[ISC] Q. 48 Retirement of Partner TS Grewal Solution Class 12 (2023-24)

Solution to Question number 48 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2023 – 24 session?

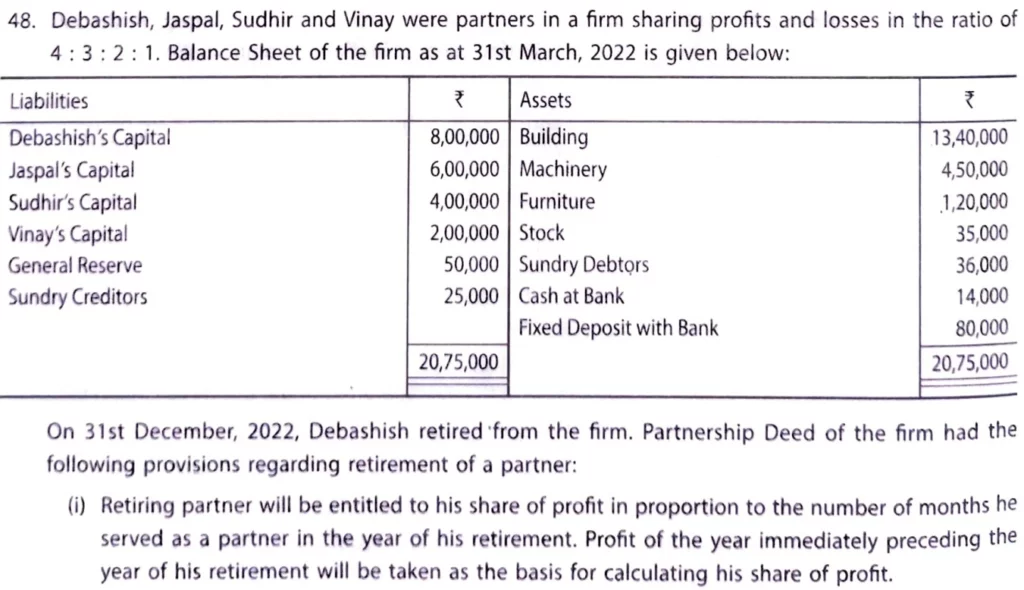

Debashish, Jaspal, Sudhir and Vinay were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 2 : 1. Balance Sheet of the firm as at 31st March, 2022 is given below:

| Liabilities | ₹ | Assets | ₹ |

| Debashish’s Capital Jaspal’s Capital Sudhir’s Capital Vinay’s Capital General Reserve Sundry Creditors | 8,00,000 6,00,000 4,00,000 2,00,000 50,000 25,000 | Building Machinery Furniture Stock Sundry Debtors Cash at Bank Fixed Deposit with Bank | 13,40,000 4,50,000 1,20,000 35,000 36,000 14,000 80,000 |

| 20,75,000 | 20,75,000 |

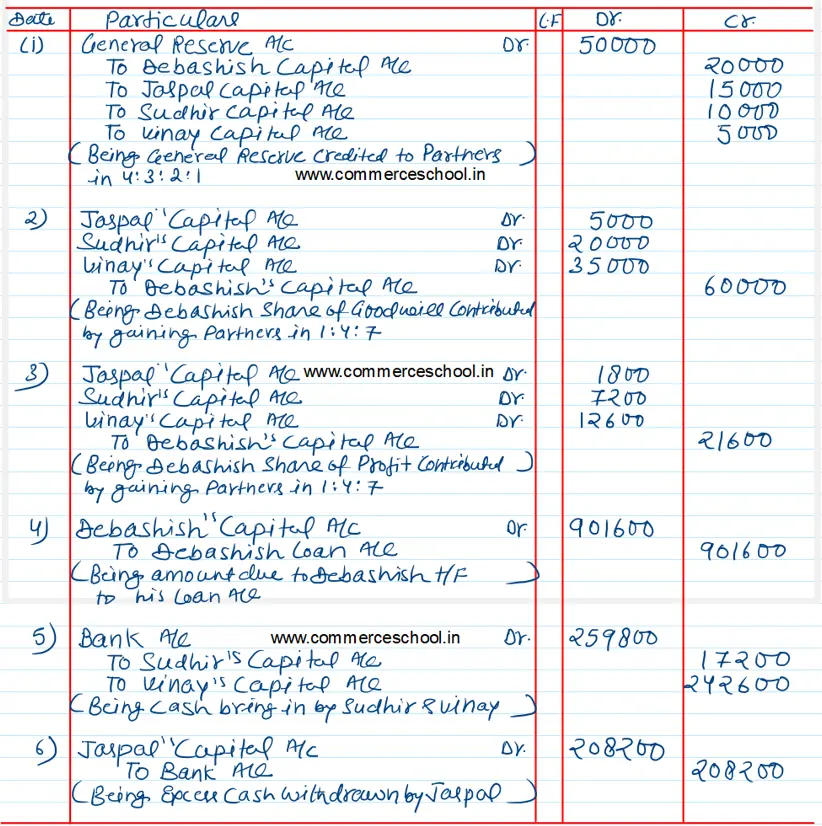

On 31st December, 2022, Debashish retired from the firm. Partnership Deed of the firm had the following provisions regarding retirement of a partner:

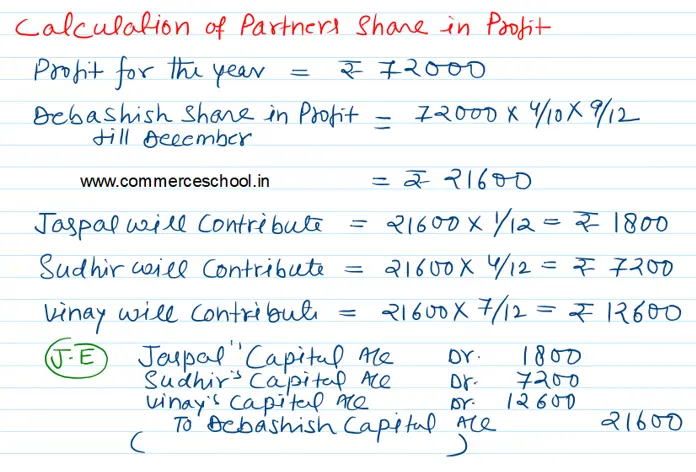

(i) Retiring partner will be entitled to his share of profit in proportion to the number of months he served as a partner in the year of his retirement. Profit of the year immediately preceding the year of his retirement will be taken as the basis for calculating his share of profit.

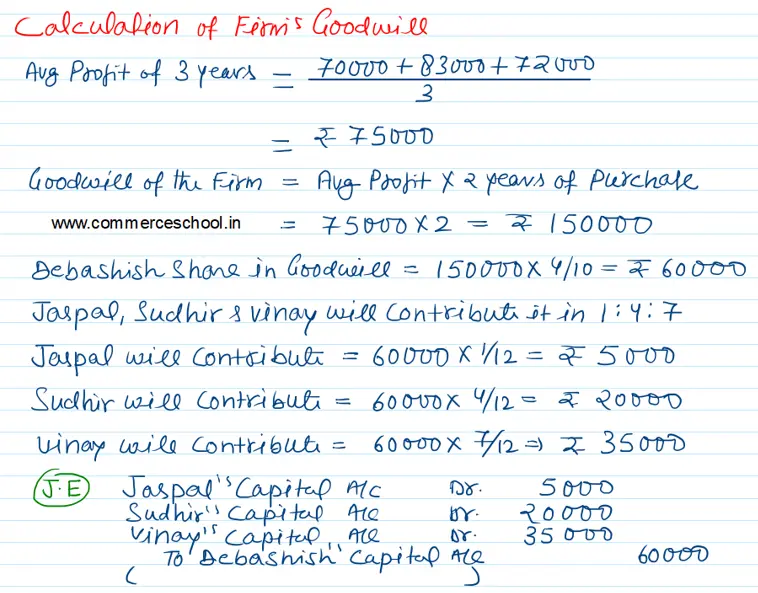

(ii) Retiring partner will be entitled to a share of goodwill on the basis of two year’s purchase of the average profit of three years preceding the year of his retirement.

(iii) Retiring partner’s share of goodwill is to be adjusted to the Capital Accounts of the Continuing Partners.

(iv) The profits of last three years are given below:

| Year | Profit (₹) |

| 2019 – 20 | 70,000 |

| 2020 – 21 | 83,000 |

| 2021 – 22 | 72,000 |

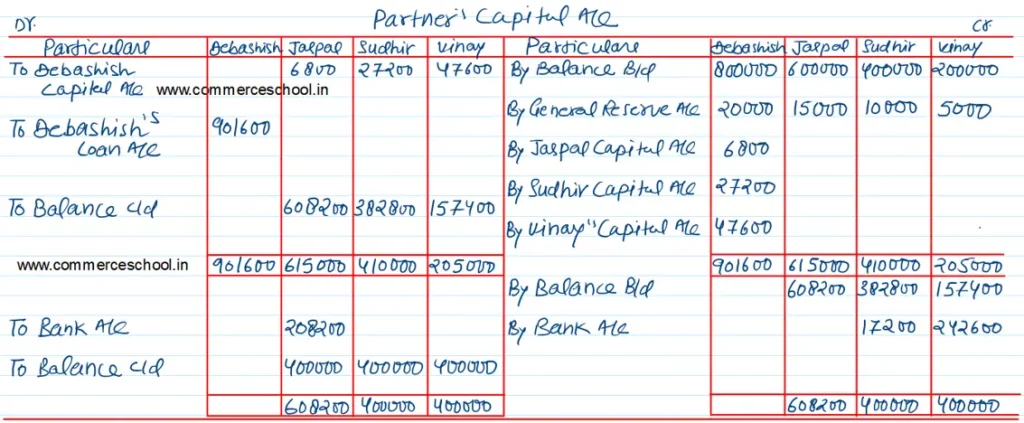

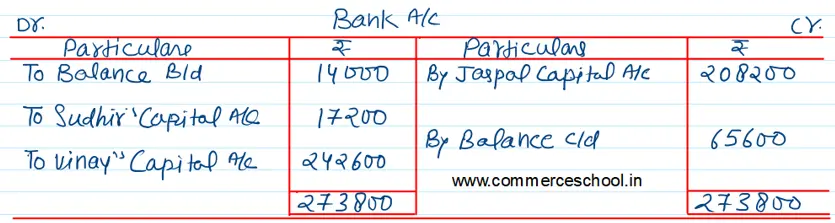

Jaspal, Sudhir and Vinay decided to share future profits and losses equally and to maintain a fixed capital of ₹ 4,00,000 each, making necessary addition or withdrawal of cash immediately without affecting the bank overdraft balance. Total amount due to Debashish will remain in the business of the firm as loan, earning 10% interest per annum.

Show Journal entries and the Capital Accounts of the Partners on the basis of the above-mentioned conditions, which were duly complied with.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2023 – 24)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |