[NCERT] Q 23 Accounting for Partnership Basic Concepts Solutions Class 12 (2022-23)

Solutions of Question number 23 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board 2022-23 Session?

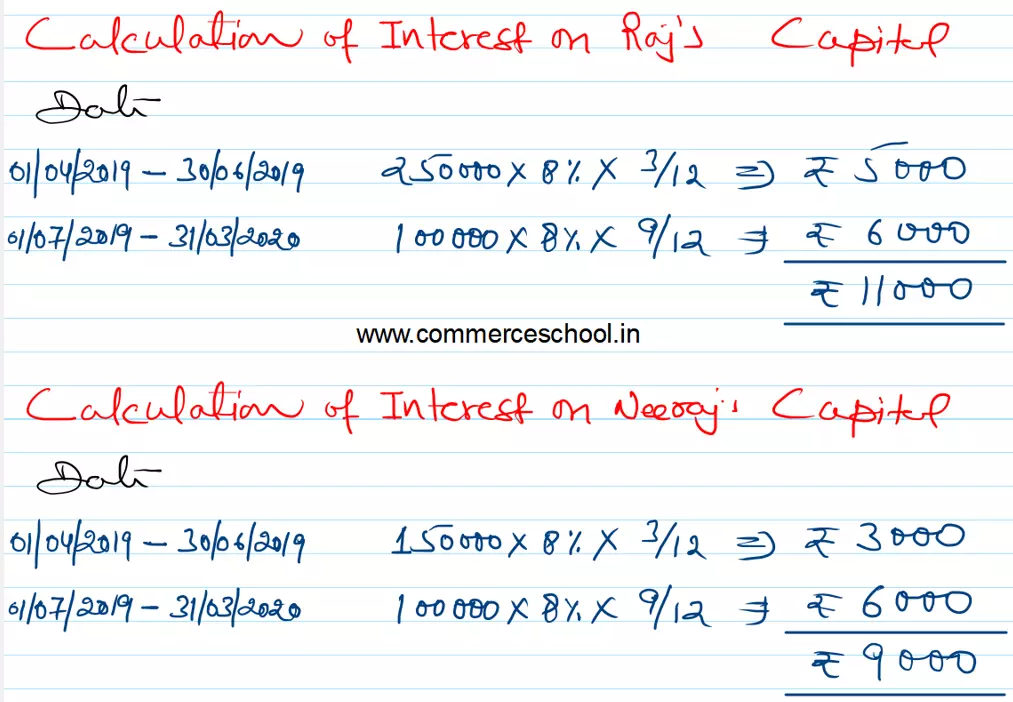

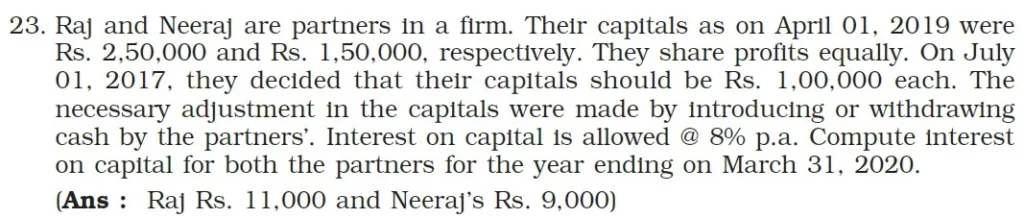

Raj and Neeraj are partners in a firm. Their capitals as on April 01, 2019 were ₹ 2,50,000 and ₹ 1,50,000, respectively. They share profits equally. On July 01, 2017, they decided that their capitals should be ₹ 1,00,000 each. The necessary adjustment in the capitals were made by introducing or withdrawing cash by the partners’. Interest on capital is allowed @ 8% p.a. Compute interest on capital for both the partners for the year ending on March 31, 2020.

[Ans: Raj ₹ 11,000 and Neeraj’s ₹ 9,000.]

Solution:-