[ISC] Q 6 Solution Final Accounts with adjustments TS Grewal Class 11 (2023-24)

Solution of Question number 6 solution of Final Accounts with adjustments TS Grewal class 11 Accountancy ISC Board 2023-24.

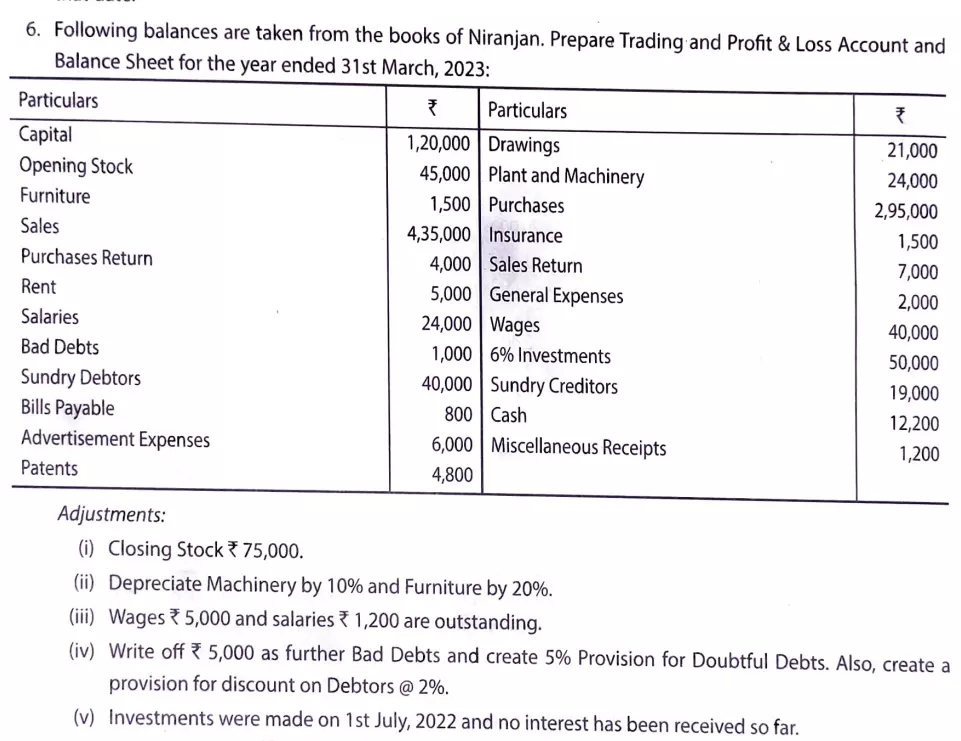

Following balances are taken from the books of Niranjan. Prepare Trading and Profit & Loss Account and Balance Sheet for the year ended 31st March, 2023:

| Particulars | ₹ | Particulars | ₹ |

| Capital Opening Stock Furniture Sales Purchases Return Rent Salaries Bad Debts Sundry Debtors Bills Payable Advertisement Expenses Patents | 1,20,000 45,000 1,500 4,35,000 4,000 5,000 24,000 1,000 40,000 800 6,000 4,800 | Drawings Plant and Machinery Purchases Insurance Sales Return General Expenses Wages 6% Investments Sundry Creditors Cash Miscellaneous Receipts | 21,000 24,000 2,95,000 1,500 7,000 2,000 40,000 50,000 19,000 12,200 1,200 |

Adjustments:

(i) Closing Stock ₹ 75,000.

(ii) Depreciate Machinery by 10% and Furniture by 20%.

(iii) Wages ₹ 5,000 and salaries ₹ 1,200 are outstanding.

(iv) Write off ₹ 5,000 as further Bad Debts and Create 5% Provision for Doubtful Debts. Also, create a provision for discount on Debtors @ 2%.

(v) Investments were made on 1st July, 2022 and no interest has been received so far.

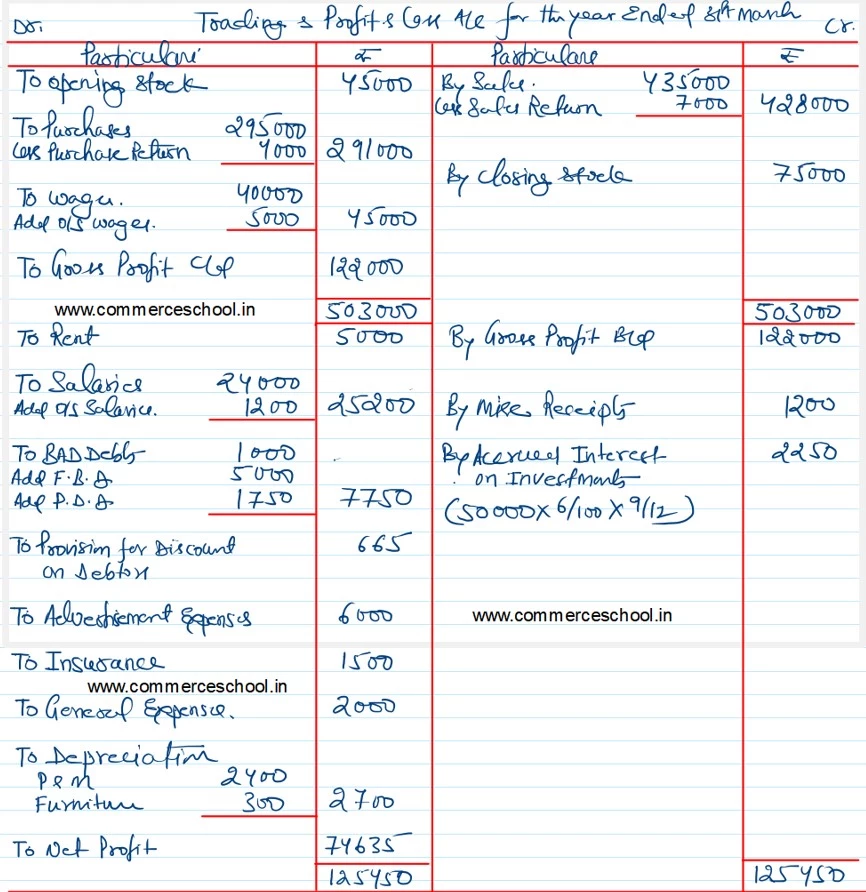

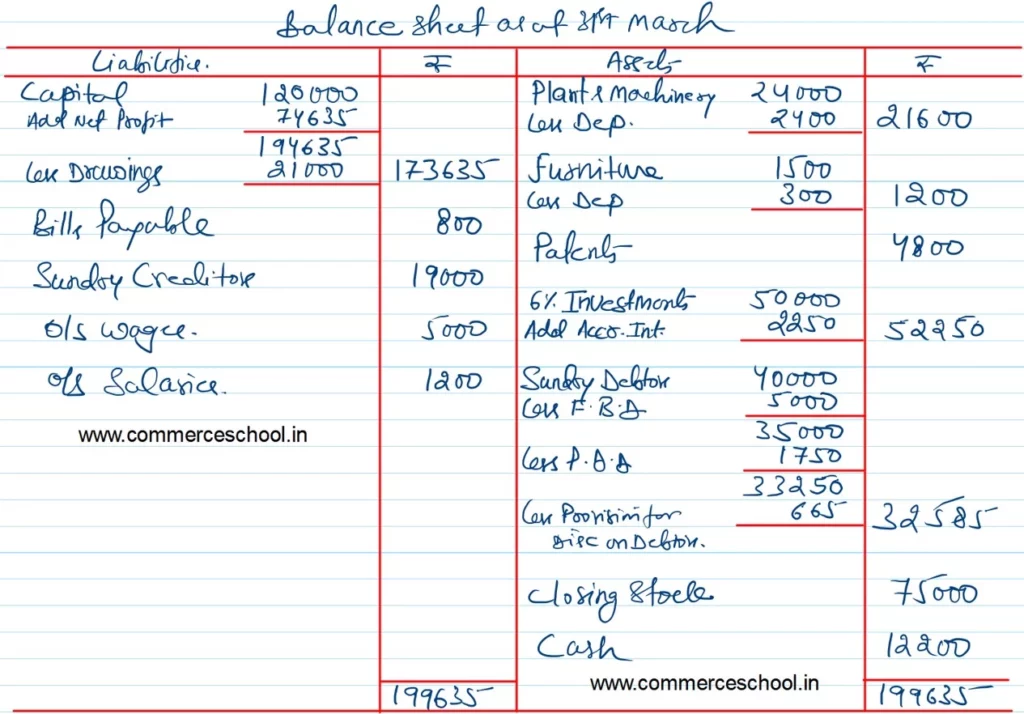

Solution:-

Here is the list of all solutions of Practical Problems below

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |