[ISC] Q. 64 Solution of Fundamentals of Partnership Firms TS Grewal Book (2024-25)

Solution of Question Number 64 of the Fundamentals of Partnership Accounts (Firm) chapter TS Grewal Book 2024-25 Edition ISC Board.

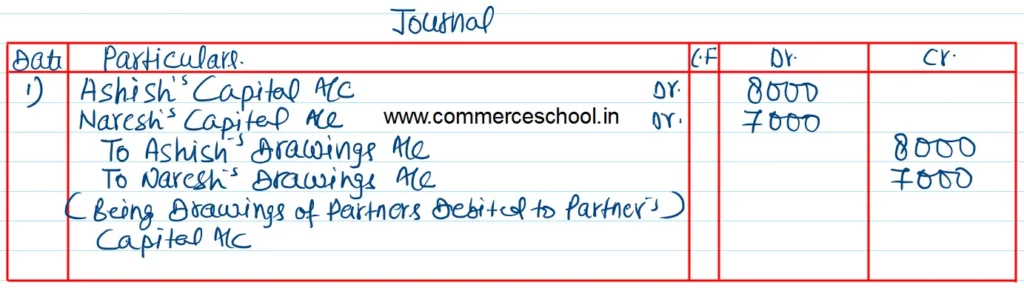

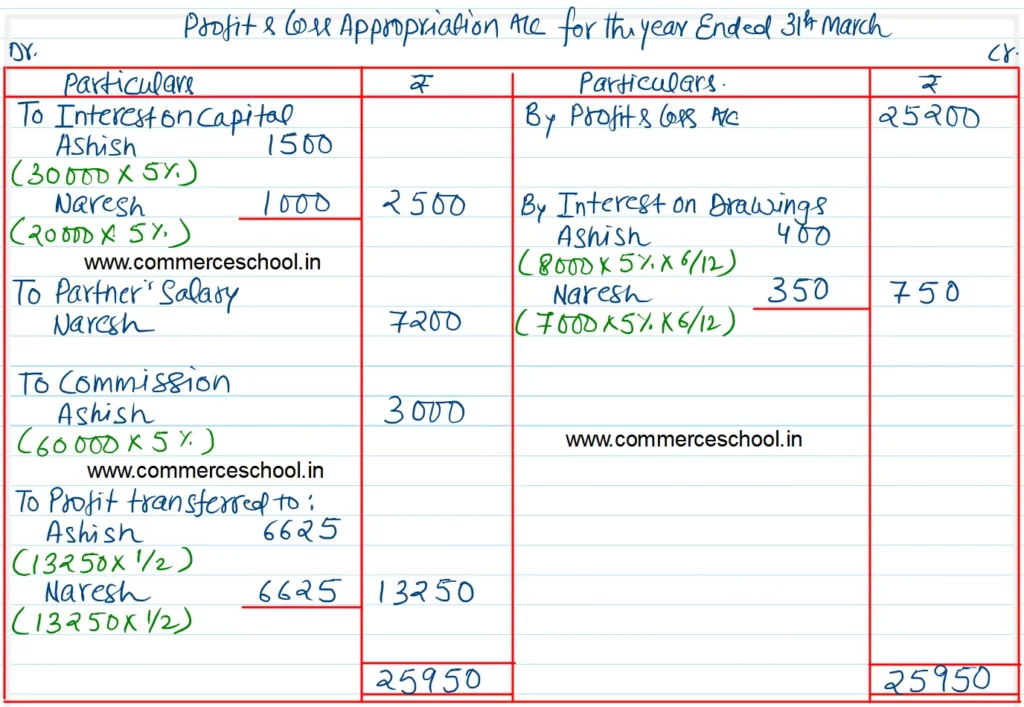

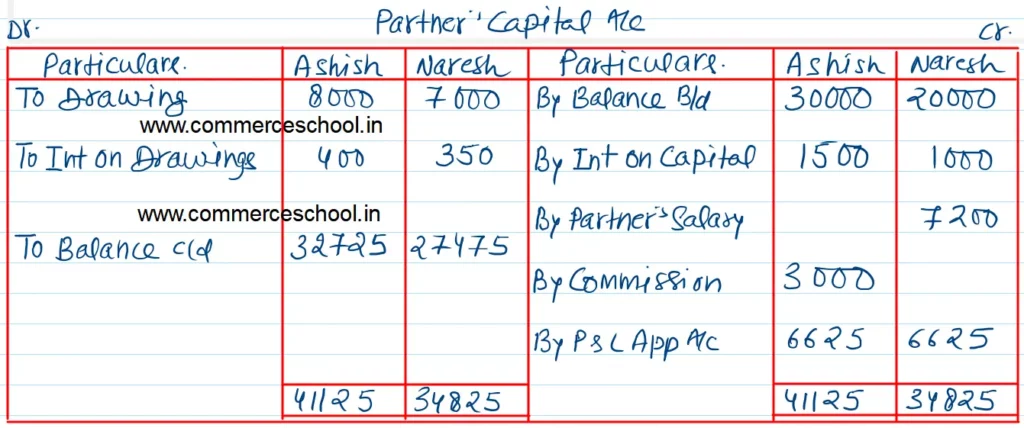

Ashish and Naresh are equal partners. The balances of their Capital Accounts as at 1st April 2023 were:

Ashish – ₹ 30,000 and Naresh – ₹ 20,000.

The Partnership Deed provides for the following:

(i) Interest on Capitals and Drawings @ 5%;

(ii) Salary for Naresh @ ₹ 600 per months; and

(iii) Commission to Ashish @ 5% on sales.

During the year ended 31st March 2024, the Profit and Loss Account showed a net profit of ₹ 25,200.

Sales for the year ended 31st March 2024 were ₹ 60,000.

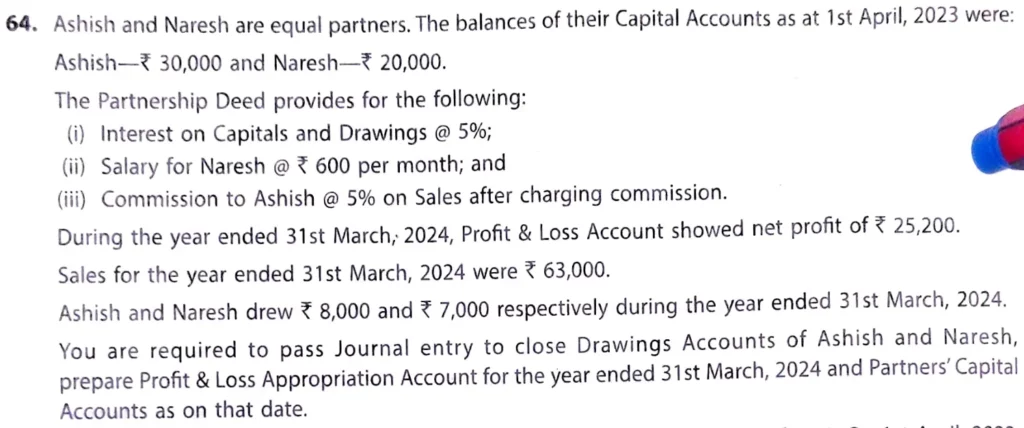

Ashish and Naresh drew ₹ 8,000 and ₹ 7,000 respectively during the year ended 31st March 2024.

You are required to prepare Profit and Loss Appropriation Account for the year ended 31st March 2024 and Partner’s Capital Account as on that date.

Solution:-

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |