[NCERT] Q 10 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 10 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board

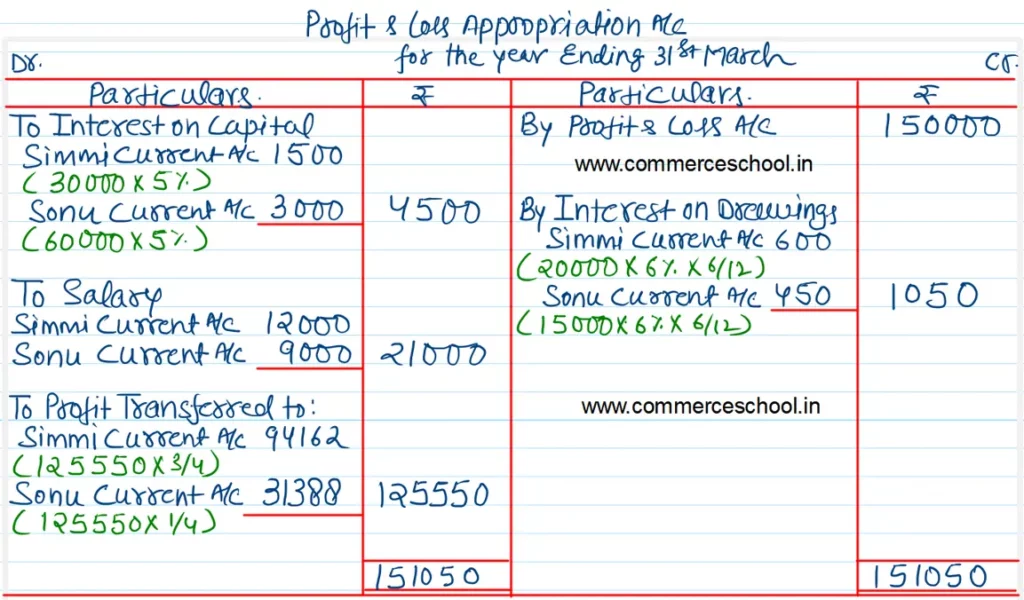

Simmi and Sonu are partners in a firm, sharing profits and losses in ther atio of 3 : 1. The profit and loss account of the firm for the year ending March 31, 2020 shows a net profit of ₹ 1,50,050. Prepare the Profit and Loss Appropriation Account and Partners current account by taking into consideration the following information:

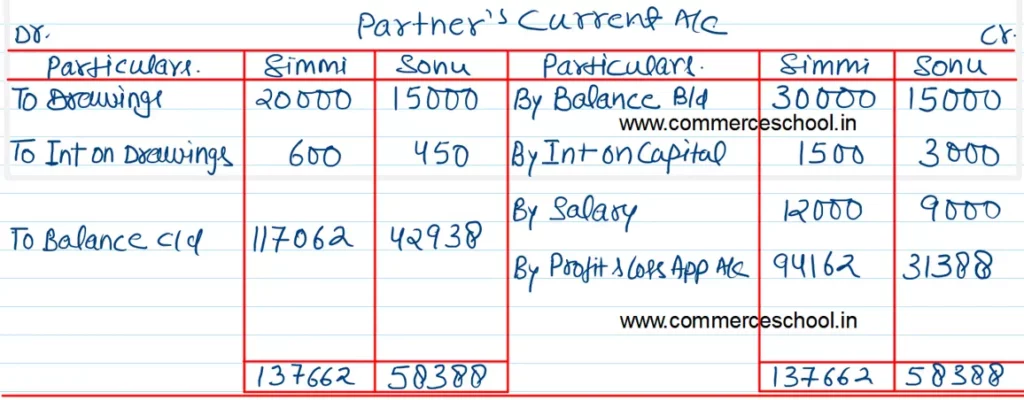

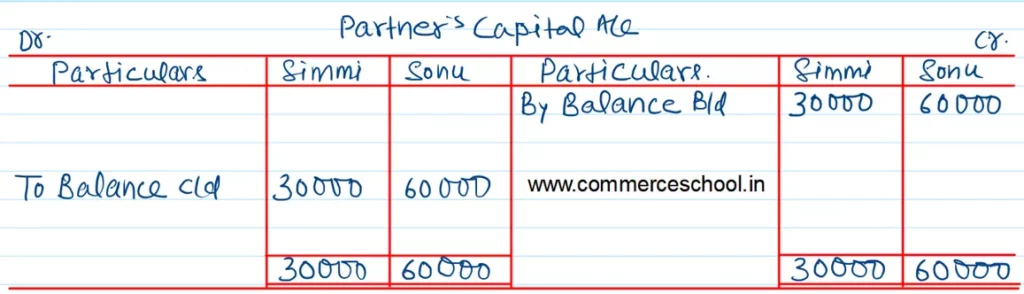

(i) Partners capital on April 1, 2019; Simmi, ₹ 30,000; Sonu, ₹ 60,000;

(ii) Current accounts balances on April 1, 2016; Simmi, ₹ 30,000 (cr.); Sonu, ₹ 15,000 (cr.);

(iii) Partners drawings during the year amounted to Simmi, ₹ 20,000; Sonu, ₹ 15,000;

(iv) Interest on capital was allowed @ 5% p.a.,:

(v) Interest on drawings was to be charged @ 5% p.a. at an average of six months;

(vi) Partner’s salaries : Simmi ₹ 12,000 and Sonu ₹ 9,000.

[Ans. Profit transferred to Simmi’s Capital, ₹ 94,162 and Sonu’s Capital, ₹ 31,388]

Solution:-