[NCERT] Q 12 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 12 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

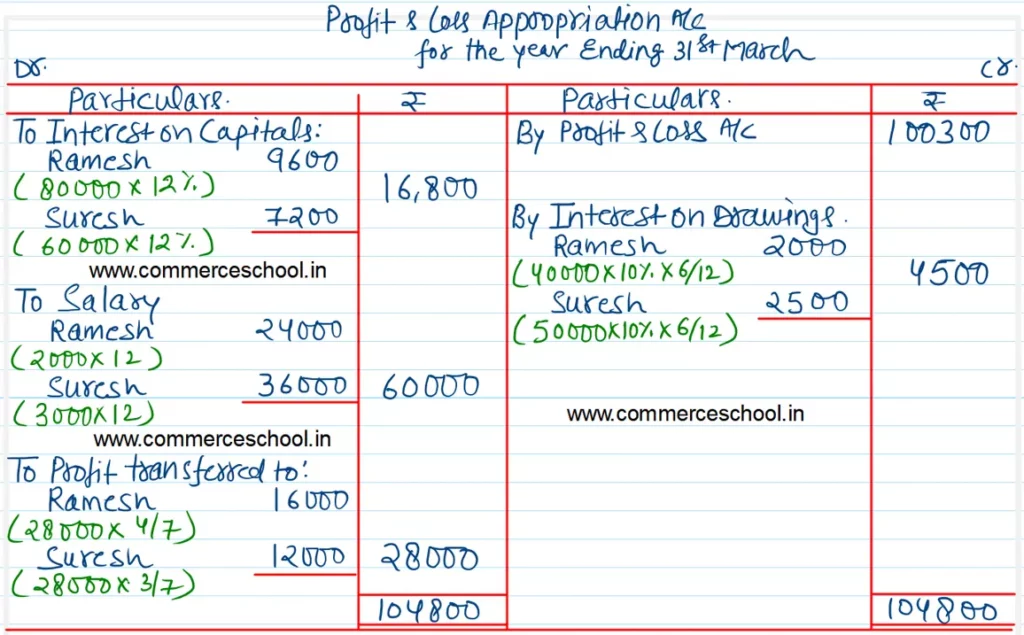

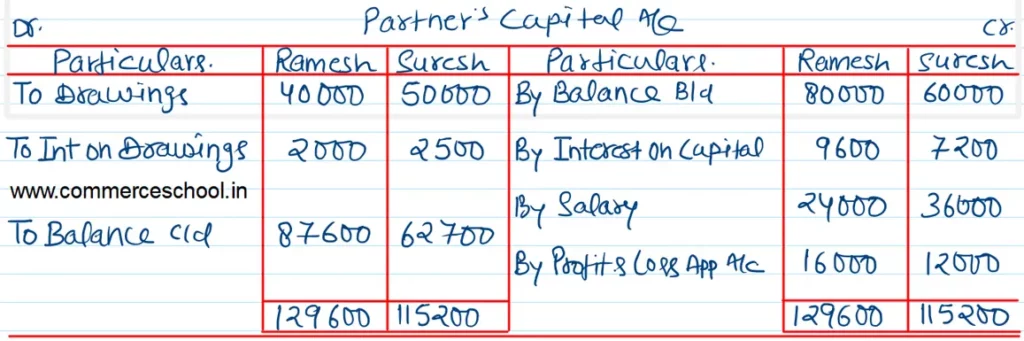

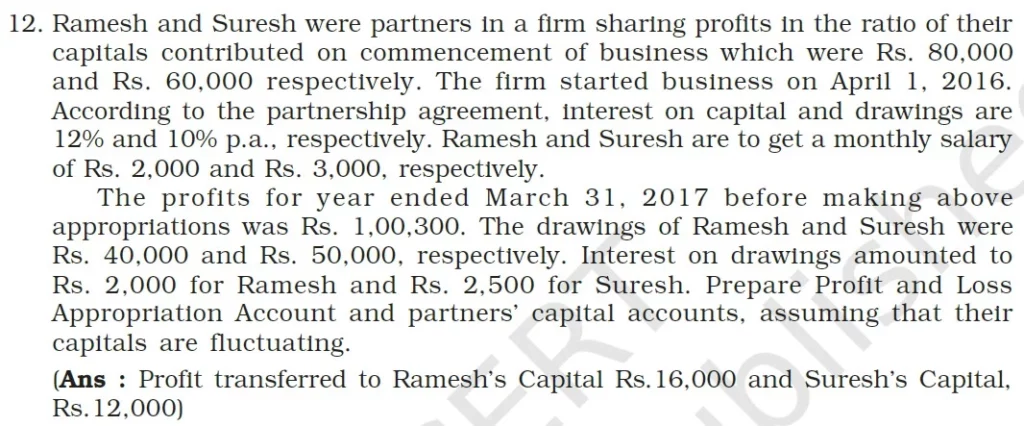

Ramesh and Suresh were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of busienss which were ₹ 80,000 and ₹ 60,000 respectively. The firm started business on April 1, 2016.

According to the partnership agreement, interest on capital and drawings are 12% and 10% p.a., respectively. Ramesh and Suresh are to get a monthly salary of ₹ 2,000 and ₹ 3,000 respectively.

The profits for year ended March 31, 2017 before making above appropriations was ₹ 1,00,300. The drawings of Ramesh and Suresh were ₹ 40,000 and ₹ 50,000, respectively. Interest on drawings amounted to ₹ 2,000 for Ramesh and ₹ 2,500 for Suresh. Parepare Profit and Loss Appropriation Account and partner’s Capital accounts, assuming that their capitals are fluctuating.

[Ans: Profit transferred to Ramesh’s Capital ₹ 16,000 and Suresh’s Capital ₹ 12,000]

Solution:-