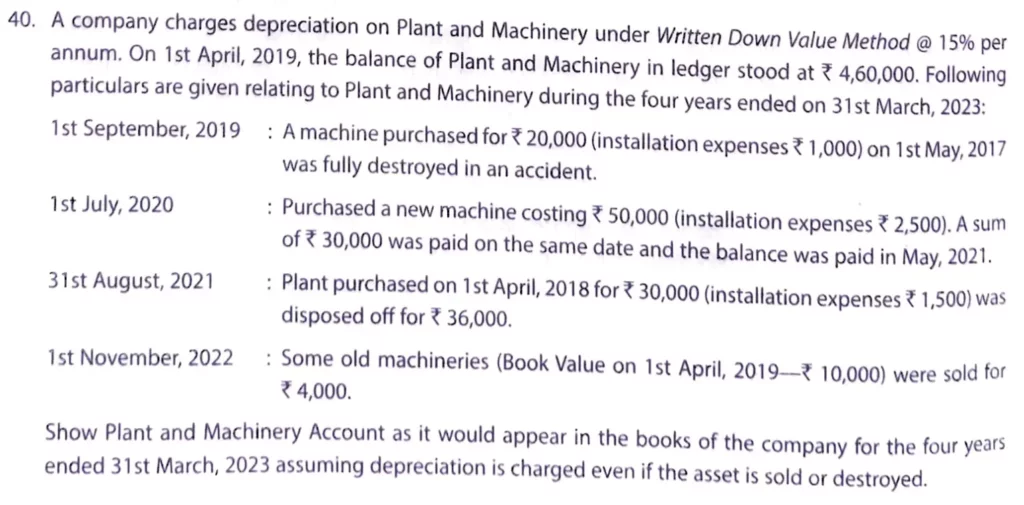

A company charges depreciation on Plant and Machinery under Written Down Value Method @ 15% per annum. On 1st April, 2013 the balance of Plant and Machinery in ledger stood at ₹ 4,60,000. Following particulars are given relating to Plant and Machinery during the four years ended on 31st March, 2017:

| 1st September, 2013 | A machine purchased for ₹ 20,000 (installation expenses ₹ 1,000) on 1st May, 2011 was fully destroyed in an accident. |

| 1st July, 2014 | Purchased a new machine costing ₹ 50,000 (installation expenses ₹ 2,500). A sum of ₹ 30,000 was paid on the same date and the balance was paid in May, 2015. |

| 31st August, 2015 | Plant purchased on 1st April, 2012 for ₹ 30,000 (installation expenses ₹ 1,500) was disposed off for ₹ 36,000. |

| 1st November, 2016 | Some old machineries (Book Value on 1st April, 2013 – ₹ 10,000) were sold for ₹ 4,000. |

Show Plant and Machinery Account as it would appear in the books of the company for the four years ended 31st March, 2017 assuming depreciation is charged even if the asset is sold or destroyed.

no answer given only the question

no answer given