[ISC] Q. 44 solution of Retirement of Partner TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 44 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2022-23 session?

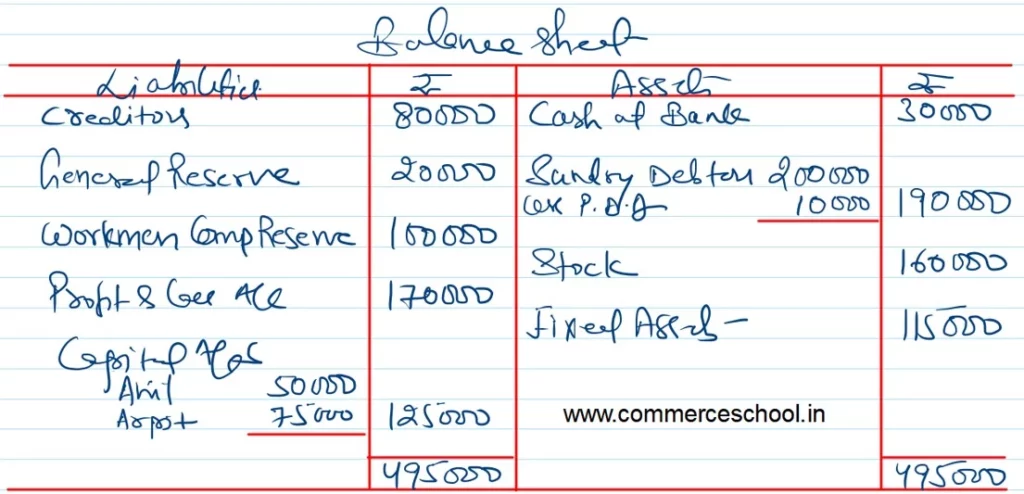

The Balance Sheet of Palak, Anil and Arpit who were sharing profits and losses in the ratio of 5 : 3 : 2 as at 31st March, 2022:

| Liabilities | ₹ | Assets | ₹ |

| Creditors General Reserve Workmen Compensation Reserve Profit & Loss A/c Palak’s Capital Anil’s Capital Arpit’s Capital | 1,00,000 20,000 1,00,000 1,70,000 80,000 1,24,000 66,000 | Cash at Bank Sundry Debtors Stock Fixed Assets Goodwill | 80,000 2,00,000 1,60,000 1,20,000 1,00,000 |

| 6,60,000 | 6,60,000 |

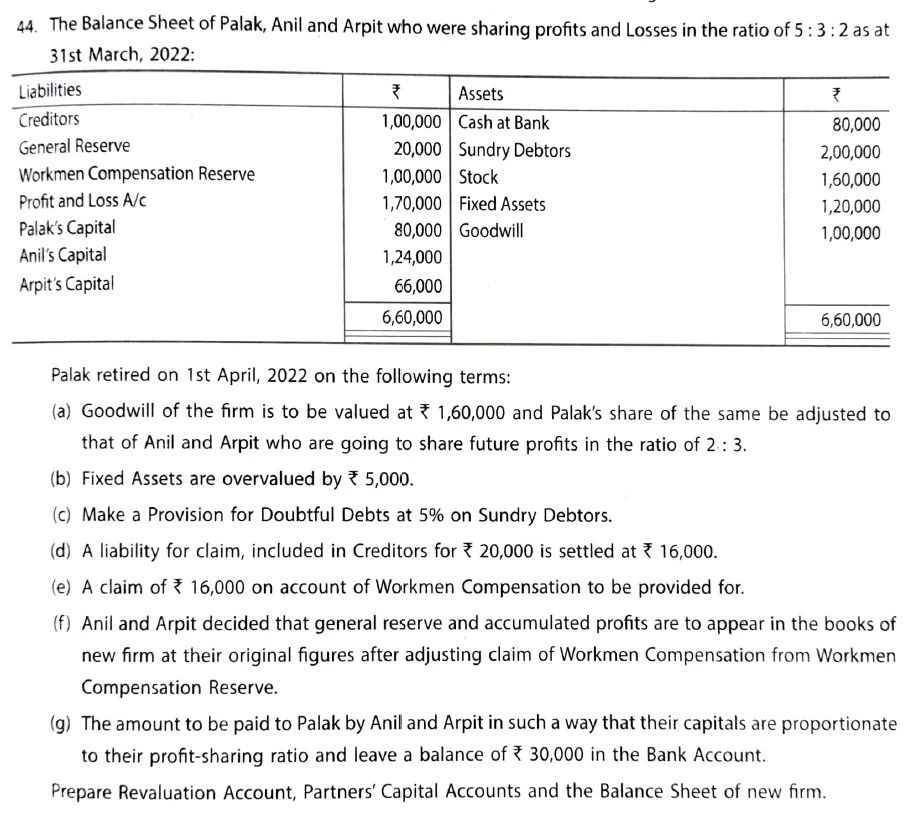

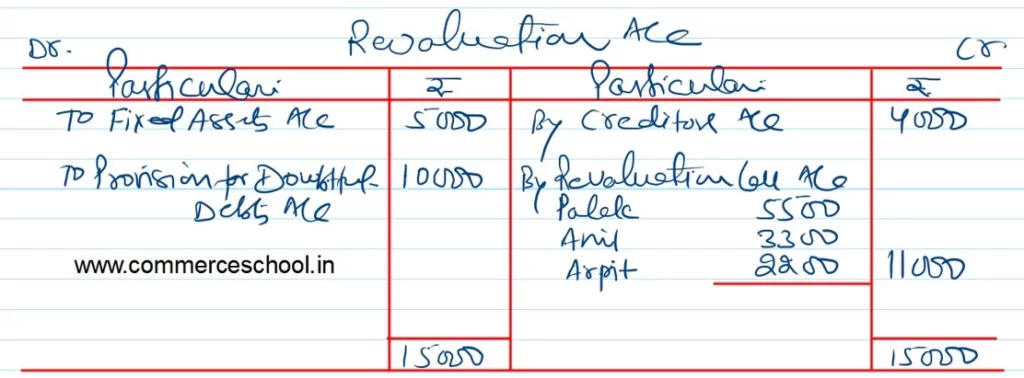

Palak retired on 1st April, 2022 on the following terms:

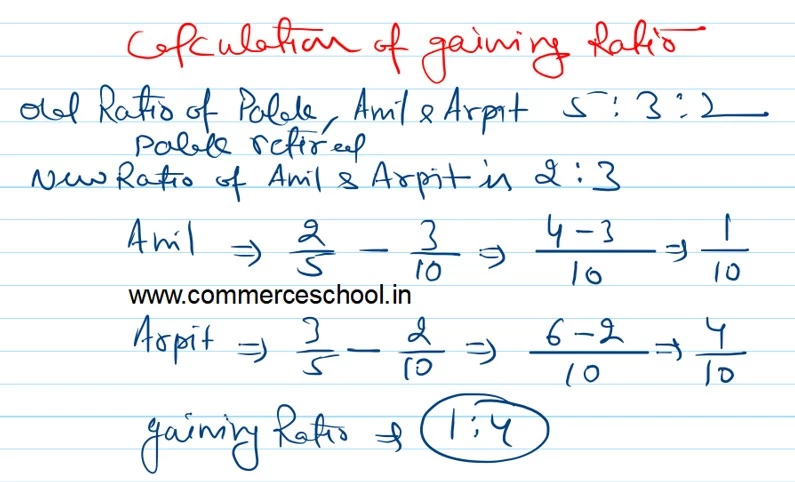

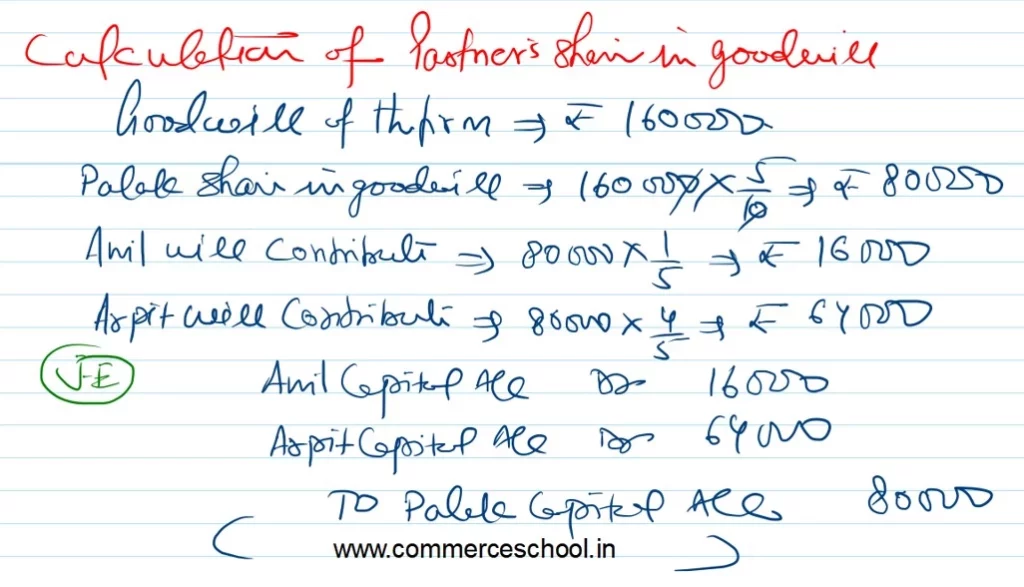

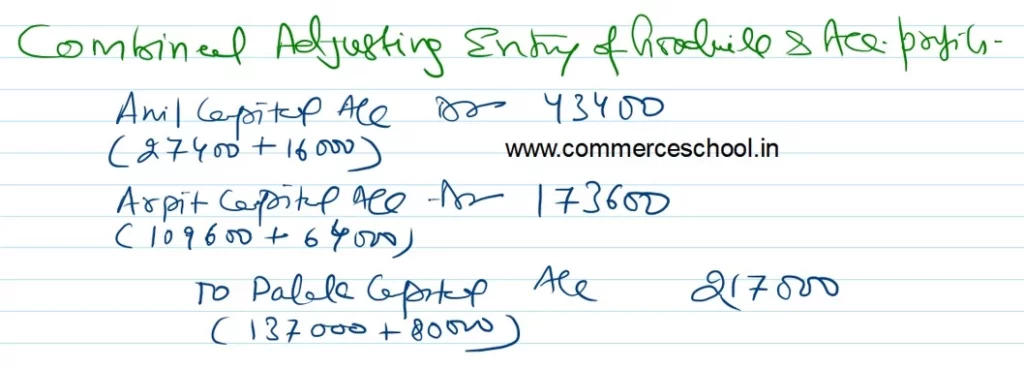

(a) Goodwill of the firm is to be valued at ₹ 1,60,000 and Palak’s share of the same be adjusted to that of Anil and Arpit who are going to share future profits in the ratio of 2 : 3.

(b) Fixed Assets are overvalued by ₹ 5,000.

(c) Make a Provision for Doubtful Debts at 5% on Sundry Debtors.

(d) A liability for claim, included in creditors for ₹ 20,000 is settled at ₹ 16,000.

(e) A calim of ₹ 16,000 on account of Workmen Compensation to be provided for.

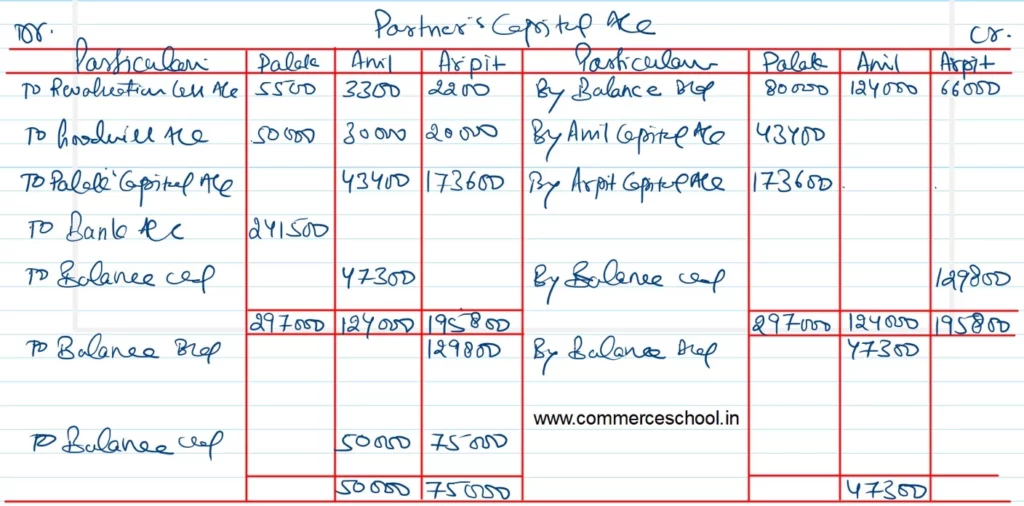

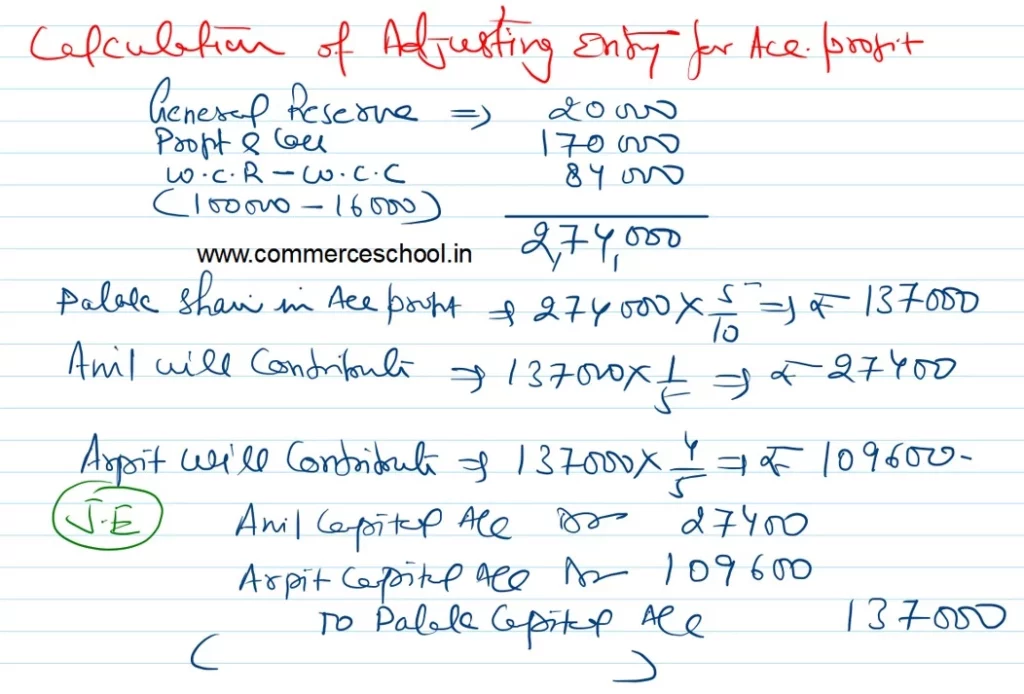

(f) Anil and Arpit decided that general reserve and accumulated profits are to appear in the books of new firm at their original figures after adjusting claim of Workmen Compensation from Workmen Compensation Reserve.

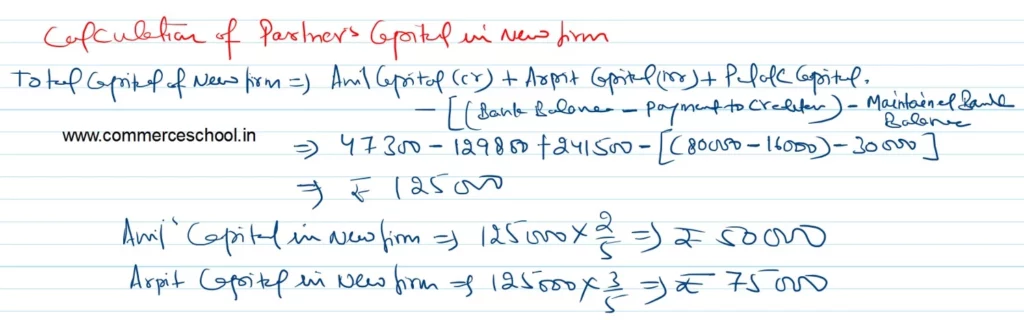

(g) The amount to be paid to Palak by Anil and Arpit in such a way that their capitals are proportionate to their profit sharing ratio and leave a balance of ₹ 30,000 in the Bank Account.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2022-23)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |