Q. 19 solution of Cash Flow Statement TS Grewal Book Class 12 2021-22

Are you looking for the solution of Question number 19 of the Cash Flow Statement of TS Grewal Book 2021-22 Edition for the 2021-22 session?

Question number 19 of the Cash Flow Statement is a practical one.

Solution of Question Number 19 of Cash Flow Statement of TS Grewal Book 2021-22 Class 12

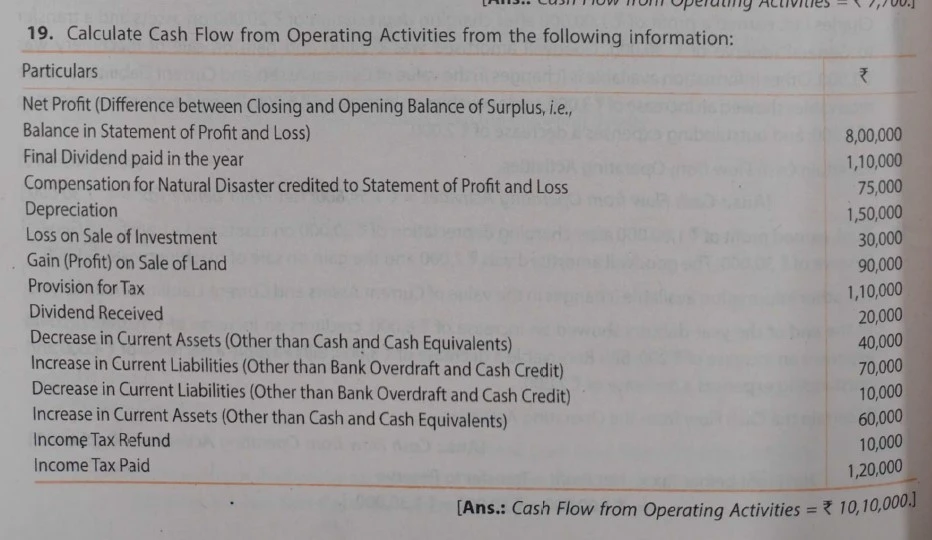

Question – 19

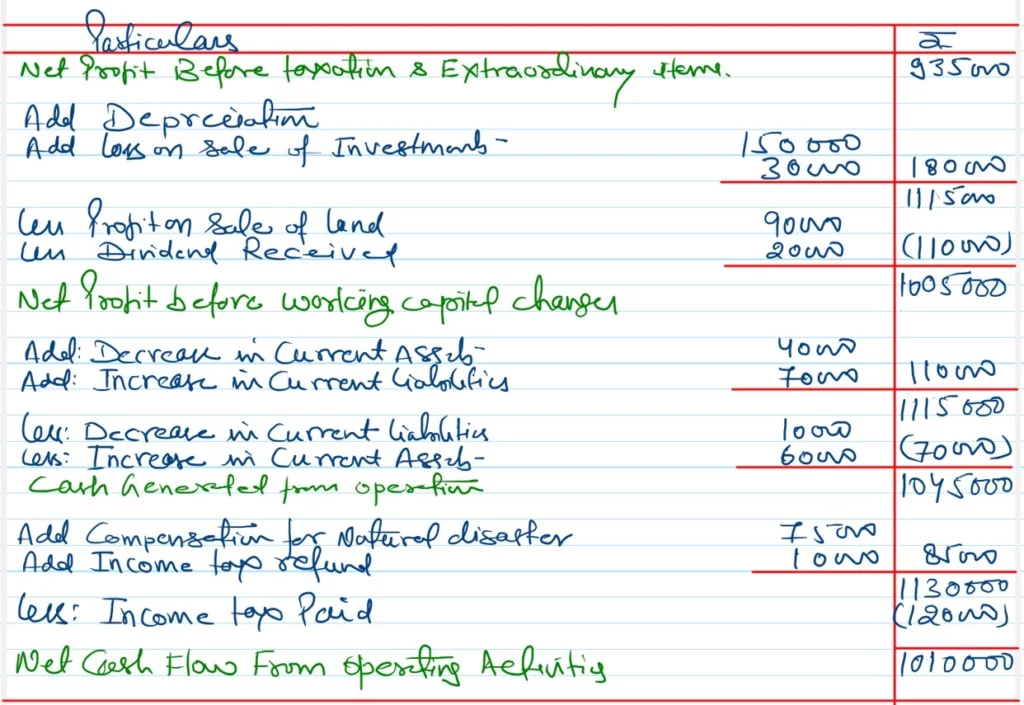

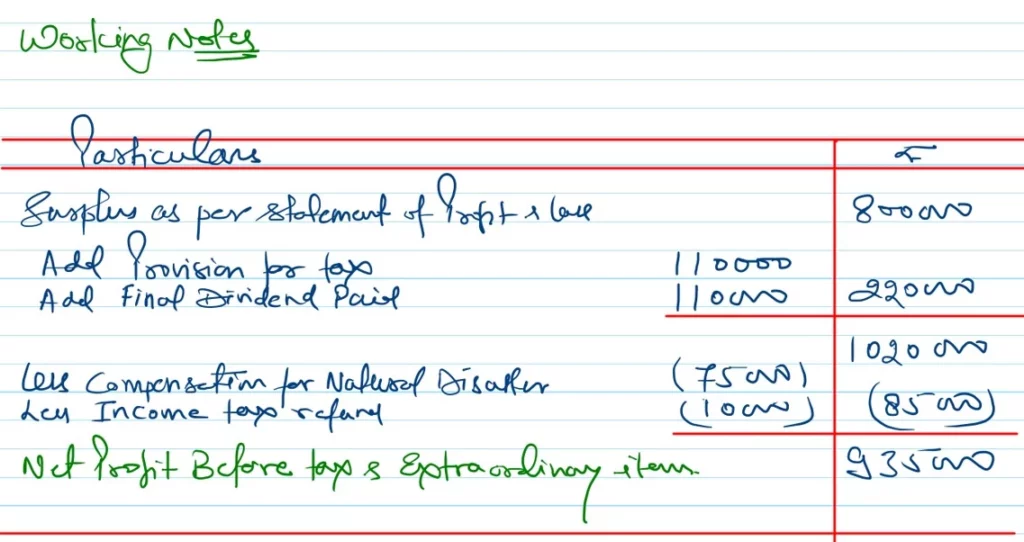

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Solutions |

| 1. | Question – 11 |

| 2. | Question – 12 |

| 3. | Question – 13 |

| 4. | Question – 14 |

| 5. | Question – 15 |

| 6. | Question – 16 |

| 7. | Question – 17 |

| 8. | Question – 18 |

| 9. | Question – 19 |

| 10. | Question – 20 |

| S.N | Solutions |

| 1. | Question – 21 |

| 2. | Question – 22 |

| 3. | Question – 23 |

| 4. | Question – 24 |

| 5. | Question – 25 |

| 6. | Question – 26 |

| 7. | Question – 27 |

| 8. | Question – 28 |

| 9. | Question – 29 |

| 10 | Question – 30 |

| S.N | Solutions |

| 1. | Questions – 31 |

| 2. | Questions – 32 |

| 3. | Questions – 33 |

| 4. | Questions – 34 |

| 5. | Questions – 35 |

| 6. | Questions – 36 |

| 7. | Questions – 37 |

| 8. | Questions – 38 |

| 9. | Questions – 39 |

| 10. | Questions – 40 |

| S.N | Solutions |

| 1. | Question – 41 |

| 2. | Question – 42 |

| 3. | Question – 43 |

| 4. | Question – 44 |

| 5. | Question – 45 |

| 6. | Question – 46 |

| 7. | Question – 47 |

| 8. | Question – 48 |

| 9. | Question – 49 |

| 10. | Question – 50 |

| S.N | Solutions |

| 1. | Questions – 51 |

| 2. | Questions – 52 |

| 3. | Questions – 53 |

| 4. | Questions – 54 |

| 5. | Questions – 55 |

| 6. | Questions – 56 |

| 7. | Questions – 57 |

Sir, net profit before tax and extraordinary items is 935,000.That is why there is a difference of 10,000 in your answer.

I have corrected it, taken provision for taxation 1,00,000 instead to 1,10,000

I have corrected it.

Sir this Answer is wrong because u misinterprited the no. of provision for tax please check.

I have corrected it, I wrong took provision for taxation 1,00,000 instead to 1,10,000

Made the correction don’t worry

Sir provision for tax is 1,10,000 u wrote 1,00,000 so your ans is coming 10,000 less and also in ans u have written 1,00,000 instead of 10 lakh

I have corrected it