[ISC] Q 9 Solution Final Accounts with adjustments TS Grewal Class 11 (2023-24)

Solution of Question number 9 solution of Final Accounts with adjustments TS Grewal class 11 Accountancy ISC Board 2023-24.

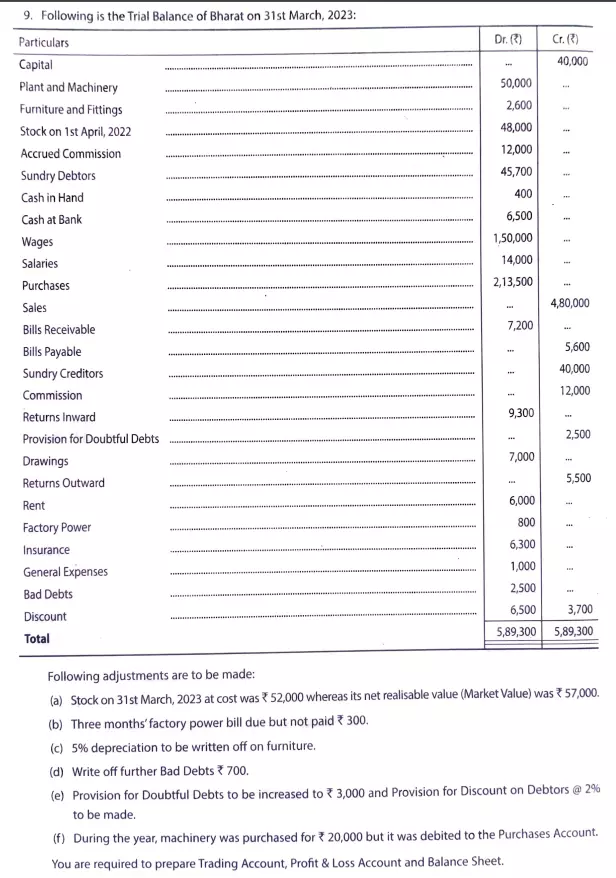

Following is the Trial Balance of Bharat on 31st March, 2023:

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital Plant and Machinery Furniture and Fittings Stock on 1st April, 2022 Accrued Commission Sundry Debtors Cash in Hand Cast at Bank Wages Salaries Purchases Sales Bills Receivable Bills Payable Sundry Creditors Commission Returns Inward Provision for Doubtful Debts Drawings Returns Outward Rent Factory Power Insurance General Expenses Bad Debts Discount | – 50,000 2,600 48,000 12,000 45,700 400 6,500 1,50,000 14,000 2,13,500 – 7,200 – – – 9,300 – 7,000 – 6,000 800 6,300 1,000 2,500 6,500 | 40,000 – – – – – – – – – – 4,80,000 – 5,600 40,000 12,000 – 2,500 – 5,500 – – – – – 3,700 |

| Total | 5,89,300 | 5,89,300 |

Following adjustments are to be made:

(a) Stock on 31st March, 2023 at cost was ₹ 52,000 whereas its net realisable value (Market Value) was ₹ 57,000.

(b) Three months’ factory power bill due but not paid ₹ 300.

(c) 5% depreciation to be written off on furniture.

(d) Write off further Bad Debts ₹ 700.

(e) Provision for Doubtful Debts to be increased to ₹ 3,000 and Provision for Discount on Debtors @ 2% to be made.

(f) During the year, machinery was purchased for ₹ 20,000 but it was debited to the Purchases Account.

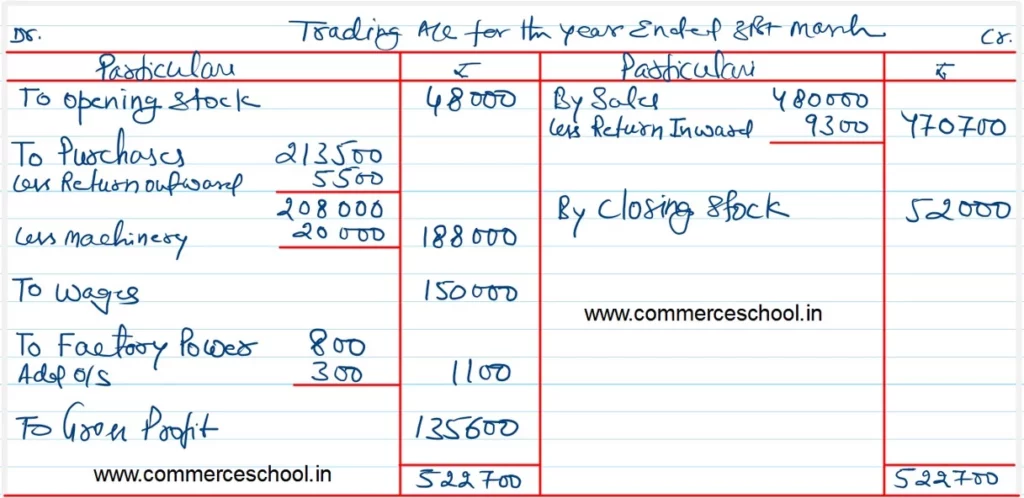

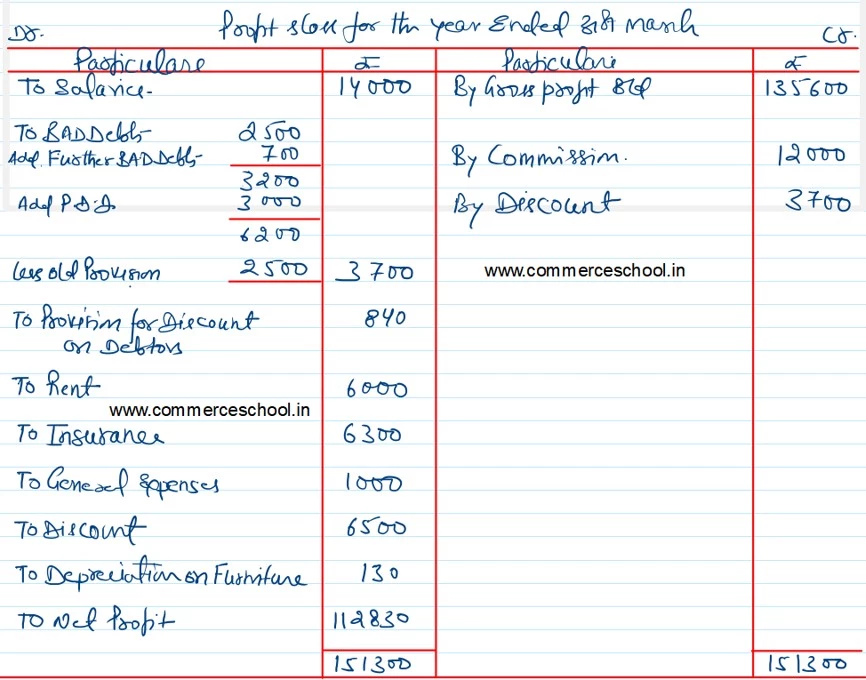

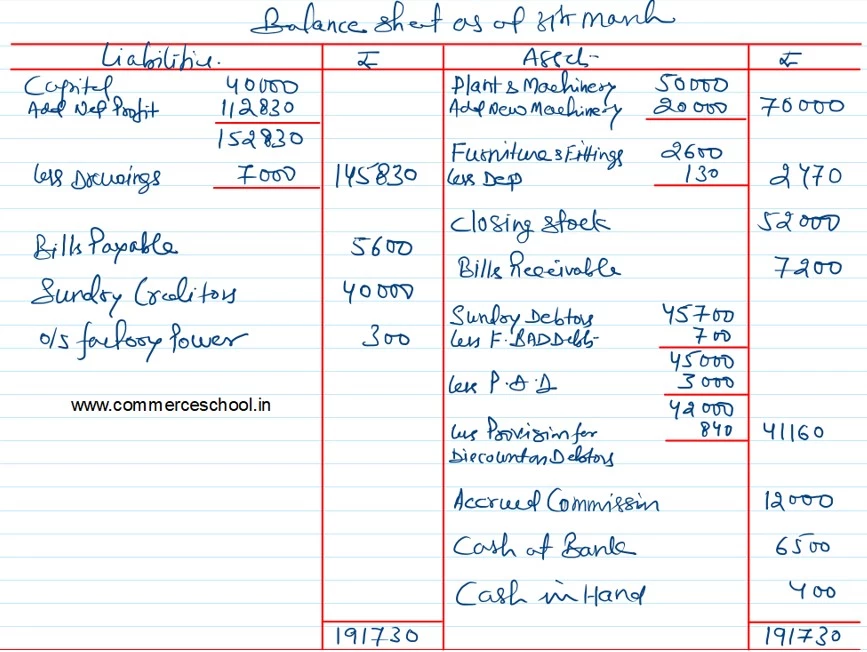

You are required to prepare Trading Account, Profit & Loss Account and Balance Sheet.

Solution:-

Here is the list of all solutions of Practical Problems below

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |