[NCERT] Q 3 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 3 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

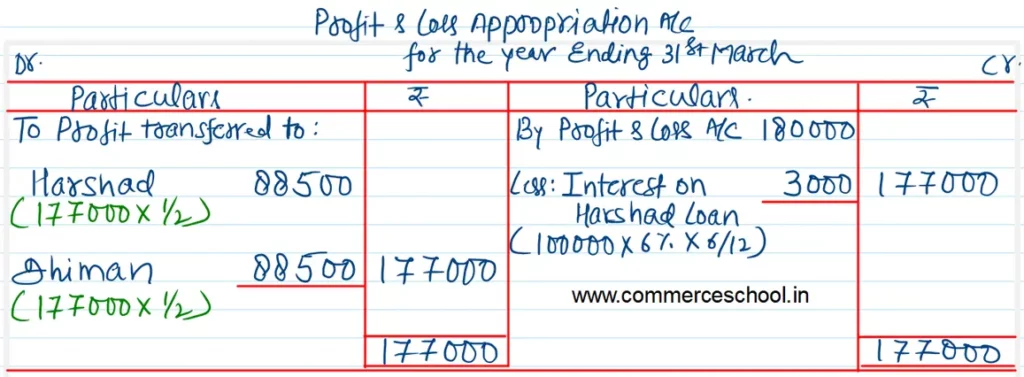

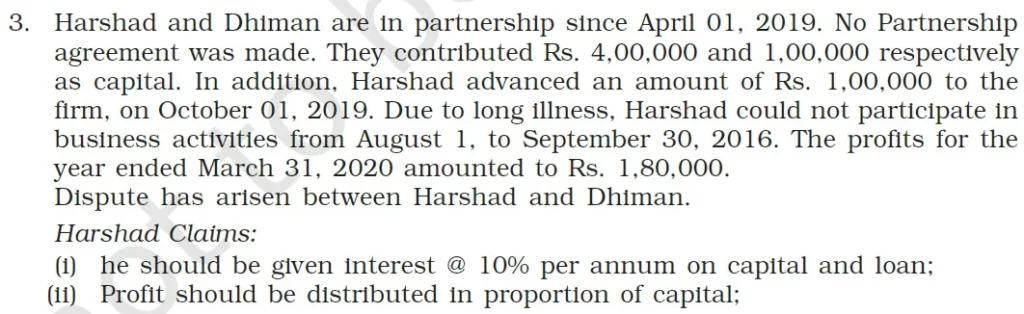

Harshad and Dhiman are in partnership since April 01, 2019, No Partnership agreement was made. They contributed ₹ 4,00,000 and 1,00,000 respectively as capital. In addition, Harshad advanced an amount of ₹ 1,00,000 to the firm, on October 01, 2019. Dur to long illness, Harshad could not participate in business activities from August 1, to September 30, 2016. The profits for the year ended March 31, 2020 amounted to ₹ 1,80,000. Dispute has arisen between Harshad and Dhiman.

Harshad Claims:

(i) he should be given interest @ 10% per annum on capital and loan:

(ii) Profit should be distributed in proportion of capital:

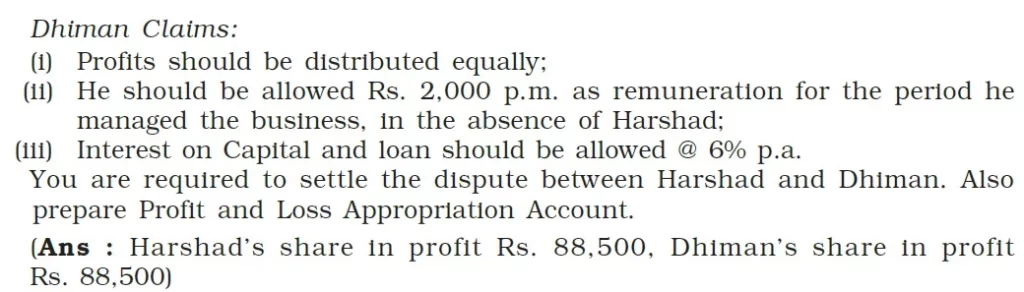

Dhiman Claims:

(i) Profits should be distributed equally:

(ii) He should be allowed ₹ 2,000 p.a. as remuneration for the period he managed the business, in the absence of Harshad:

(iii) Interest on Capital and loan should be allowed @ 6% p.a.

You are required to settle the dispute between Harshad and Dhiman. Also prepare Profit & Loss Appropriation Account.

(Ans : Harshad’s share in profit ₹ 88,500. Dhiman’s share in profit ₹ 88,500)

Solution:-