Q. 11 DK Goel Cash Flow Statement Solutions Class 12 CBSE (2024-25)

Solution of question number 11 of Cash Flow Statement chapter 7 of DK Goel Class 12 CBSE (2024-25).

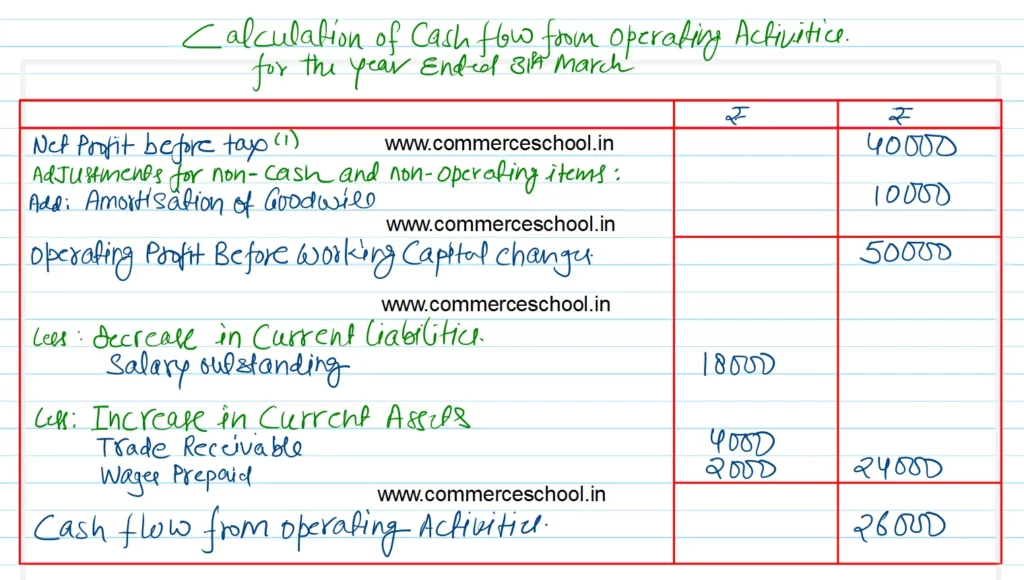

Q. 11 (A). Calculate ‘Cash from Operating activities’ from the following figures:-

| 31.3.2022 (₹) | 31.3.2023 (₹) | |

| Profit and Loss Balance | 60,000 | 65,000 |

| Trade Receivables | 1,49,000 | 1,53,000 |

| General Reserve | 2,02,000 | 2,37,000 |

| Salary Outstanding | 30,000 | 12,000 |

| Wages Prepaid | 5,000 | 7,000 |

| Goodwill | 80,000 | 70,000 |

| Cash and Bank Balance | 40,000 | 30,000 |

[Ans. Cash from Operating activities ₹ 26,000.]

Hint. Cash and Bank Balance will not affect Cash Flow from Operating Activities.

Solution:-

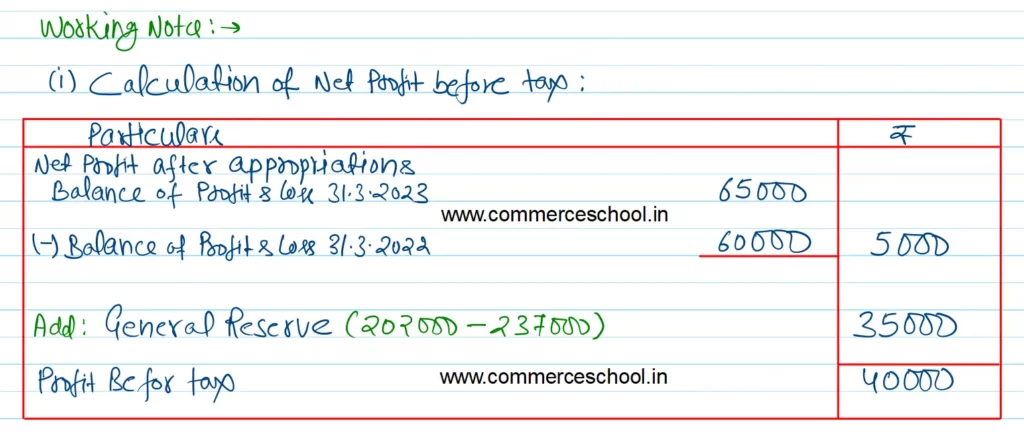

Q. 11 (B) Calculate ‘Cash from Operating activities’ from the following:-

| 31.3.2023 (₹) | 31.3.2024 (₹) | |

| Profit and Loss Balance | 2,00,000 | 3,00,000 |

| Trade Receivable | 1,40,000 | 1,80,000 |

| Provision for Depreciation | 3,00,000 | 3,20,000 |

| Outstanding Rent Payable | 16,000 | 40,000 |

| Prepaid Insurance | 14,000 | 12,000 |

| Goodwill | 2,00,000 | 1,60,000 |

| Inventories | 1,40,000 | 1,80,000 |

[Ans. Cash from Operating activities ₹ 1,06,000.]

Solution:-

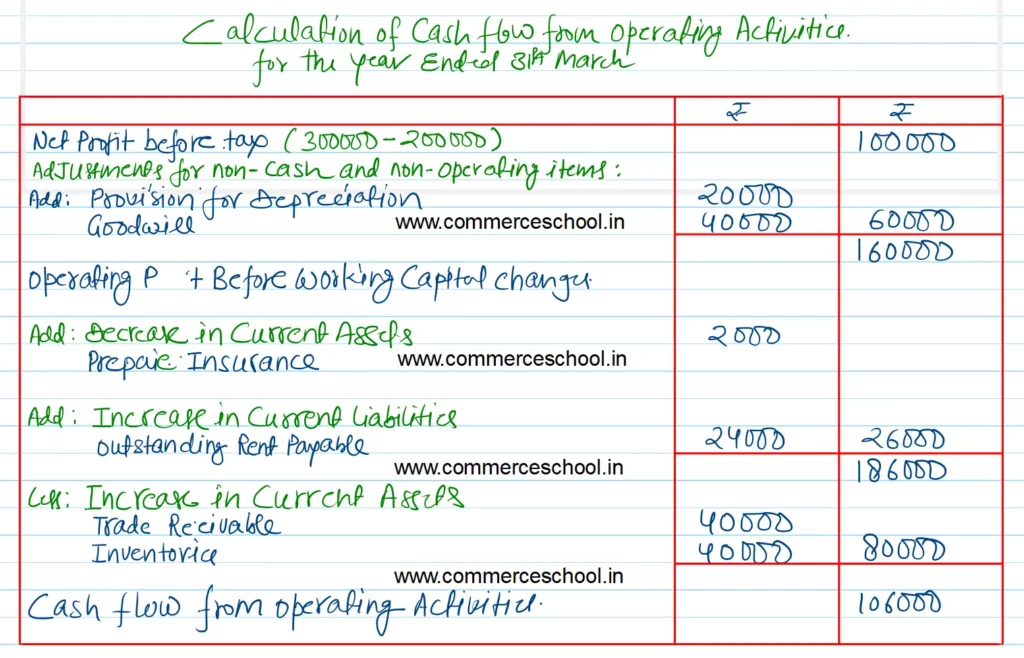

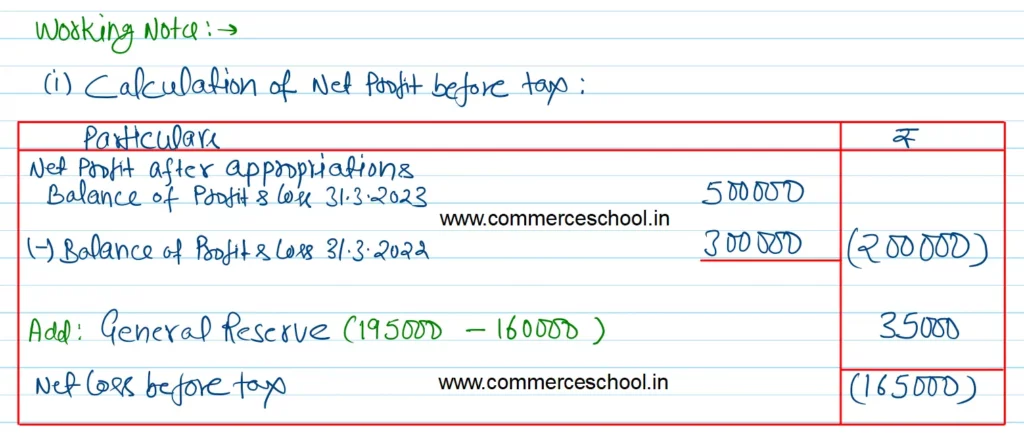

Q. 11 (C) From the following figures calculate ‘Cash from operating activities’:

| 31.3.2023 (₹) | 31.3.2024 (₹) | |

| Profit & Loss Balance | 5,00,000 | 3,00,000 |

| Accumulated Depreciation | 80,000 | 1,20,000 |

| General Reserve | 1,60,000 | 1,95,000 |

| Outstanding Expenses | 16,000 | 24,000 |

| Trade Payables | 75,000 | 91,000 |

| Prepaid Salaries | 5,000 | 2,000 |

| Goodwill | 20,000 | 15,000 |

| Trade Receivables | 2,10,000 | 2,40,000 |

[Ans. Cash used (or lost) in operating activities ₹ 1,23,000.]

Solution:-

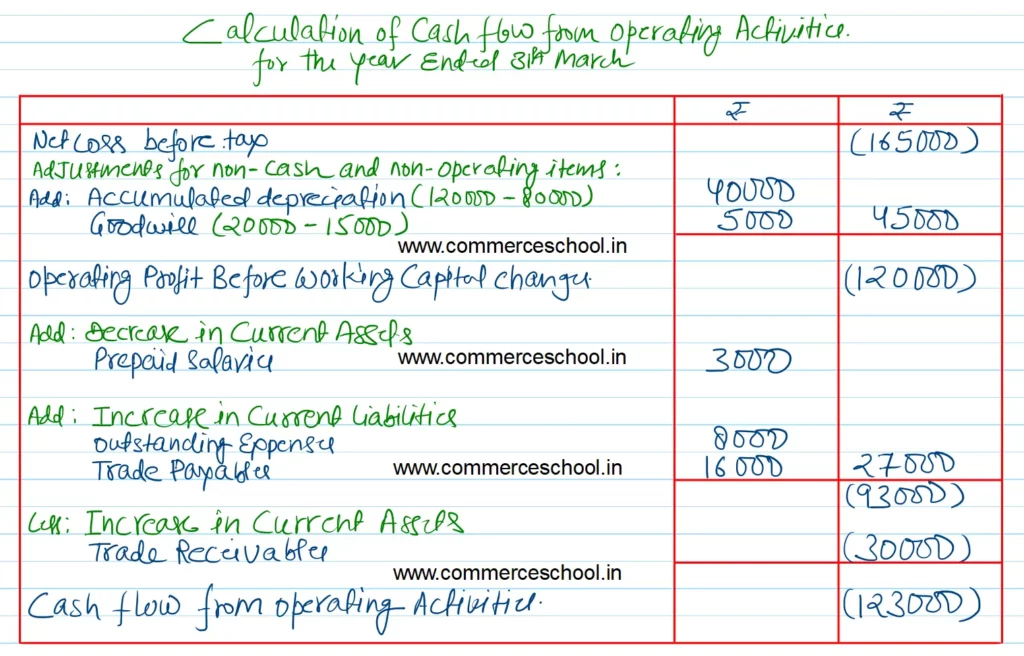

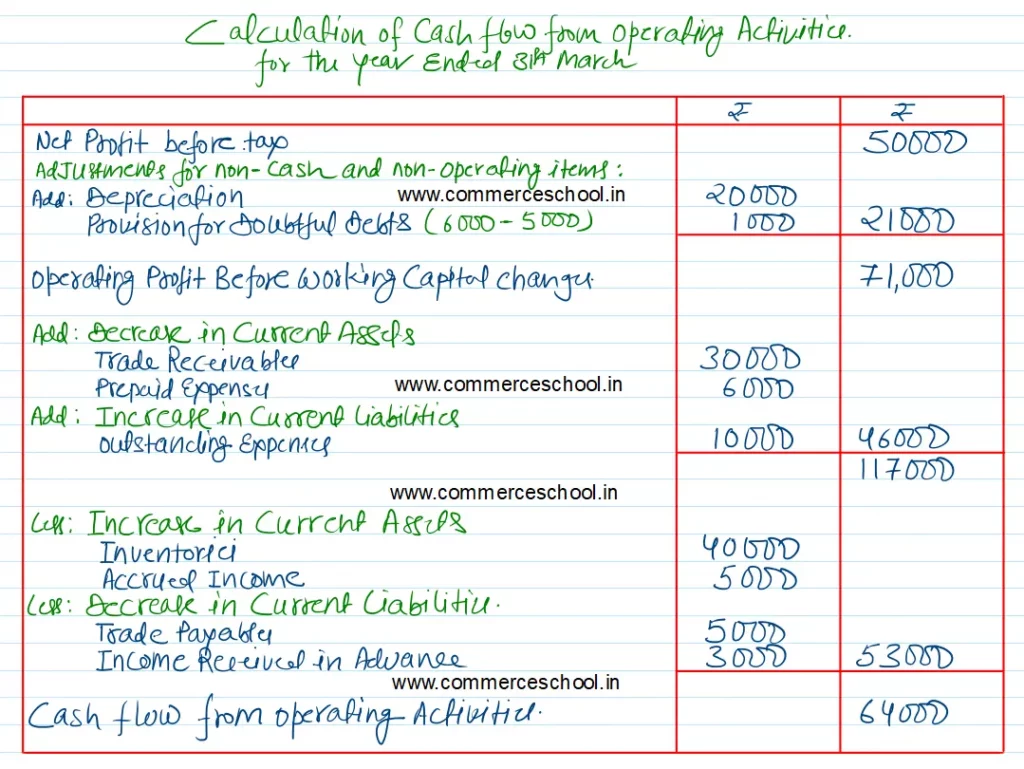

Q. 11 (D). Calculate ‘Cash from Operating activities’ from the following:-

(I) Profit for the year amounted to ₹ 50,000 after providing for depreciation of ₹ 20,000.

(II) Following is the position of current assets and current liabilities:-

| 31.3.2022 (₹) | 31.3.2023 (₹) | |

| Cash in Hand | 15,000 | 28,000 |

| Trade Receivables | 1,00,000 | 70,000 |

| Provision for Doubtful Debts | 5,000 | 6,000 |

| Trade Payables | 80,000 | 75,000 |

| Inventories | 1,20,000 | 1,60,000 |

| Outstanding Expenses | – | 10,000 |

| Prepaid Expenses | 8,000 | 2,00,000 |

| Accrued Income | 10,000 | 15,000 |

| Income Received in Advance | 6,000 | 3,000 |

| Bank Overdraft | 75,000 | 60,000 |

[Ans. Cash from Operating activities ₹ 64,000.]

Solution:-

List of all Solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |