[NCERT] Q 6 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 6 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

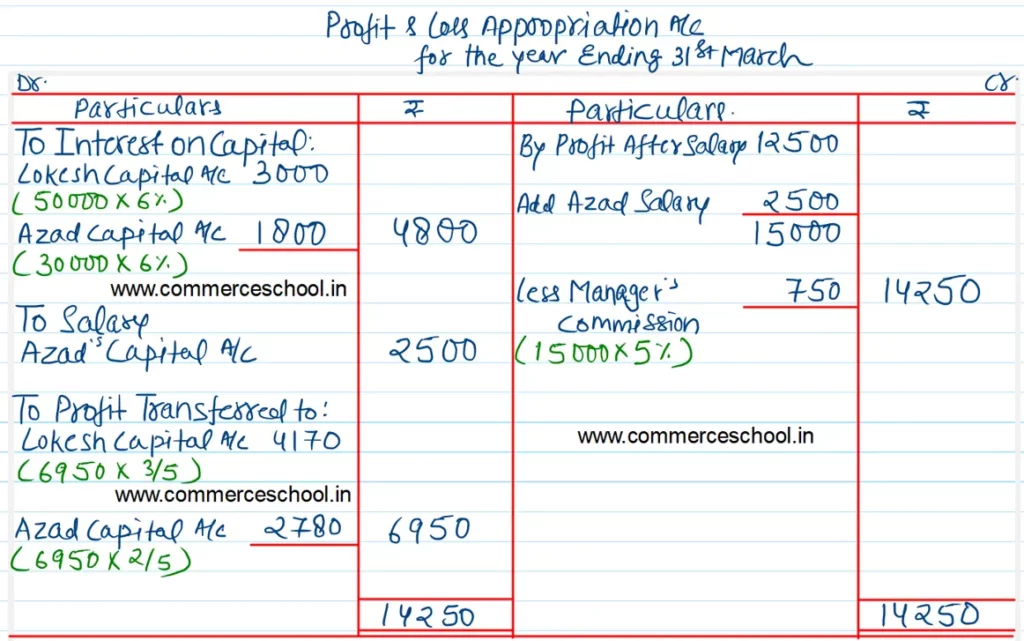

Lokesh and Azad are partners sharing profits in the ratio 3 : 2 with capitals of ₹ 50,000 and 30,000, respectively. Interest on capital is agreed to be paid @ 6% p.a. Azad is allowed a salary of ₹ 2,500 p.a. During 2016, the profits prior to the calculation of interest on capital but after charging Azad’s salary amounted to ₹ 12,500. A provision of 5% of profits is to be made in respect of manager’s commission. Prepare partner’s capital accounts and profit and loss Appropriation Account.

[Ans. Profit transferred to Lokesh’s Capital ₹ 4,170 and Azad’s Capital ₹ 2,780)

Solution:-