[ISC] Q. 7 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 7 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

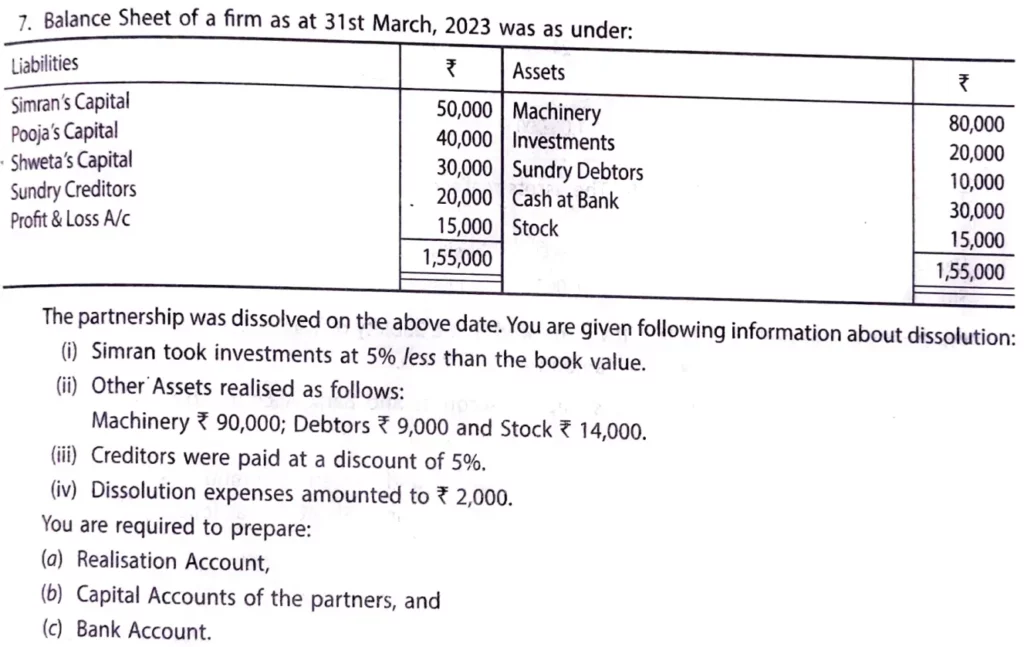

Balance Sheet of a firm as at 31st March, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Simran’s Capital Pooja’s Capital Shweta’s Capital Sundry Creditors Profit & Loss A/c | 50,000 40,000 30,000 20,000 15,000 | Machinery Investments Sundry Debtors Cash at Bank Stock | 80,000 20,000 10,000 30,000 15,000 |

| 1,55,000 | 1,55,000 |

The partnership was dissolved on the above date. You are given following information about dissolution:

(i) Simran took investments at 5% less than the book value.

(ii) Other Assets realised as follows:

Machinery ₹ 90,000; Debtors ₹ 9,000 and Stock ₹ 14,000.

(iii) Creditors were paid at a discount of 5%.

(iv) Dissolution expenses amounted to ₹ 2,000.

You are required to prepare:

(a) Realisation Account,

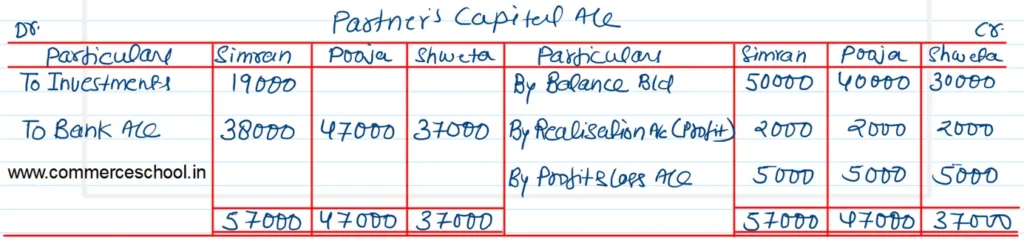

(b) Capital Accounts of the partners, and

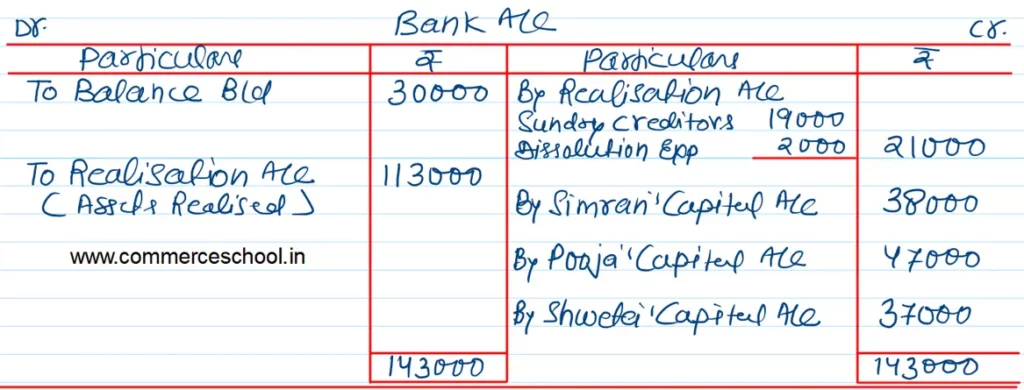

(c) Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |