[NCERT] Q 13 Accounting for Partnership Basic Concepts Solutions Class 12

Solution of Question number 13 of Accounting for Partnership Basic Concepts NCERT Accountancy solution Class 12 CBSE Board.

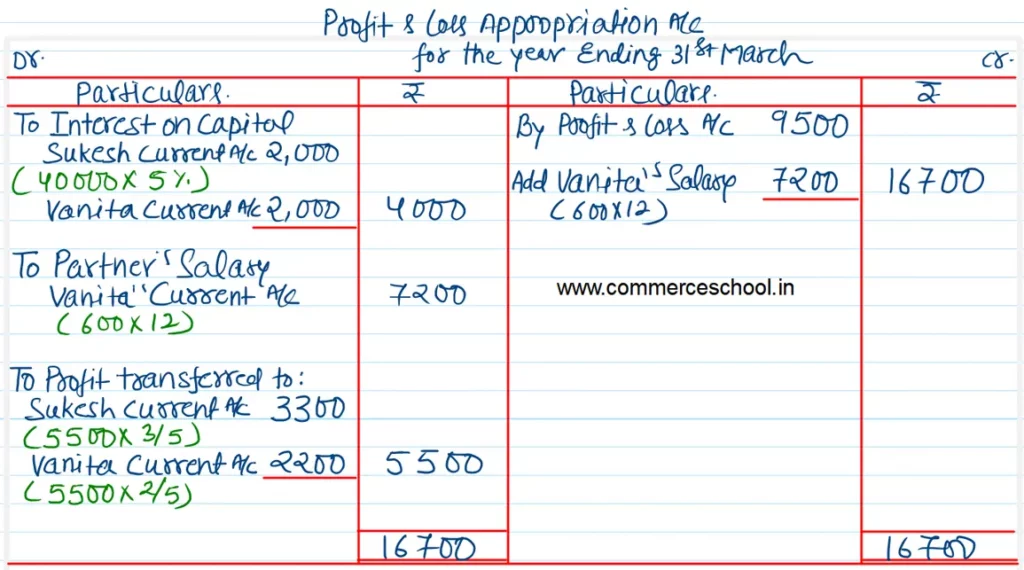

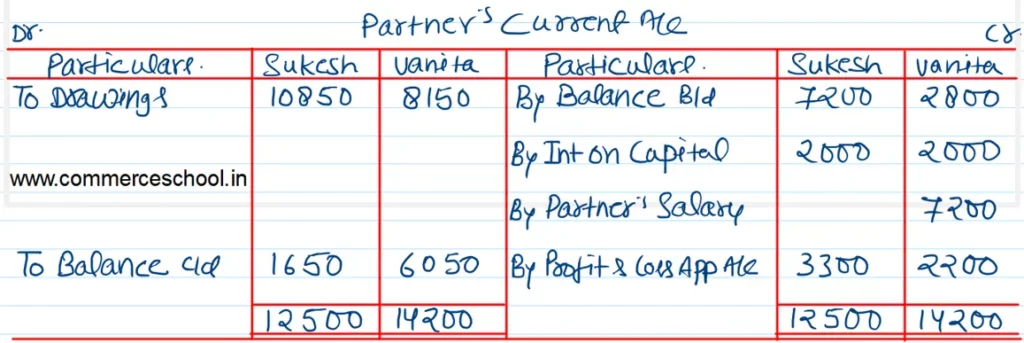

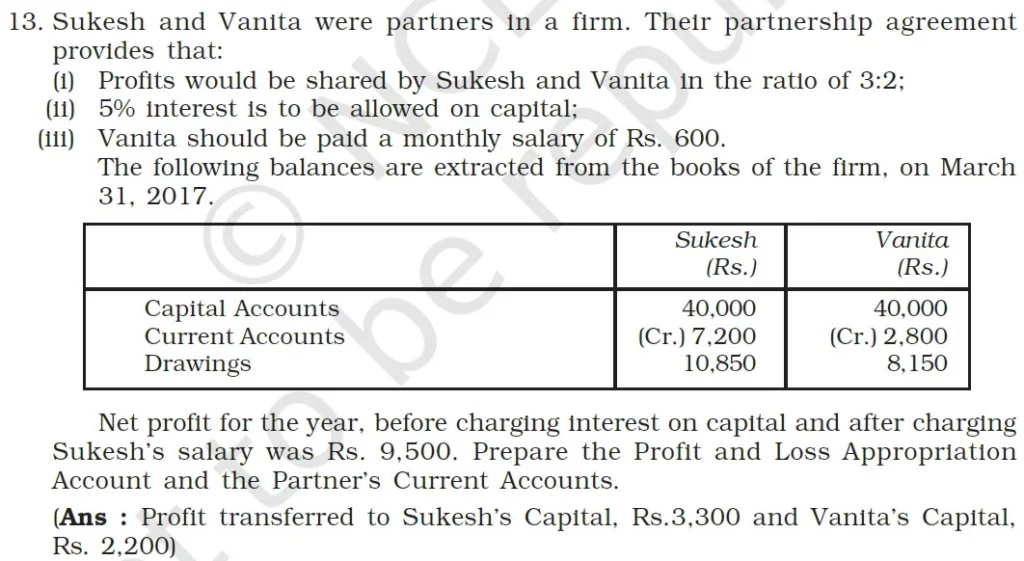

Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

(i) Profits would be shared by Sukesh and Vanita in the ratio of 3 : 2;

(ii) 5% interest is to be allowed on capital:

(iii) Vanita should be paid a monthly salary of ₹ 600.

The following balances are extracted from the books of the firm, on March 31, 2017.

| Sukesh (₹) | Vanita (₹) | |

| Capital Accounts Current Accounts Drawings | 40,000 (Cr.) 7,200 10,850 | 40,000 (Cr.) 2,800 8,150 |

Net profit for the year, before charging interest on capital and after charging Sukesh’s salary was ₹ 9,500. Prepare the Profit and Loss Appropriation Account and the Partner’s Current Accounts.

[Ans: Profit transferred to Sukesh’s Capital, ₹ 3,300 and Vanita’s Capital, ₹ 2,200]

Solution:-