[NCERT] Q 5 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 5 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

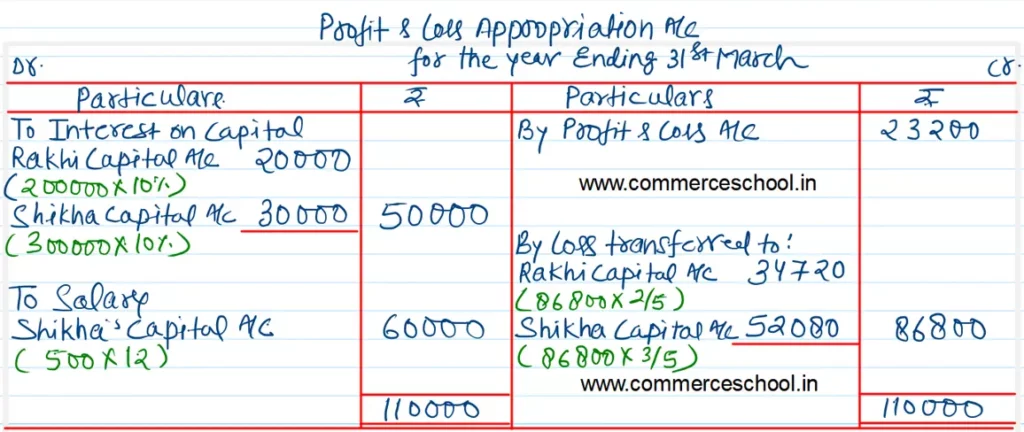

Rakhi and Shikha are partners in a firm, with capitals of ₹ 2,00,000 and ₹ 3,00,000 respectively. The profit of the firm, for the year ended 2016-17 is ₹ 23,200. As per the Partnership agreement, they share the profit in their capital ratio, after allowing a salary of ₹ 5,000 per month to Shikha and interest on Partner’s capital at the rato of 10% p.a. During the year Rakhi withdrew ₹ 7,000 and Shikha ₹ 10,000 for their personal use. As per partnership Deed, salary and interest on capital appropriation treated as charge on profit. You are required to prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts.

(Ans : Loss Transferred to Rakhi Capital ₹ 34,720 and Shikha Capital ₹ 52,080)

Solution:-