[ISC] Q 9 Redemption of Debenture TS Grewal (2023-24)

Solution of question number 9 of Redemption of Debenture Ts Grewal class 12 ISC Board (2023-24)

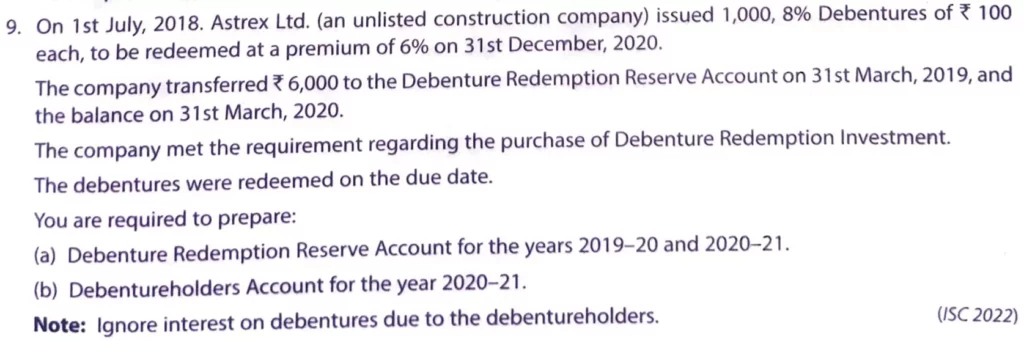

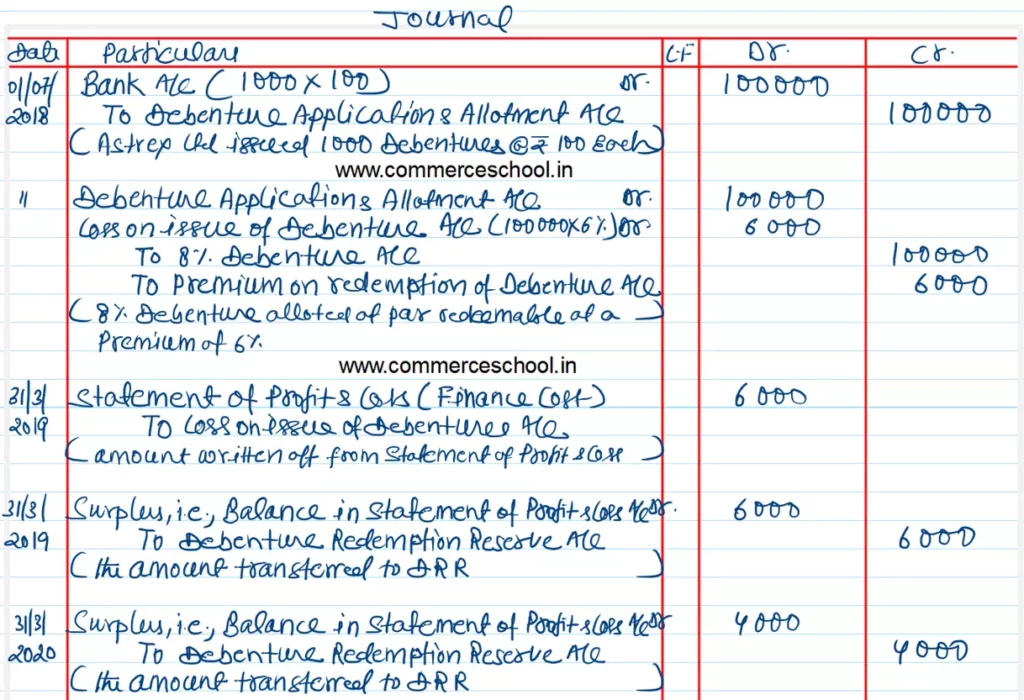

On 1st July, 2018. Astrex Ltd. (an unlisted construction company) issued 1,000, 8% Debentures of ₹ 100 each, to be redeemed at a premium of 6% on 31st December, 2020.

The company transferred ₹ 6,000 to the Debenture Redemption Reserve Account on 31st March, 2019, and the balance on 31st March, 2020.

The company met the requirement regarding the purchase of Debenture Redemption Investment.

The debentures were redeemed on the due date.

You are required to prepare:

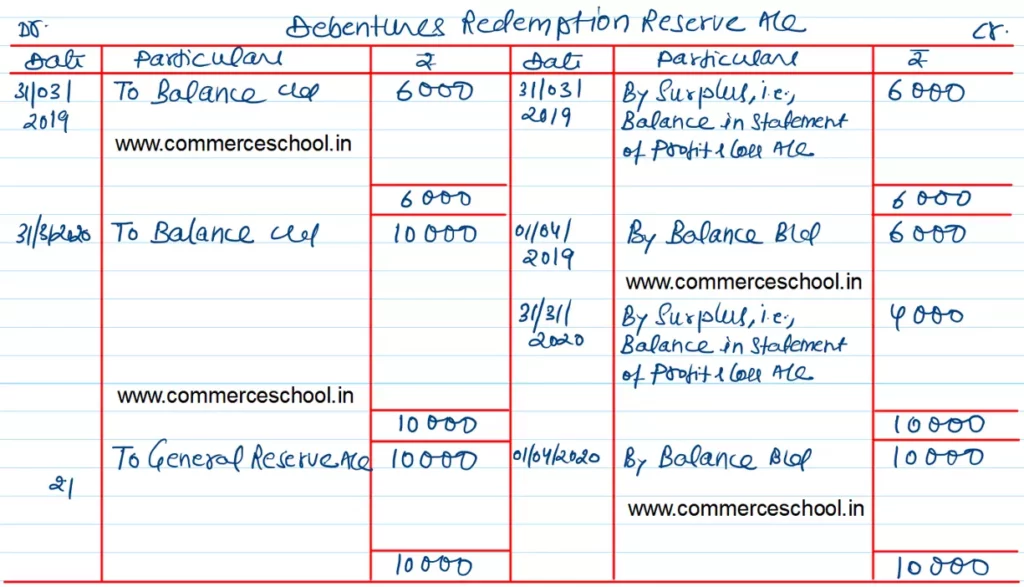

(a) Debenture Redemption Reserve Account for the years 2019–20 and 2020–21.

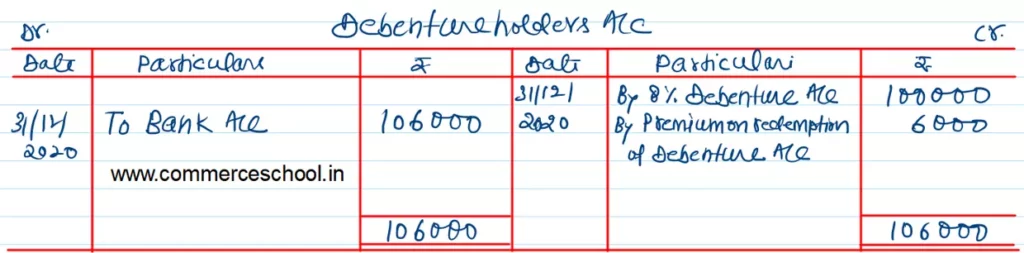

(b) Debenture holders Account for the year 2020–21

Note: Ignore interest on debentures due to the debenture holders.

Solution:-

Here is the list of all Solutions of Redemption of Debenture of TS Grewal class 12 ISC Board 2023-24.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |