[NCERT] Q 19 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 19 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

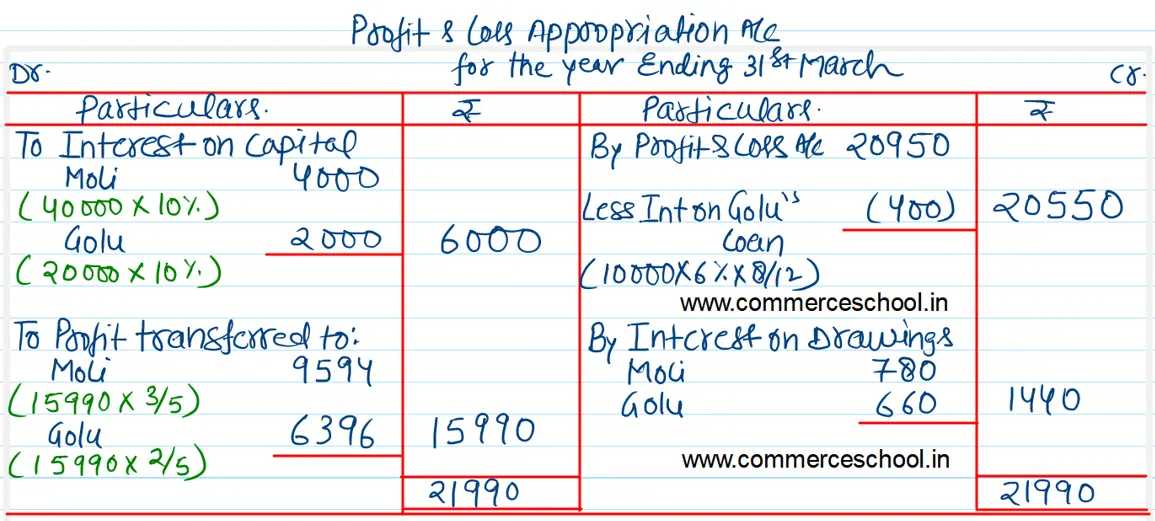

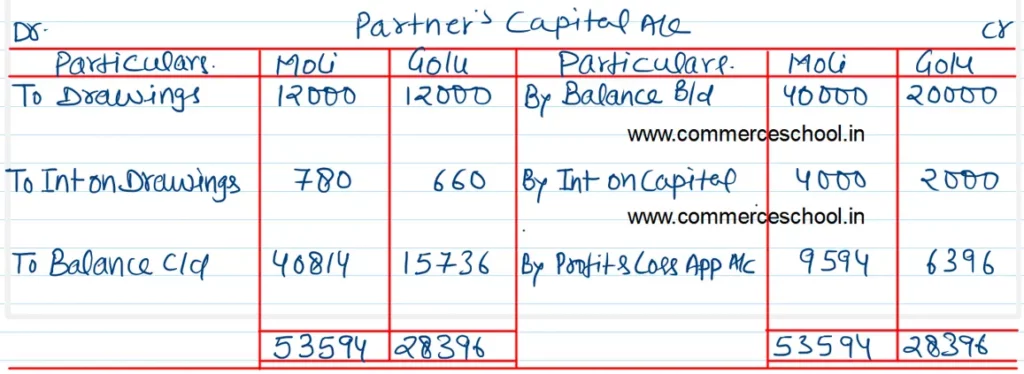

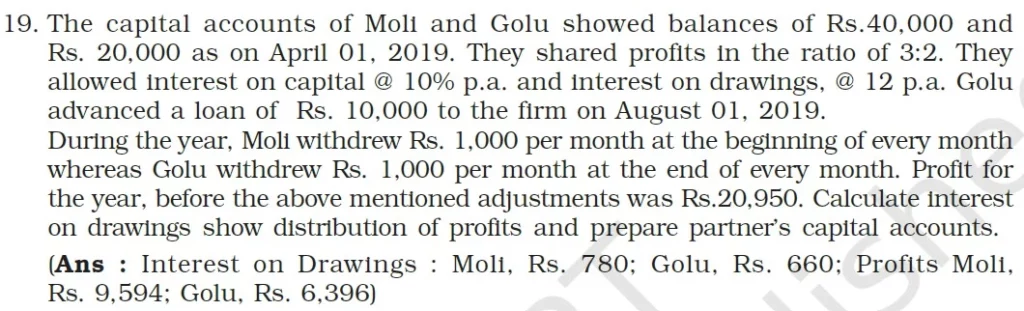

The capital accounts of Moli and Golu showed balancees of ₹ 40,000 and ₹ 20,000 as on April 01, 2019. They shared profits in the ratio of 3 : 2. They allowed interest on capital @ 10% p.a. and interest on drawings, @ 12 p.a. Golu advanced a loan of ₹ 10,000 to the firm on August 01, 2019.

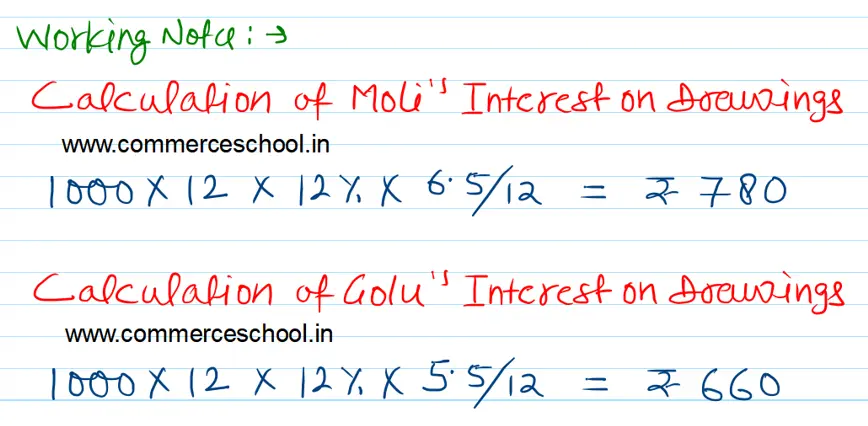

During the year, Moli withdrew ₹ 1,000 per month at the beginning of every month whereas Golu withdrew ₹ 1,000 per month at the end of every month. Profit for the year, before the above mentioned adjustments was ₹ 20,950. Calculate interest on drawings show distribution of profits and prepare partner’s capital accounts.

[Ans: Interest on drawings : Moli, ₹ 780; Golu, ₹ 660; Profits Moli, ₹ 9,594; Golu, ₹ 6,396)

Solution:-