[ISC] Q. 52 Cash Flow Statement Solution TS Grewal Class 12 (2023-24)

Solution of Question number 52 of the Cash Flow Statement of TS Grewal Book 2023-24 session ISC Board?

From the following Balance Sheet of Pioneer Construction Ltd. as at 31st March, 2023, prepare Cash Flow Statement:

Balance Sheet of PIONEER CONSTRUCTION LTD. as at 31st March, 2023

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

| Shareholders Funds (a) Share Capital (b) Reserves and Surplus | 3,50,000 1,75,000 | 2,50,000 1,00,000 |

| Non-Current Liabilities Long-term Borrwings – Bank Loan | 25,000 | 50,000 |

| Non-Current Liabilities Long-term Borrowings – Bank Loan | 26,000 25,000 | 27,500 15,000 |

| Total | 6,01,000 | 4,42,500 |

| II. Assets | ||

| Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment – Equipment (ii) Intangible Assets – Patents (b) Non-Current Investments | 2,50,000 47,500 50,000 | 2,50,000 50,000 2,500 |

| Current Assets (a) Inventories – Stock (b) Trade Receivables – Debtors (c) Cash and Bank Balances (Cash at Bank) | 65,000 60,000 1,28,500 | 25,000 40,000 75,000 |

| Total | 6,01,000 | 4,42,500 |

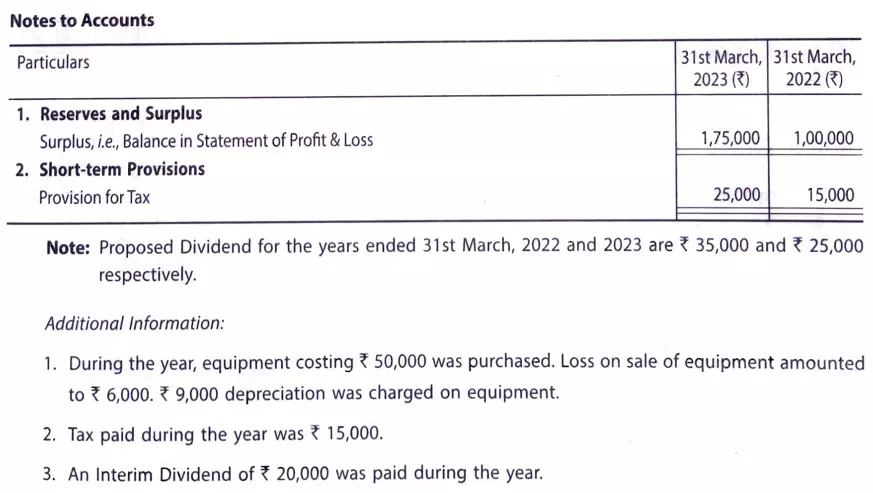

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

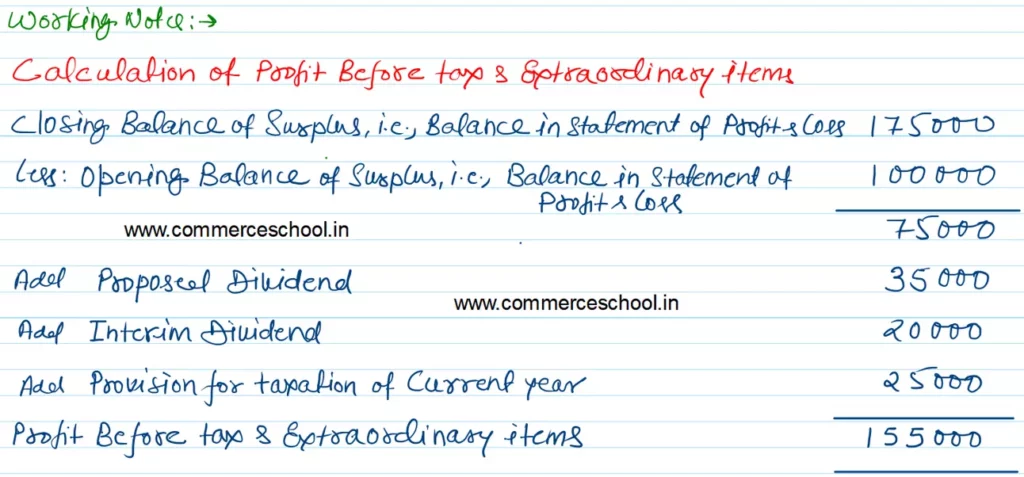

| Reserves and Surplus Surplus, i.e., Balance in Statement of Profit & Loss | 1,75,000 | 1,00,000 |

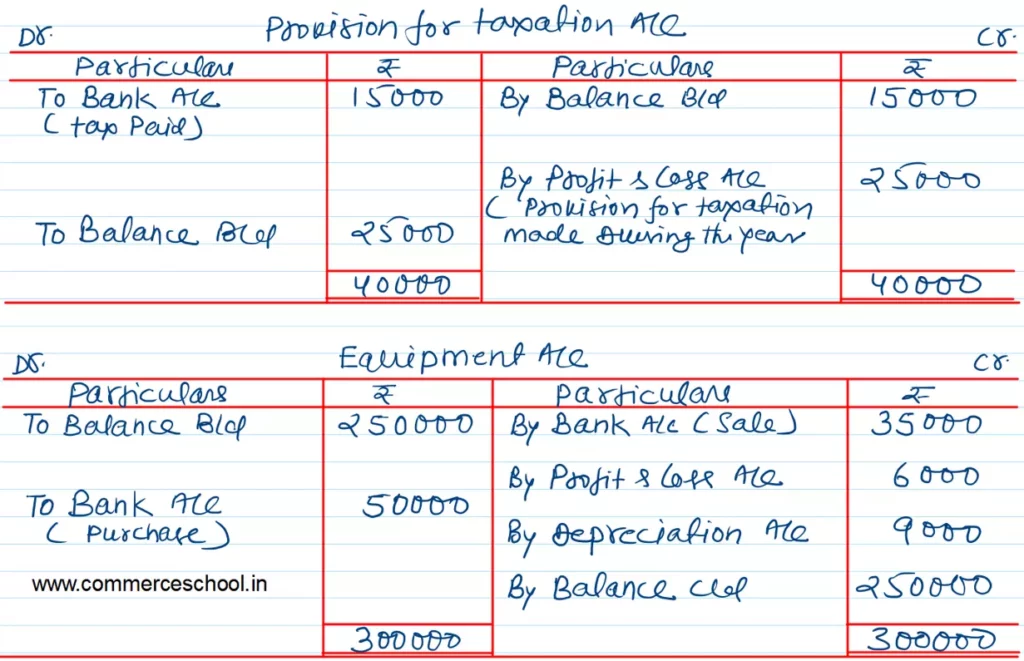

| Short-term Provisions Provision for Tax | 25,000 | 15,000 |

Notes: Proposed Dividend for the years ended 31st March, 2022 and 2023 are ₹ 35,000 and ₹ 25,000 respectively.

Additional Information:

- During the year, equipment costing ₹ 50,000 was purchased. Loss on sale of equipment amounted to ₹ 6,000, ₹ 9,000 depreciation was charged on equipment.

- Tax paid during the year was ₹ 15,000.

- An Interim Dividend of ₹ 20,000 was paid during the year.

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |