[200] MCQs of Admission of Partner chapter Class 12

Looking for Important MCQs (Multiple Choice Questions) of Admission of Partner chapter with answers of Accountancy Class 12 CBSE, ICSE, and other State Board.

I have made a collection of MCQs of this chapter with answers and explanations (Reasons)

More Resources

Multiple Choice Questions of Admission of Partner chapter of Accounts Class 12

Let’s Practice

A New Partner may be admitted into a partnership:

a) with the consent of anyone partner

b) with the consent of a majority of partners

c) With the consent of all old partners

d) With the consent of 2/3rd of old partners

Ans – c

Explanation:-

As per the Partnership Act 1932, A new partner can be admitted only with the consent of all the partners.

On the admission of a new partner

a) Old firm is dissolved

b) Old partnership is dissolved

c) Both old partnership and firm are dissolved

d) Neither partnership nor firm is dissolved

Ans:- b)

When a new partner is admitted in the firm.

a) old partners gain in profit sharing ratio

b) old partners loose in profit sharing ratio

c) only one partner gains while other losse

d) Not affected at all

Ans:- b)

the new partner takes the share a portion in profit. thus old partners loose their share in profit sharing ratio.

A and B are partners sharing profit in the ratio of 3 : 2. They admit C as a partner by giving him 1/3rd share in future profits. The new ratio will be:

a) 12 : 8 : 5

b) 8 : 12 : 5

c) 5: 5: 12

d) None of the above

Ans:- d)

Explanation:-

Remaining share = 1 – 1/3 = 2/3

remaiing portion of share would be taken by old partners A and B in 3 : 2

A’s new share = 2/3 x 3/5 = 6/15

B’s new share = 2/3 x 2/5 = 4/15

New proift shring ratio of A, B and C after making base equal is 6/15 : 4/15 : 1/3 x 5/5

= 6 : 4 : 5

X and Y are partners sharing profit in the ratio of 3 : 2. Z was admitted with 1/4 share in profits which he acquired equally from X and Y. The new ratio will be:

a) 9: 6: 5

b) 19 : 11 : 10

c) 3 : 3: 2

d) 3: 2: 4

Ans:- b)

Explanation:-

Z received from X = 1/4 x 1/2 = 1/8

Z received from Y = 1/4 x 1/2 = 1/8

X’s new share = 3/5 – 1/8 = 19/40

2/5 – 1/8 = 11/40

New Profit Sharing ratio of X, Y and Z is

= 19/40 : 11/40 : 1/4 x 10/10

19 : 11 : 10

Sacrificing Ratio is

a) Old Profit sharing Ratio – New profit sharing Ratio

b) New profit sharing Ratio – Old Profit sharing Ratio

c) Equal to Old profit sharing Ratio

d) Equal to New profit sharing Ratio

Ans:- a)

A and B share profits in the ratio of 2 : 1. C is admitted with 1/4 share in profits, C acquires 3/4 of his share from A and 1/4th of his share from B. The new ratio will be:

a) 2 : 1 : 1

b) 23 : 13 : 12

c) 3 : 1 : 1

d) 13 : 23 : 12

Ans:- b)

C receives from A = 1/4 x 3/4 = 3/16

C receives from B = 1/4 x 1/4 = 1/16

A’s new share = 2/3 – 3/16 = 23/48

B’s new share = 1/3 – 1/16 = 13/48

New Profit sharing ratio of A, B and C after making base equal

23/48 : 13/48 : 1/4 x 12/12

= 23 : 13 : 12

At the time of admission of a new partner in the firm, the new partner compensates the old partners for their loss of share in the super-profits of the firm for which he brings in an additional amount which is known as:-

a) Capital share

b) Premium for goodwill

c) Both a) and b)

d) None of the above

Ans:- b)

The account which shows change in the value of assets and liabilities is known as

a) Profit and Loss Account

b) Profit and Loss Appropriation Account

c) Current Account

d) Revaluation Account

Ans:- d)

At the time of admission, an incoming partner becomes liable for the________of the firm and also acquires right on the ___________ .

a) assets, liabilities

b) goodwill, capital

c) liabilities, assets

d) None of these

Ans:- c)

At the time of admission of partners, it is presumed that the new partner acquires his share in profits from the old partners in______ratio in the absence of any additional information.

a) New

b) Gaining

c) Old

d) None of these

Ans:- c)

General Reserve at the time of admission of a partner is transferred to

a) Revaluation Account

b) the credit of old partner’s Capital Accounts

c) the debit of Old partner’s Capital Accounts

d) the credit of Capital Accounts of all the Partners

Ans:- b)

At the time of admission of partners, the new profit sharing ratio is concerned with ________ partners while sacrificing ratio is concerned with __________ partners.

a) new, old

b) new, all

c) old, new

d) all, old

Ans:- d)

The share of premium of goodwill brought in by the new partner is divided in which ratio?

a) In new Ratio

b) In old Ratio

c) In sacrificing Ratio

d) None of these

Ans:- c)

Accumulated Profits/Losses are transferred to the Capital Accounts of old partners in

a) New Profit sharing ratio

b) Old profit sharing ratio

c) Capital Ratio

d) None of these

Ans:- b)

A newly admitted partner acquires the right to

a) share in the future profits

b) share in the assets of the firm

c) Both a) and b)

d) None of these

Ans:- c)

Explanation

After the admission, a new partner acquires the right to share in the future profits and also in the assets of the firm. He is also liable to share the losses and the liabilities of the firm.

According to section 31(1) of the Indian Partnership Act, 1932, “A person can be admitted as a new partner only with the ___ unless otherwise agreed upon.”

a) consent of one partner

b) consent of the existing partners

c) Both a) and b)

d) consent of the firm

Ans:- b)

The asset that normally is valued/revalued at the time of admission of a new partner is

a) Goodwill

b) Fixed Assets

c) Stock

d) Investments

Ans:- a)

X and Y are partners in a firm that develops software for industries. X’s minor son Z is a computer wizard. Can he be admitted to the partnership firm?

a) Yes if X agrees

b) Yes, if Y agrees

c) Yes if X and Y agree

d) No, he can not be admitted

Ans:- c)

Explanation:-

Section 30 of the Indian Partnership Act 1932 states that while a minor cannot be a partner in a firm,But he/she still can be admitted to the benefits of the partnership firm and be a partner only in the profit of the firm. As X’s minor son is a computer wizard, it can increase the profit of the firm. Thus with the consent of all the current partners X’s minor son can be admitted.

When share of new or incoming partner is given without giving the details of sacrifice made by old or existing partners, then

a) it is assumed that old partners make sacrifice in their old profit sharing ratio.

b) there is no change in profit sharing ratio of the old partners

a) only a is correct

b) Only b is correct

c) Both a) and b) are correct

d) Both a) and b) are incorrect

Ans:- c)

In the Balance Sheet prepared after the new partnership agreement, Assets and Liabilities are usually shown at

a) Original Value

b) Revalued Value or Amount

c) Realisable Value

d) Current Cost

Ans:- b)

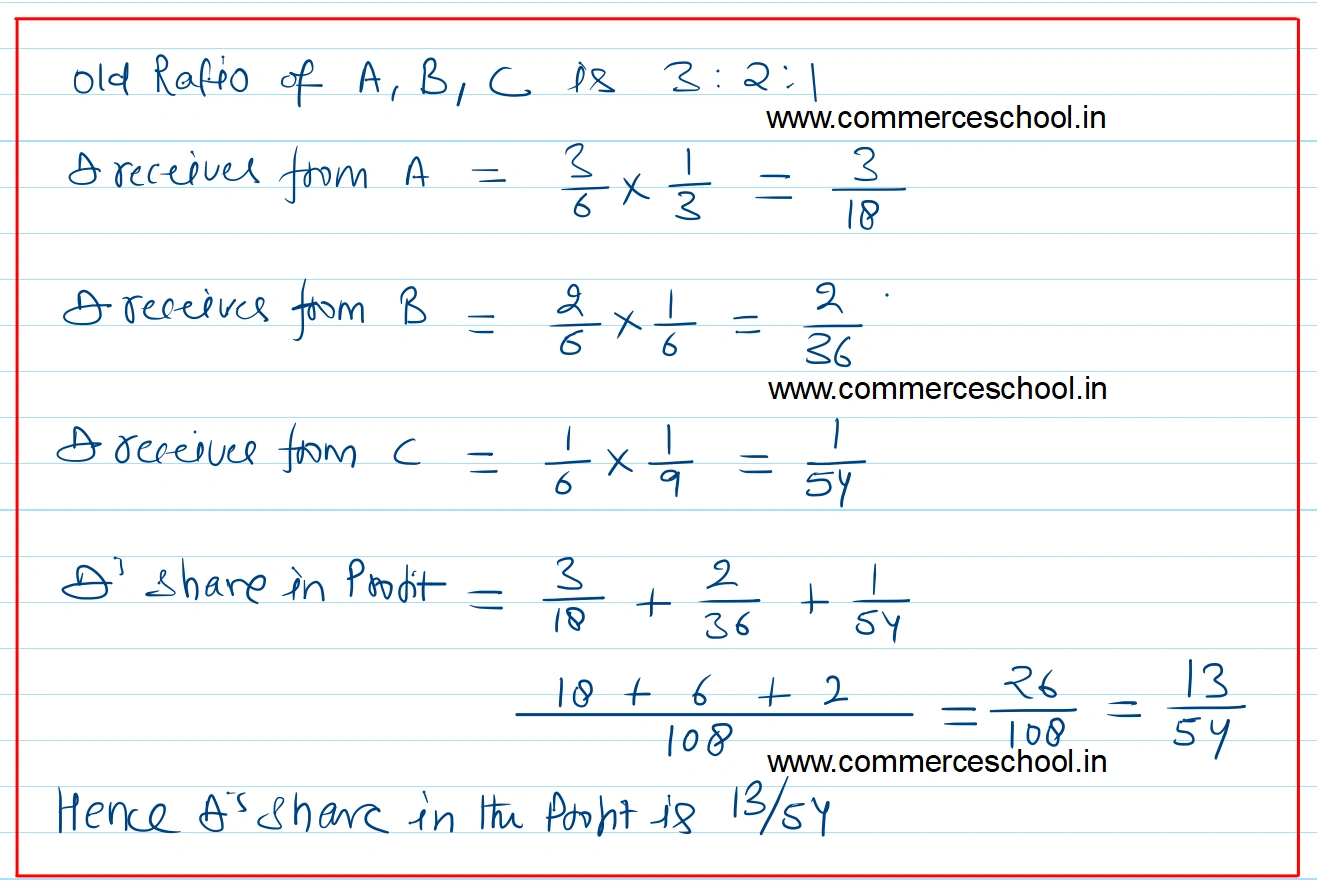

A, B, and C are partners sharing profits in the ratio of 3 : 2 : 1. They agree to admit D into the firm. A, B, and C agreed to give 1/3rd, 1/6th, and 1/9th share of their profit. The share of profit of, D will be

a) 1/10

b) 11/64

c) 12/54

d) 13/54

Ans:- d)

Explanation:-

The amount of goodwill brought in by the new partner is credited to _____ partner’s capital account.

a) old

b) sacrificing

c) gaining

d) All of these

Ans:- b)

Explanation:-

The amount of goodwill brought in by the new partner is credited to the capital accounts of sacrificing partners to compensate them for their sacrifice in profit sharing ratio

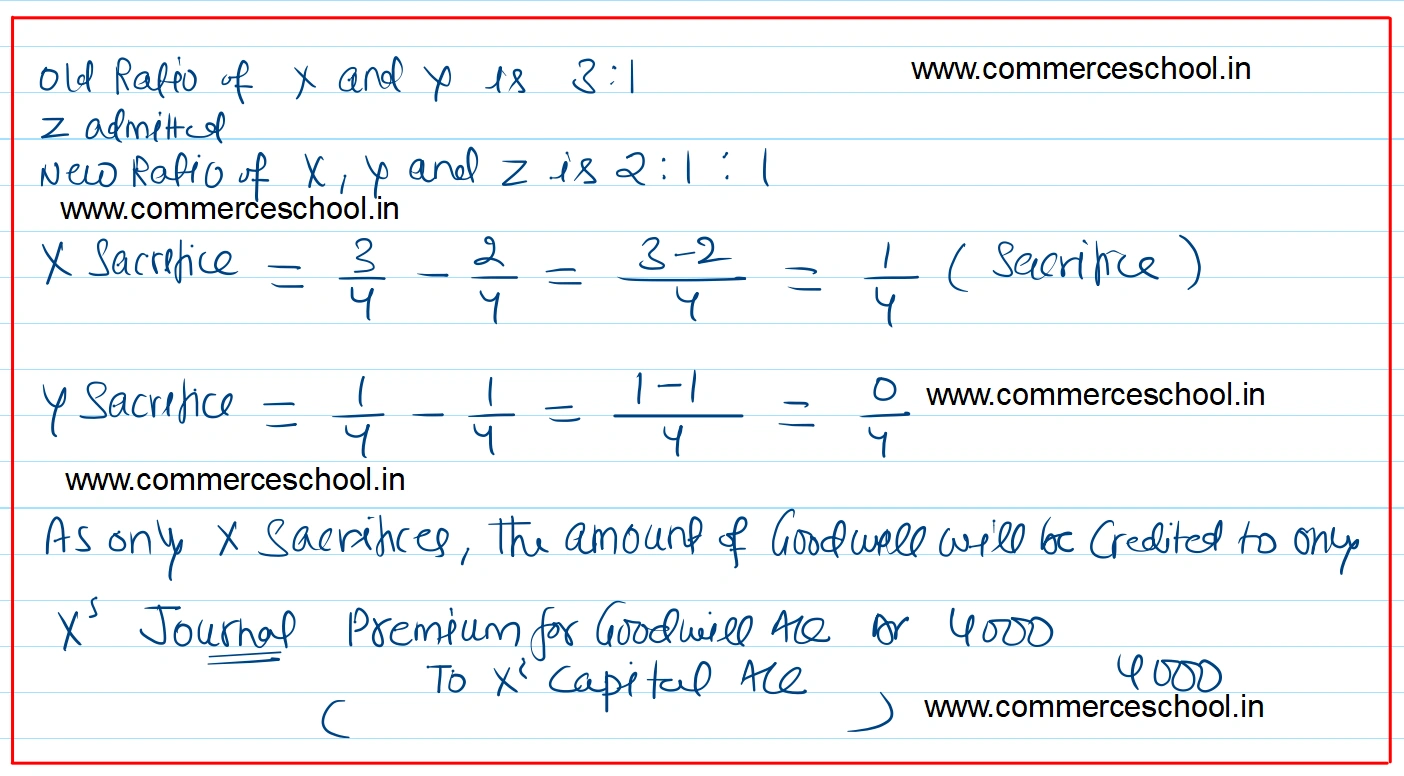

X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who pays ₹ 4000 as goodwill, the new profit sharing ratio being 2 : 1 : 1 among X, Y and Z. The amount of goodwill will be credited to

a) X and Y as ₹3000 and ₹1000

b) 2,000 each

c) only Y

d) Only X

Ans:- d)

Explanation:-

Contingency reserve appearing in the balance sheet at the time of admission of the partner is ________ to old partners capital accounts in old ratio.

a) debited

b) credited

c) Either a) or b)

d) None of these

Ans:- b)Explanation:-

Contingency reserve is a free reserve created out of profits related to the period prior to admission. Since it is a part of the profit, therefore it is credited to the old partner’s capital accounts in the old ratio.

Workmen Compensation Reserve (WCR) appears in the Balance Sheet of Rashmi and Suman, Who share profits in the ratio of 2 : 3, at ₹ 80,000. Deepa is admitted and the new profit sharing ratio is 1:1:1. If the claim on account of WCR is estimated at ₹1,00,000, then

a) the difference of ₹ 20,000 will be debited to the revaluation account

b) the difference of ₹ 20,000 will be debited to Rashmi’s Capital account

b) the difference of ₹ 20,000 will be credited to Suman’s Capital account

d) None of the above.

Ans:- a)Explanation:-

In this case, the difference amount is debited to the revaluation account as it results in an increase in the amount of liability.

Can employee provident funds be distributed among old partners in the old ratio at the time of admission?

a) It can be distributed

b) It can’t be distributed

c) can be distributed if tax is paid

d) None of these

Ans:- b)

Explanation:-

Employee Provident fund is neither a free reserve nor is an accumulated profit. It is an liability of the firm towards the employees. Therefore, it is not distributed amongst old partners.

If the market value and the book value of investments are ₹ 1,47,000 and 1,50,000. The Investment Fluctuation Fund appears in the Balance Sheet is ₹ 13,500. The ratio of the old partner’s A, B, and C at the time of admission of new partner D is 5:3:2.

a) 5,250, 3,150, 2,100

b) 6,750, 4050, 2,700

c) 5,000, 5,000, 3,500

d) None of these

Ans:- a)

Explanation:-

Investment Fluctuation Fund to be disributed = ₹ 13,500 – ₹ 3,000 = ₹ 10,500

A’s sahre = 10,500 x 5/10 = ₹ 5,250

= 10,500 x 3/10 = ₹ 3,150

= 10,500 x 2/10 = ₹ 2,100

X and Y are sharing profits and losses in the ratio of 3:2. They admit Z as a partner and give him a 2/10th share in the profits. The new profit sharing ratio will be

a) 12:8:5

b) 3:2:2

c) 3:2:5

d) 2:1:2

Ans:- a)

X’s New Share = 8/10 x 3/5 = 24/50

Y’s New Share = 8/10 x 2/5 = 16/50

New Profit sharin ratio after making base equal is

24/50 : 16/50 : 2/10 x 5/5

24 : 16 : 10 i.e., 12 : 8 : 5

B and N are partners in firm sharing profits in the ratio of 3:2. They admit S as a partner for 1/4th share in the profits. S acquires his share from B and N in the ratio of 2:1. The new profit sharing ratio will be:

a) 2:1:4

b) 19:26:15

c) 3:2:4

d) 26:19:15

Ans:- d)

Explanation:-

B sacrifices = 1/4 x 2/3 = 2/12

N Sacrifices = 1/4 x 1/3 = 1/12

B’s New Share = 3/5 – 1/12 = 26/60

C’s New Share = 2/5 – 1/12 = 19/60

new profit sharing ratio after making base equal

= 26/60 : 19/60 : 1/4 x 15/15

= 26 : 19 : 15

Shiv and Mohan are sharing profits and losses in the ratio of 5:3. They admit Jia as a partner and give her 3/10th share of the profits. He takes this share as 1/5th from Shiv and 1/10th from Mohan. New profit sharing ratio will be

a) 5:6:3

b) 2:4:6

c) 17:11:12

d) 18:24:38

Ans:- c)

Explanation:-

Shiv’s New Share = 5/8 – 1/5 = 17/40

Mohan’s new Share = 3/8 – 1/10 = 22/80

New Profit Sharing ratio of Shiv & Mohan after making base equal

= 17/40 x 2/2 : 22/80 : 3/10 x 8/8 i.e., 34 : 22 : 24

-= 17 : 11 : 12

A and B are partners sharing profits and losses in the ratio of 7:5. They agree to admit C, their manager, into partnership who is to get 1/6th share in the profits. He acquires this share as 1/24th from A and 1/8th from B. The new profit sharing ratio will be:

a) 13:7:4

b) 7:13:4

c) 7:5:6

d) 5:7:6

Ans:- a)

Explanation:-

A’s new share = 7/12 – 1/24 = 13/24

B’s new share = 5/12 – 1/8 = 7/24

= New profit sharing ratio after making base equal

= 13/24 : 7/24 : 1/6 x 1/4 = 13 : 7 : 4

Gain (profit) or Loss on revaluation of assets and reassessment of liabilities is transferred to Partner’s capital Accounts in their

a) Capital Ratio

b) Equal Ratio

c) Old profit sharing Ratio

d) Gaining Ratio

Ans:- c)

Explanation:-

revaluation gain belongs to the prevoius partnership firm. thus it is credited/debited to the old partners in old profit sharing ratio.

A and B share profits in the ratio of 3:2. They agreed to admit C on the condition that A will sacrifice 3/25th of his share of profit in favour of C and B will sacrifice 1/25th of his profits in favour of C. The new profit sharing ratio will be:

a) 12:9:4

b) 3:2:4

c) 66:48:11

d) 48:66:11

Ans:- c)

Explanation:-

A sacrifices = 3/5 x 3/25 = 9/125

B sacrifices = 2/5 x 1/25 = 2/125

A’s new Share = 3/5 – 9/125 = 66/125

B’s new share = 2/5 – 2/125 = 48/125

C’s Share = 9/125 + 2/125 = 11/125

New Profit sharing ratio after making base equal

66/125 : 48/125 : 11/125

= 66 : 48 : 11

A firm has an unrecorded investment of ₹10,000. Journal entry to record the unrecorded investment on the admission of a partner will be:

a) Revaluation A/c Dr ₹10,000

To Unrecorded Investment A/c ₹10,000

b) Unrecorded Investment A/c Dr ₹10,000

To Revaluation A/c ₹10,000

C) Partner’s Capital A/c Dr ₹10,000

To Unrecorded Investment A/c ₹10,000

d) None of the above

Ans:- b)

Aditya and Shiv were partners in a firm with capitals of ₹3,00,000 and ₹2,00,000, respectively. Naina was admitted as a new partner 1/4th share in the profits of the firm. Naina brought ₹1,20,000 for her share of goodwill premium and ₹2,40,000 for her capital. The amount of goodwill premium credited to Aditya will be

a) ₹40,000

b) ₹30,000

c) ₹72,000

d) ₹60,000

Ans:- d)

Explanation:-

Premium for goodwill will be credited to Aditya and Shiv in their sacrificing ratio i.e., 1 : 1

Aditya will becredited

= 1,20,000 x 1/2 = ₹ 60,000

A and B are partners in firm sharing profits and losses in the ratio of 3:2. A new partner C is admitted. A surrenders 1/15th share of his profit in favour of C and B surrenders 2/15th of his share in favour of C. The new ratio will be:

a) 8:4:3

b) 42:26:7

c) 4:8:3

d) 26:42:7

Ans:- b)

Explanation:-

A surrenders = 3/5 x 1/15 = 3/75

B surrenders = 2/5 x 2/15 = 4/75

A’s new share = 3/5 – 3/75 = 42/75

B’s new share = 2/5 – 4/75 = 26/75

C’s new share = 3/75 + 4/75 = 7/75

New Profit sharing ratio of A, B and C after making base equal

= 42/75 : 26/75 : 7/75

= 42 : 26 : 7

When a new partner is admitted, he is entitled to a share of

a) past profits

b) Present Profits

c) Future profits

d) Reserve appearing in the Balance Sheet of the firm

Ans:- c)

Unrecorded assets or liabilities are transferred to

a) Partner’s Capital Accounts

b) Revaluation Account

c) Profit and Loss Account

d) partner’s Current Accounts

Ans:- b)

A and B are partners sharing profit or loss in the ratio of 4:1. A surrenders 1/4 of his share and B surrenders 1/2 of his share in favour of C, a new partner. What will be the C’s share?

a) 3/4

b) 1/5

c) 1/10

d) 3/10

Ans:- d)Explanation:-

C acquires from A = 4/5 x 1/4 = 4/20

C acquires from B = 1/5 x 1/2 = 1/10

C’s share = 4/20 + 1/10 = 6/20 i.e., 3/10

Which of the following statement is incorrect in the case of admission of a partner?

a) Increase in the value of the asset will increase capital

b) Increase in the value of assets will decrease capital

c) Increase in the value of liability will decrease capital

d) Decrease in the value of liability will increase capital

Ans:- b)

Explanation:-

Increase in the value of assets will results in revaluation profit. It will be credited to the partners increasing partners capital.

X and Y are partners sharing profits in the ratio of 3:2, and capitals as ₹1,00,000 and ₹50,000 respectively. Z is admitted for 1/5th share in profits. The amount, Z will contribute as capital will be

a) ₹50,000

b) ₹35,000

c) ₹37,500

d) ₹60,000

Ans:- c)

Explanation:-

Combined Capital of X and Y = ₹ 1,00,000 + ₹ 50,000 = ₹ 1,50,000

= Combined Share of X and Y = 1 – 1/5 = 4/5

Total Capital of the Firm = Combined Capital of X and Y/Combined Share of X and Y

= Total Capital of the firm = 1,50,000 x 5/4 = ₹ 1,87,500

Z will bring Capital = 187500 x 1/5 = ₹ 37,500

A and B are partners in a business sharing profits and losses in the ratio of 7:3 respectively. They admit C as a new partner. A sacrificed 1/7th share of his profit and B sacrificed 1/3rd of his share in favour of C. The new profit sharing ratio of A, B and C will be:

a) 3:1:1

b) 2:1:1

c) 2:2:1

d) None of the above

Ans:- a)

Explanation:-

= A sacrifices = 7/10 x 1/7 = 7/70

B sacrifices = 3/10 x 1/3 = 3/30

A’s new share = 7/10 – 7/70 = 42/70

= B’s new Share = 3/10 – 3/30 = 6/30

C’s share = 7/70 + 3/30 = 420/2100

new profit sharing ratio after making base equal

42/70 x 30/30 : 6/30 x 70/70 : 420/2100

= 126 : 42 : 42 i.e., 3 : 1 : 1

Premium paid by a new partner in addition to the capital brought in, is meant for

a) Creditors

b) Goodwill

c) Loan

d) Mortgage

Ans:- b)

X and Y are partners sharing profits and losses in the ratio of 3:2. Z was admitted for the 1/5th share and for this he brings ₹1,50,000, as capital. If capitals are to be proportionate to profit sharing ratio, the respective capitals of the partners will be

a) ₹3,00,000: ₹3,00,000 :₹1,50,000

b) ₹3,60,000: ₹2,40,000 :₹1,50,000

c) ₹1,50,000: ₹1,50,000 :₹1,50,000

d) ₹1,50,000: ₹2,00,000 :₹4,00,000

Ans:- b)

Explanation:-

Calculation of new profit sharing ratio of X , Y and Z

= remaining share 1 – 1/5 = 4/5

= X’s new share = 4/5 x 3/5 = 12/25

Y’s new share = 4/5 x 2/5 = 8/25

New Profit sharing ratio of X, Y and Z after making base equal

= 12/25 : 8/25 : 1/5 x 5/5

= 12 : 8 : 5

X, Y and Z would maintain the capital in new profit sharing ratio

Total Capital of the firm = Z’s Capital x reciprocal of his share

= 1,50,000 x 5 = ₹ 7,50,000

X’s capital in new firm = 7,50,000 x 12/25 = ₹ 3,60,000

Y’s Capital in new firm = 7,50,000 x 8/25 = ₹ 2,40,000

A and B are partners sharing the profit of loss in the ratio of 3:2. C is admitted into partnership as a new partner. A sacrifices 1/3 of his share of B sacrifices 1/4 of his share in favour of C. What will be the C’s share in the firm?

a) 1/5

b) 2/10

c) 3/10

d) None of the above

Ans:- c)

Explanation:-

A sacrifices = 3/5 x 1/3 = 3/15

B Sacrifices = 2/5 x 1/4 = 2/20

C’s share = 3/15 + 2/20 = 18/60 i.e., 3/10

Aditya and Shiv were partners in a firm with capitals of ₹3,00,000 and ₹2,00,000, respectively. Naina was admitted as a new partner for 1/4th share in the profits of the firm. Naina brought ₹1,20,000 for her share of goodwill premium and ₹2,40,000 for her capital. The amount of goodwill premium credited by Aditya will be

a) ₹40,000

b) ₹30,000

c) ₹72,000

d) ₹60,000

Ans:- d)

Explanation:-

Premium for goodwill will be credited to Aditya and Shiv in their sacrificing ratio i.e., 1 : 1

Aditya will be credited = 1,20,000 x 1/2 = ₹ 60,000

Goodwill brought by the incoming partner is distributed among the old partners in their

a) Old profit sharing ratio

b) New profit sharing ratio

c) Sacrificing ratio

d) Gaining ratio

Ans:- c)

Niyati and Aisha were partners in a firm sharing profit and losses in the ratio of 4:3. They admitted Bina as a new partner. Niyati sacrificed 1/4th from her share and Aisha sacrificed 1/7th from her share in favour of Bina. Bina’s share in the profits of the firm will be:

a) 2/7

b) 10/49

c) 11/28

d) 7/16

Ans:- c)

Explanation:-Bina’s Share = 1/4 + 1/7 = 11/28

Unrecorded assets and liabilities are transferred to

a) Partner’s Capital Accounts

b) Revaluation Account

c) Profit and Loss Account

d) Partner’s Current Accounts

Ans:- b)

When goodwill existing in the books is written off at the time of admission of a partner, it is transferred to Partner’s Capital Accounts in their

a) Old Profit Sharing ratio

b) New profit sharing ratio

c) sacrificing ratio

d) Gaining Ratio

Ans:- a)

A and B are partners in firm sharing profits and losses in the ratio of 2:3. C is admitted for 1/5 share in the profits of the firm. If C gets it wholly from A, the new profit sharing ratio after C’s admission will be:

a) 1:3:3

b) 3:1:1

c) 2:2:1

d) 1:3:1

Ans:- d)

Explanation:-

A’s new share = 2/5 – 1/5 = 1/5

B’s new share = 3/5 – 0/5 = 3/5

New Profit sharing ratio after making base equal

1/5 : 3/5 : 1/5 i.e., 1 : 3 : 1

M and N are partners in a firm sharing profits and losses in the ratio of 5:3. On 1st April 2021, they admit R as a partner. The new profit sharing ratio of M, N and R will be 7:5:4. The sacrificing ratio of M and N is

a) 5:3

b) 3:1

c) 3:2

d) 4:5

Ans:- b)

Explanation:-

M sacrifices = 5/8 – 7/16 = 3/16

N sacrifices = 3/8 – 5/16 = 1/16

Sacrificing ratio of M and N is

= 3/16 : 1/16 i.e., 3 : 1

A and B are partners sharing profits in the ratio of 2:3, they admit C as a partner for 1/4th share, the sacrificing ratio of A and B will be

a) 2:3

b) 1:1

c) 3:2

d) 2:1

Ans:- a)

Explanation:-

In the absense of any additional informatoin about the share of new parter, the sacrificing ratio is always equal to the old ratio

A and B are partners sharing ratios in the ratio of 4:3. They admitted C as a new partner who gets 1/5th share of profit, entirely from A. The new profit sharing ratio will be:

a) 20:8:7

b) 13:15:15

c) 13:15:7

d) 15:13:5

Ans:- c)

Explanation:-

A’s new share = 4/7 – 1/5 = 13/35

B’s new share = 3/7 – 0 = 3/7

new profit sharing ratio after making base equal

= 13/35 : 3/7 x 5/5 : 1/5 x 7/7

13 : 15 : 7

When a new partner is admitted, the balance of ‘General Reserve’ appearing in the Balance Sheet at the time of admission is credited to

a) Profit and Loss Appropriation Account

b) Capital Accounts of all the partners

c) Capital Accounts of Old Partners

d) Revaluation Account

Ans:- c)

Niyati and Aisha were partners in a firm sharing profits and losses in the ratio of 4:3. They admitted Bina as a new partner. Niyati sacrificed 1/4th from her share and Aisha sacrificed 1/7th from her share in favour of Bina. Bina’s share in the profits of the firm will be:

a) 2/7

b) 11/28

c) 10/49

d) 7/16

Ans:- b)Explanation:-

Bina’s share = 1/4 + 1/7 = 11/28

A, B, C, D are in partnership sharing profits and losses in the ratio of 9:6:5:5. E joins the partnership for 20% share, A, B, C and D would in future share profits among themselves as 3/10:4/10:2/10:1/10. The new profit sharing ratio will be:

a) 3:4:2:1:5

b) 9:6:5:5:5

c) 6:8:4:2:5

d) 8:6:4:2:5

Ans:- c)

Explanation:-

Remaining Share = 1 – 1/5 = 4/5

A’s new share = 4/5 x 3/10 = 12/50

B’s new share = 4/5 x 4/10 = 16/50

C’s new share = 4/5 x 2/10 = 8/50

D’s new share = 4/5 x 1/10 = 4/50

new profit sharing ratio after making base equal

12/50 : 16/50 : 8/50 : 4/50 : 1/5 x 10/10

= 12 : 16 : 8 : 4 : 10

= i.e., 6 : 8 : 4 : 2 : 5

Anita and Babita were partners sharing profits and losses in the ratio of 3:1. Savita was admitted for 1/5th share in the profits. Savita was unable to bring her share of goodwill premium in cash. The Journal entry recorded for goodwill premium is given below:

a) Savita’s Current A/c Dr. 24,000

To Anita’s Capital A/c 8,000

To Babita’s Capital A/c 16,000

The new profit sharing ratio of Anita, Babita and Savita, will be

a) 41:7:12

b) 13:12:10

c) 3:1:1

d) 5:3:2

Ans:- a)

Explanation:-

Sacrificing ratio of Anita & Babita is

= 8,000 : 16,000 i.e., 1 : 2

Anita sacrifices = 1/5 x 1/3 = 1/15

Babita Sacrifices = 1/5 x 2/3 = 2/15

Anita’s new share = 3/4 – 1/15 = 41/60

Babita new share = 1/4 – 2/15 = 7/60

New profit sahring ratio after making base equal

= 41/60 : 7/60 : 1/5x 12/12

= 41 : 7 : 12

Goodwill brought by the incoming partner is distributed among the old partners in their

a) Old profit sharing ratio

b) New profit sharing ratio

c) sacrificing ratio

d) Gaining ratio

Ans:- c)

A and B are in partnership sharing profits and losses as 3:2. C is admitted for 1/4th share. Afterwards, D enters for 20 paise in the rupee. The new profit sharing ratio after D’s admission will be:

a) 9:6:5:5

b) 6:9:5:5

c) 3:2:4:5

d) 3:2:5:5

Ans:- a)

Explanation:-

remaining share after c’s admission

= 1 – 1/4 = 3/4

= A’s new share = 3/4 x 3/5 = 9/20

= B’s new share = 3/4 x 2/5 = 6/20

new profit sharing ratio after c’s admission

= 9/20 : 6/20 : 1/4 x 5/5 = 9 : 6 : 5

remaining share after D’s admission

= 1 – 1/5 = 4/5

A’s new share = 4/5 x 9/20 = 36/100

B’s new share = 4/5 x 6/20 = 24/100

C’s new share = 4/5 x 5/20 = 20/100

new profit sharing ratio after D’s admission

36/100 : 24/100 : 20/100 : 1/5 x 20/20

= 36 : 24 : 20 : 20

= i.e., 9 : 6 : 5 : 5

An increase in the value of liabilities at the time of admission of a partner is

a) Debited to Revaluation Account

b) Credited to Revaluation Account

c) Credited to Partner’s Capital Account

d) Debited to Partner’s Capital Account

Ans:- a)

When goodwill existing in the books is written off at the time of admission of a partner, it is transferred to the partner’s capital accounts in their

a) Old profit sharing ratio

b) New profit sharing ratio

c) Sacrificing ratio

d) Gaining ratio

Ans:- a)

The formula for calculating the sacrificing ratio is:

a) New share – Old share

b) Old share – New share

c) Gaining Ratio – Old Ratio

d) Old Ratio – Gaining Ratio

Ans:- b)

For which of the following situations, old profit sharing ratio of partners is used at the time of admission of a new partner?

a) When new partner brings only a part of his share of goodwill

b) When new partner is not able to bring his share of goodwill

c) When at the time of admission, goodwill already exists in the Balance Sheet

d) When new partner brings his share of goodwill in cash

Ans:- c)

A and B are partners sharing profits in the ratio of 2:3, they admit C as a partner for 1/4th share, the sacrificing ratio of A and B will be

a) 2:3

b) 1:1

c) 3:2

d) 2:1

Ans:- a)

In the asbsense of any additional information about the share of the new partner. The sacrificing ratio is always equal to the old ratio.

X and Y are partners sharing profits in the ratio of 3:2. Z is admitted as a partner. Calculate sacrificing ratio if new profit sharing is 9:7:4.

a) 3:1

b) 3:2

c) 1:3

d) 9:7

Ans:- a)

Explanation:-

= X sacrifices = 3/5 – 9/20 = 3/20

= Y sacrifices = 2/5 – 7/20 = 1/20

= sacrificing ratio of X and Y is

= 3/20 : 1/20

= i.e., 3 : 1

A and B are partners in a firm having a capital of ₹54,000 and ₹36,000 respectively. They admitted C for 1/3rd share in the profits. C brought the proportionate amount of capital. The capital brought in by C would be

a) ₹90,000

b) ₹45,000

c) ₹5,400

d) ₹3,600

Ans:- b)

Combined Capital of A and B

= ₹ 54,000 = ₹ 36,000 = ₹ 90,000

Combined share of A and B = 1 – 1/3 = 2/3

Total capital of the firm

= Combined capital of A and B x reciprocal of his share

= 90,000 x 3/2 = ₹ 1,35,000

C would bring capital

= 1,35,000 x 1/3 = ₹ 45,000

When a new partner is admitted, the balance of ‘General Reserve’ appearing in the Balance Sheet at the time of admission is credited to

a) Profit and Loss Appropriation Account

b) Capital Accounts of all the partners

c) Capital Accounts of Old Partners

d) Revalutaion Account

Ans:- c)