[ISC] Q. 64 Solution of Accounting for Share Capital TS Grewal Class 12 (2022-23)

solution to Question number 64 of the Accounting for Share Capital chapter of TS Grewal Book 2022-23 Edition ISC Board?

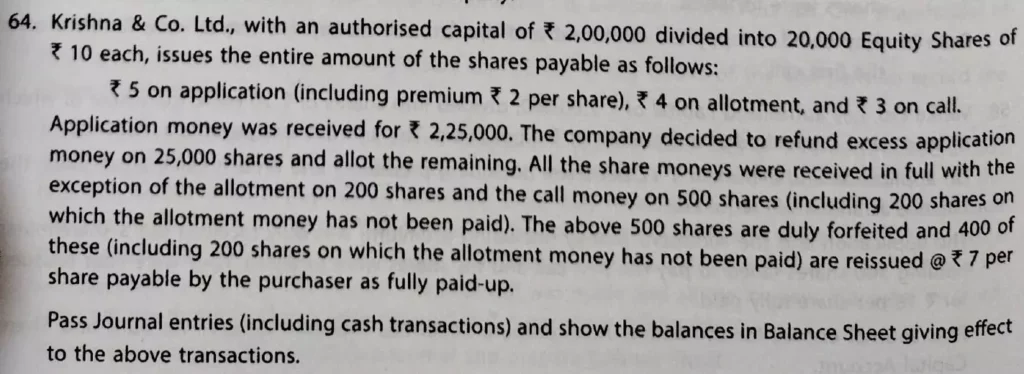

Krishan & Co. Ltd., with an authorised capital of ₹ 2,00,000 divided into 20,000 Equity Shares of ₹ 10 each, issues the entire amount of the shares payable as follows:

₹ 5 on application (including premium ₹ 2 per share),

₹ 4 on allotment, and ₹ 3 on call.

Application money was received for ₹ 2,25,000. The company decided to refund excess application money on 25,000 shares and allot the remaining. All the share moneys were received in full with the exception of the allotment on 200 shares and the call money on 500 shares (including 200 shares on which the allotment money has not been paid). The above 500 shares are duly forfeited and 400 of these (including 200 shares on which the allotment money has not been paid) are reissued @ ₹ 7 per share payable by the purchaser as fully paid-up.

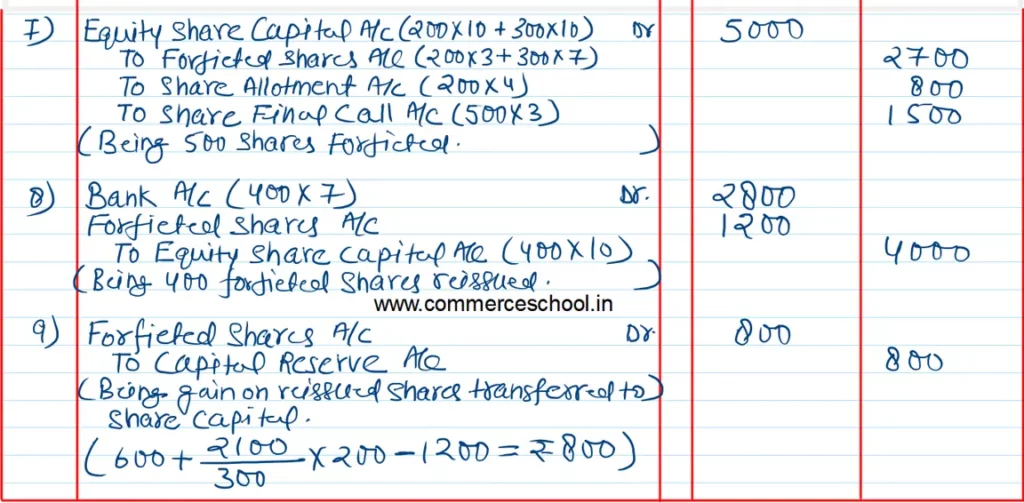

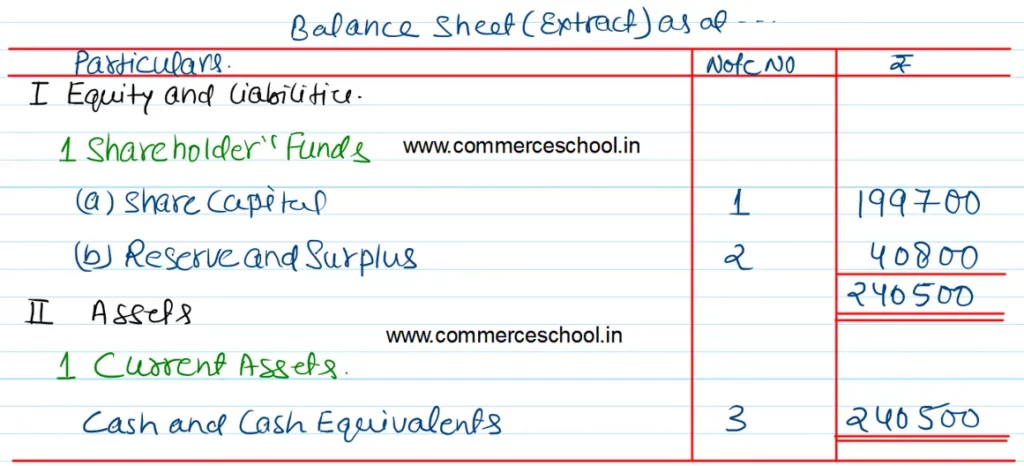

Pass Journal entries (including cash transactions) and show the balances in Balance Sheet giving effect to the above transactions.

Solution:-

Issue of Share chapter Solutions of TS Grewal Class 12 Accountancy ISC 2022-23

Let’s Practice

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |