[ISC] Q. 55 Solution of Fundamentals of Partnership Firms TS Grewal Book (2024-25)

Solution of Question Number 55 of the Fundamentals of Partnership Accounts (Firm) chapter TS Grewal Book 2024-25 Edition ISC Board.

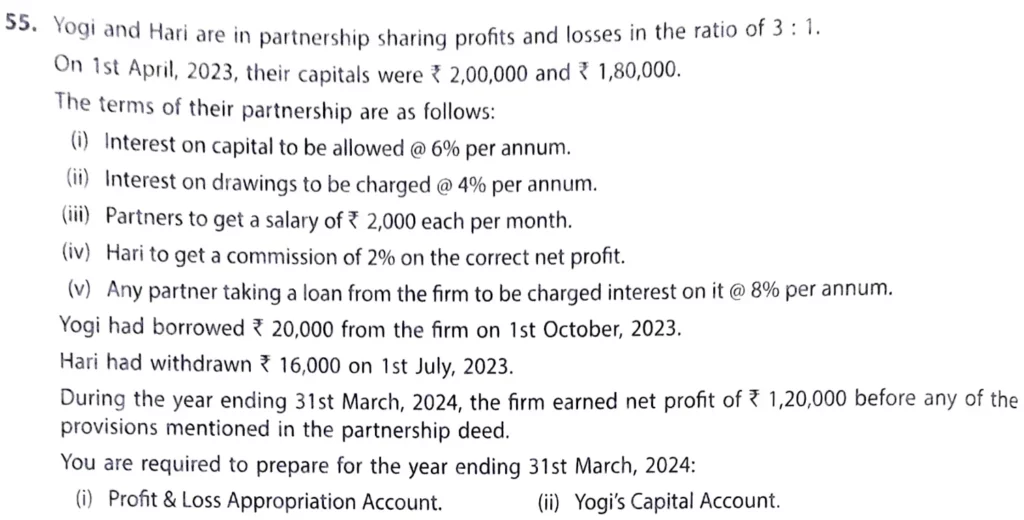

Yogi and Hari are in partnership sharing profits and losses in the ratio of 3 : 1. On 1st April 2023, their capitals were ₹ 2,00,000 and ₹ 1,80,000.

The terms of their partnership are as follows:

(i) Interest on capital to be allowed @ 6% per annum.

(ii) Interest on drawings to be charged @ 4% per annum.

(iii) Partners to get a salary of ₹ 2,000 each per month

(iv) Hari to get a commission of 2% on the correct net profit.

(v) Any partner taking a loan from the firm to be charged interest on it @ 8% per annum.

Yogi had borrowed ₹ 20,000 from the firm on 1st October 2023.

Hari had withdrawn ₹ 16,000 on 1st July 2023.

During the year ending 31st March 2024, the firm earned a net profit of ₹ 1,20,000 before any of the provisions mentioned in the partnership deed.

You are required to prepare for the year ending 31st March 2024:

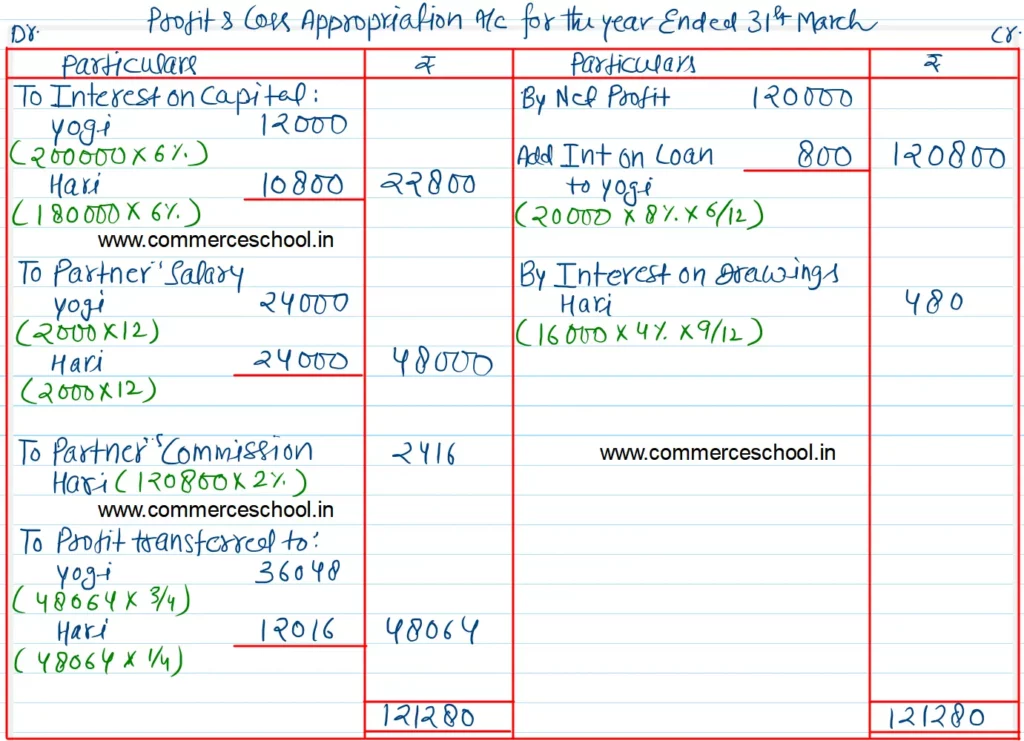

(i) Profit and Loss Appropriation Account.

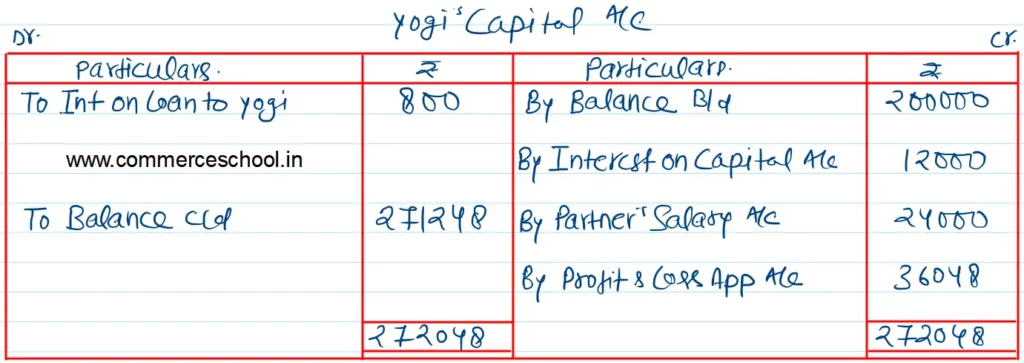

(ii) Yogi’s Capital Account.

Solution:-

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |