[ISC] Q. 57 Solution of Admission of Partner TS Grewal Accounts Class 12 (2024-25)

Solution to Question number 57 of the Admission of partner chapter 3 of TS Grewal Book 2024-25 Edition ISC/CISCE Board.

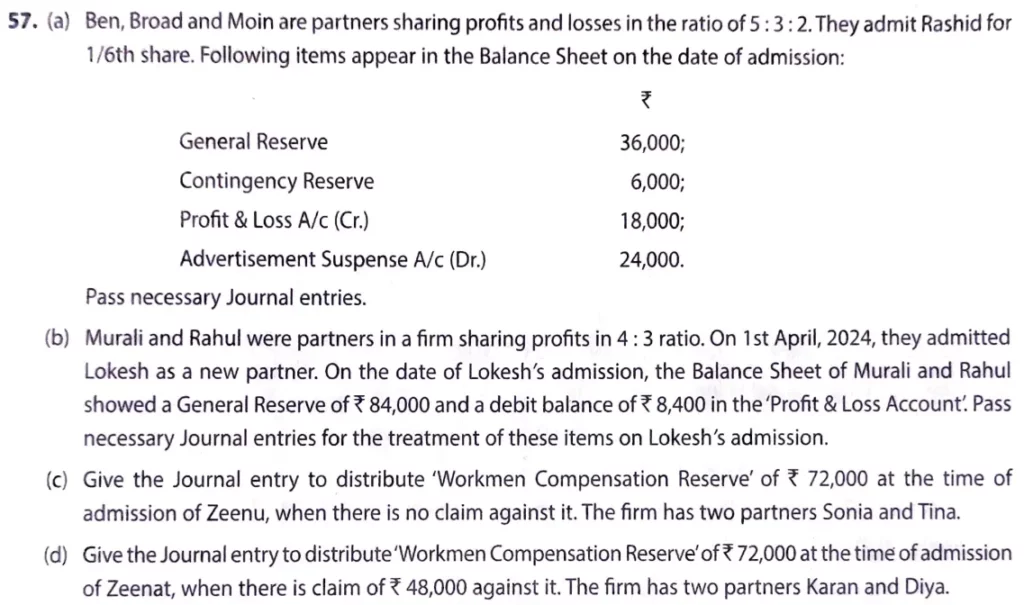

(a) Ben, Broad and Moin are partners sharing profit and losses in the ratio of 5 : 3 : 2. They admit Rashid for 1/6th share. Following items appear in the Balance Sheet on the date of admission:

| General Reserve | 36,000 |

| Contingency Reserve | 6,000 |

| Profit & Loss A/c (Cr.) | 18,000 |

| Advertisement Suspense A/c (Dr.) | 24,000 |

Pass necessary Journal entries.

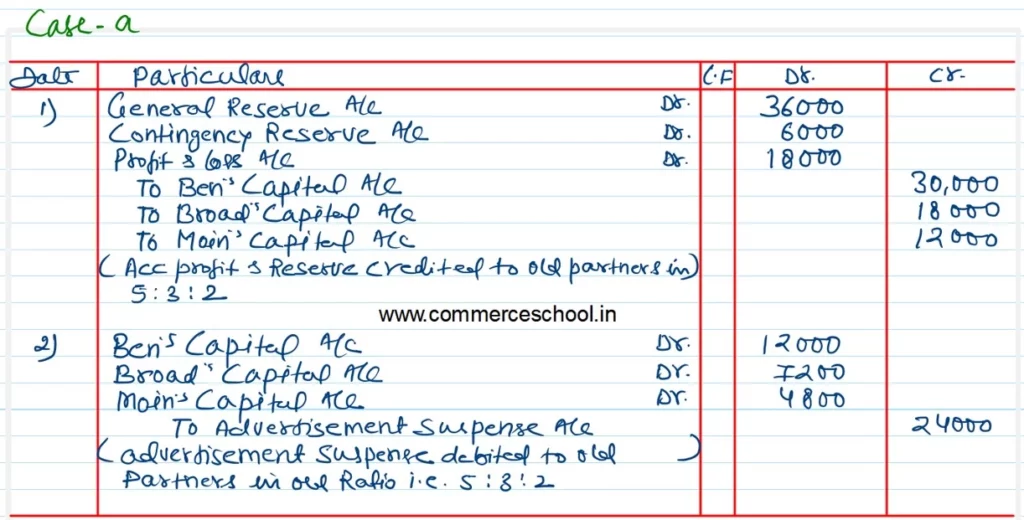

(b) Murali and Rahul were partners in a firm sharing profit in 4 : 3 ratio. On 1st April, 2023, they admitted Lokesh as a new partner. On the date of Lokesh’s admission, the Balance Sheet of Murali and Rahul showed a General Reserve of ₹ 84,000 and a debit balance of ₹ 8,400 in the ‘profit & Loss Account’. Pass necessary Journal entries for the treatment of these items on Lokesh’s admission.

(c) Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of ₹ 72,000 at the time of admission of Zeenu, when there is no claim against it. The firm has two partners Sonia and Tina.

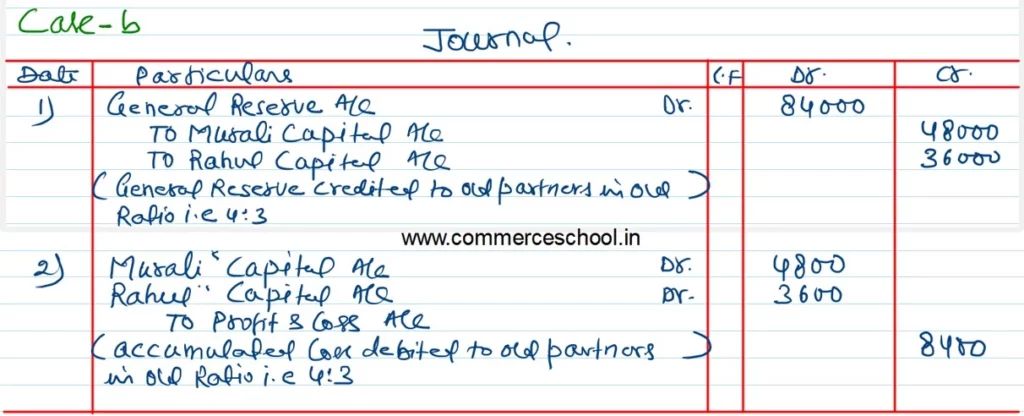

(d) Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of ₹ 72,000 at the time of admission of Zeenu, when there is no claim against it. The firm has two partners Sonia and Tina.

(d) Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of ₹ 72,000 at the time of admission of Zeenat

Solution:-

Here is the list of all Solutions of Admission of Partners of TS Grewal class 12 ISC Board 2024-25.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |