[ISC] Q. 60 Solution of Fundamentals of Partnership Firms TS Grewal Book (2024-25)

Solution of Question Number 60 of the Fundamentals of Partnership Accounts (Firm) chapter TS Grewal Book 2024-25 Edition ISC Board.

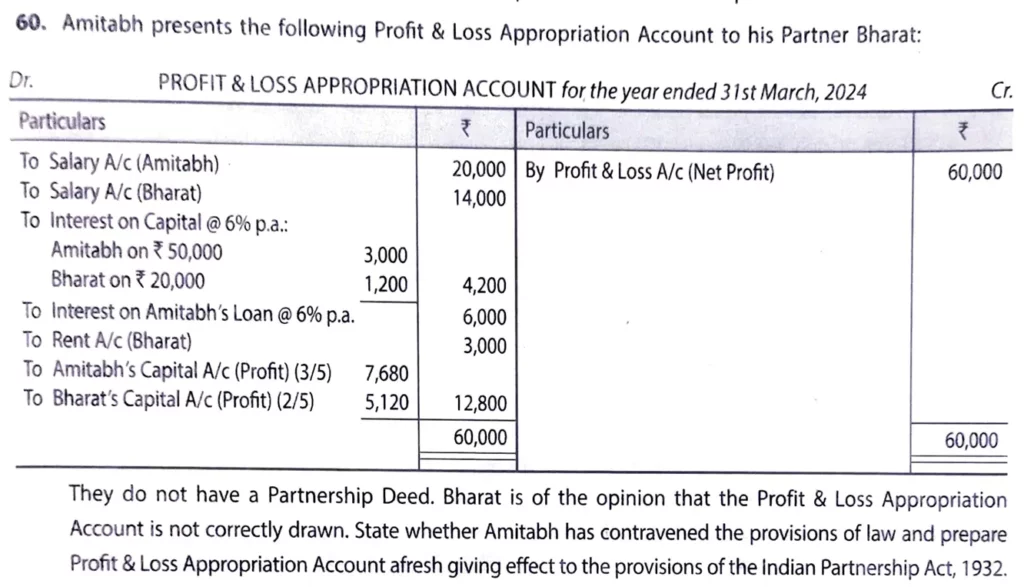

Amitabh presents the following Profit and Loss Appropriation Account to his Partner Bharat:

Profit & Loss Appropriation Account for the year ended 31st March, 2024

| Particulars | ₹ | Particulars | ₹ |

| To Salary A/c (Amitabh) To Salary A/c (Bharat) To Interest on Capital @ 6% p.a.: Amitabh on ₹ 50,000 Bharat on ₹ 20,000 To Interest on Amitabh’s Loan @ 6% p.a. To Rent A/c (Bharat) To Profit transferred to: 3/5th to Amitabh’s Capital A/c 2/5th to Bharat’s Capital A/c | 20,000 14,000 3,000 1,200 6,000 3,000 7,680 5,120 | By Profit & Loss A/c (Net Profit) | 60,000 |

| 60,000 | 60,000 |

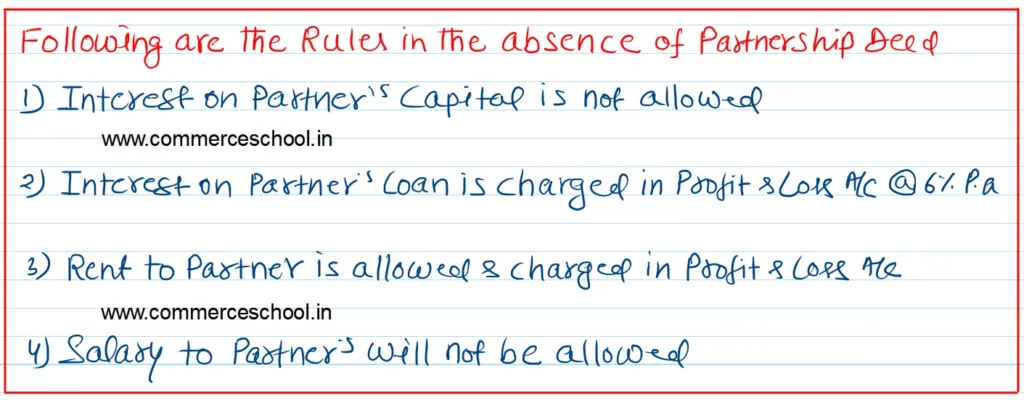

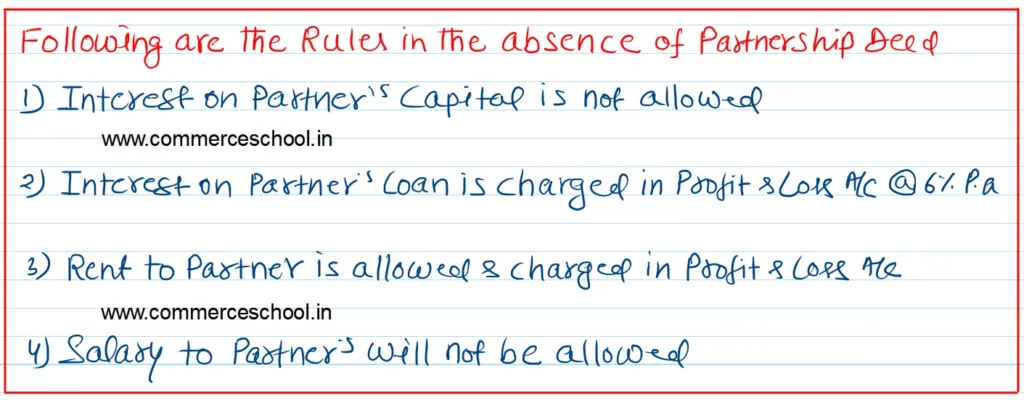

They do not have a Partnership Deed. Bharat is of the opinion that the Profit & Loss Appropriation Account is not correctly drawn. State whether Amitabh has contravened the Provisions of Law and Prepare, Profit and Loss Appropriation Account afresh giving effect to t

Solution:-

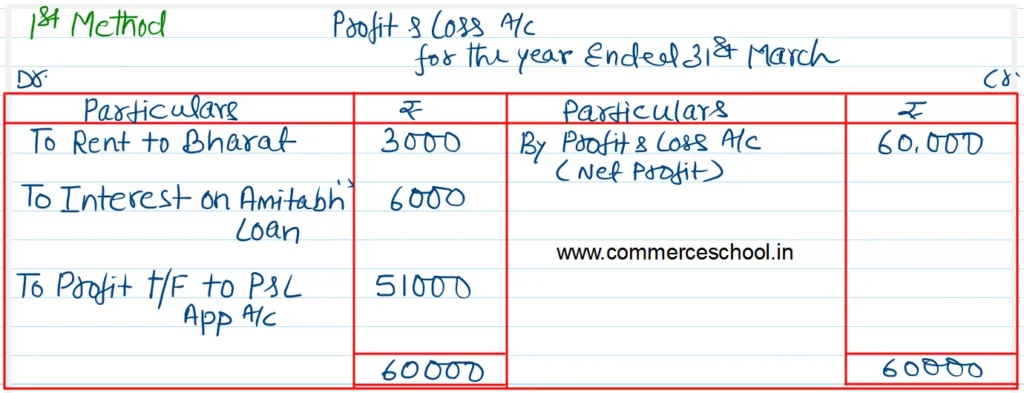

1st Method

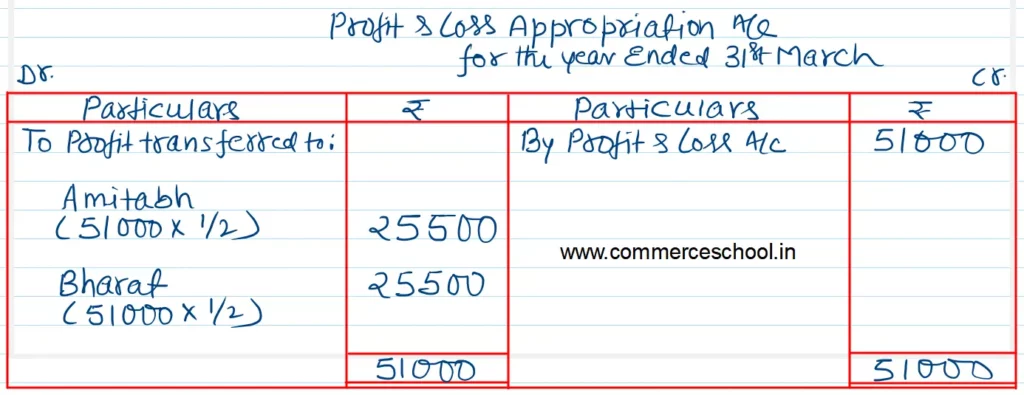

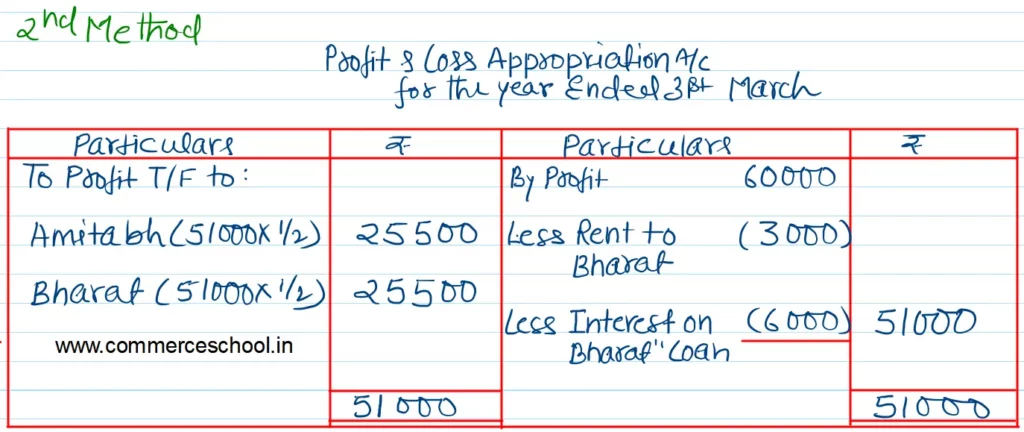

2nd Method

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |