[NCERT] Q 7 Accounting for Partnership Basic Concepts Solutions Class 12

Solutions of Question number 7 of Accounting for Partnership Basic Concepts NCERT Accountancy solutions Class 12 CBSE Board.

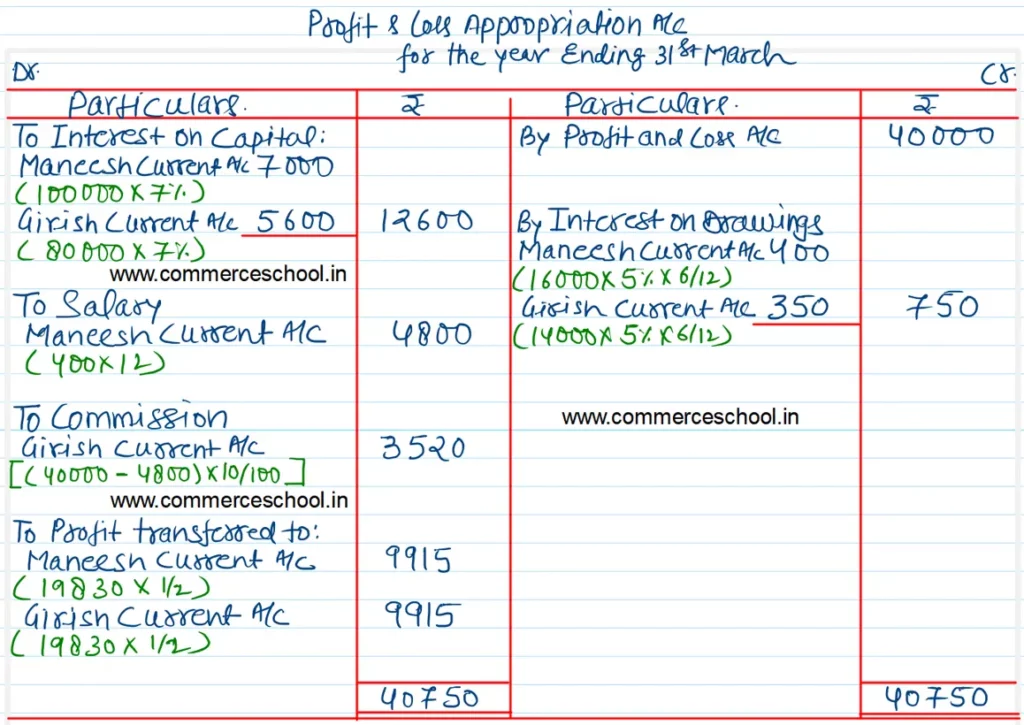

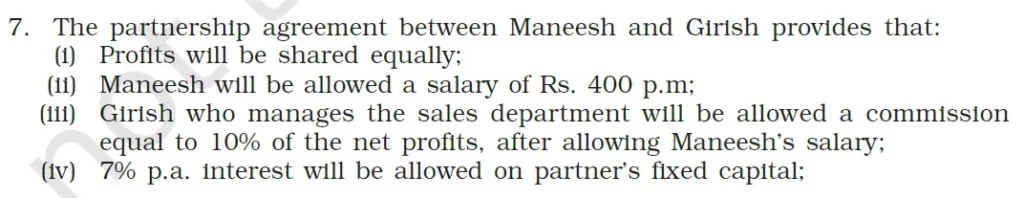

The partnership agreement between Maneesha and Girish provides that:

(i) Profits will be shared equally:

(ii) Maneesh will be allowed a salary of ₹ 400 p.m:

(iii) Girish who manages the sales department will be allowed a commission equal to 10% of the net profits, after allowing Maneesh’s salary:

(iv) 7% p.a. interest will be allowed on partner’s fixed capital;

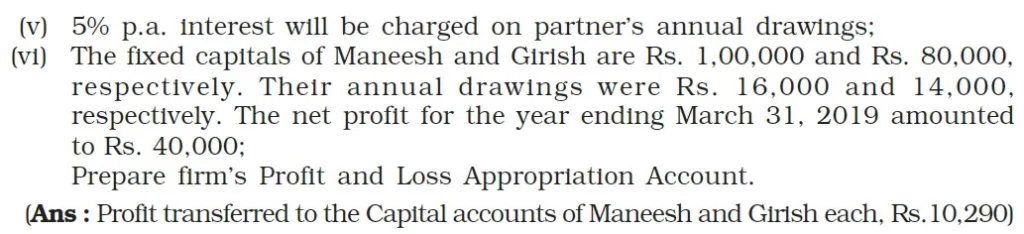

(v) 5% p.a. interest will be charged on partner’s annual drawings:

(vi) The fixed capitals of Maneesh and Girish are ₹ 1,00,000 and ₹ 80,000, respectively. Their annual drawings were ₹ 16,000 and 14,000, respectively. The net profit for the year ending March 31, 2019 amounted to ₹ 40,000;

Prepare firm’s Profit and Loss Appropriation Account.

[Ans: Profit transferred to the Capital Accounts of Maneesh and Girish each, ₹ 10,290.]

Solution:-