Q. 21 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 21 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

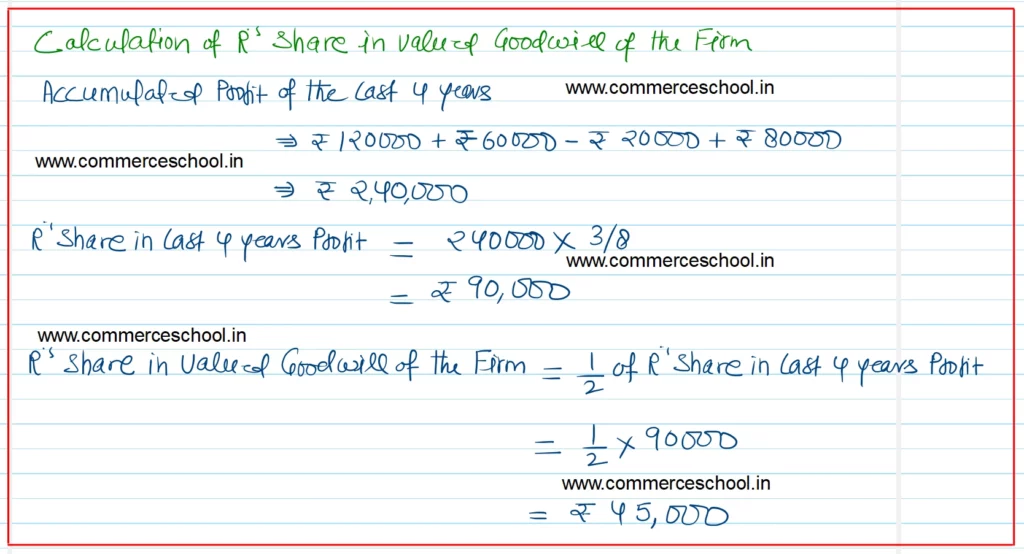

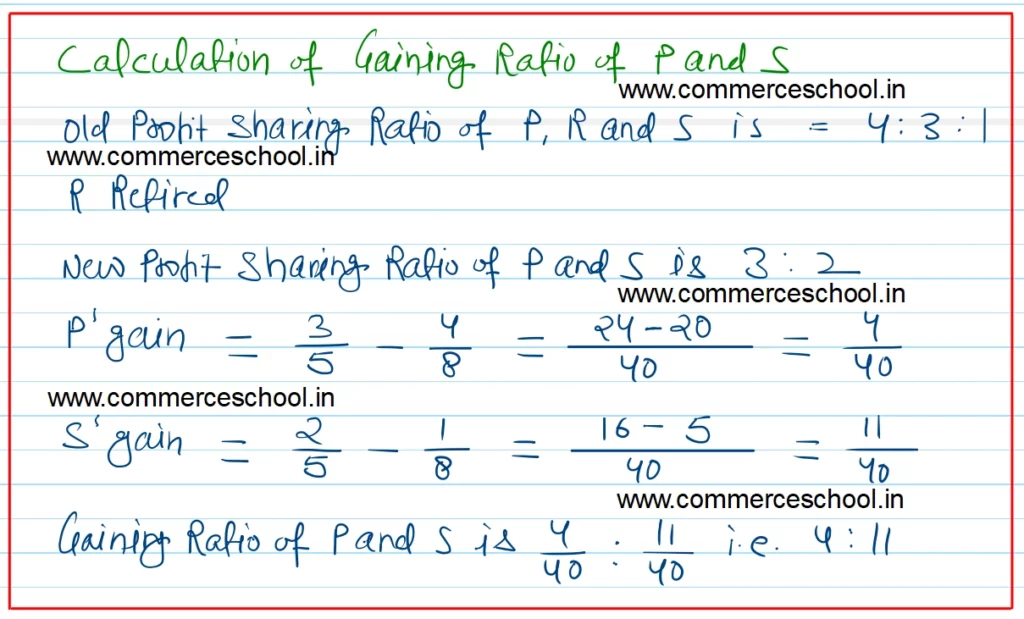

Q. 21 (A). P, R and S are in partnership sharing profits 4/8, 3/8 and 1/8 respectively. It is provided under the partnership deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profits credited to his account during the last 4 completed years (books of accounts are closed on 31st March).

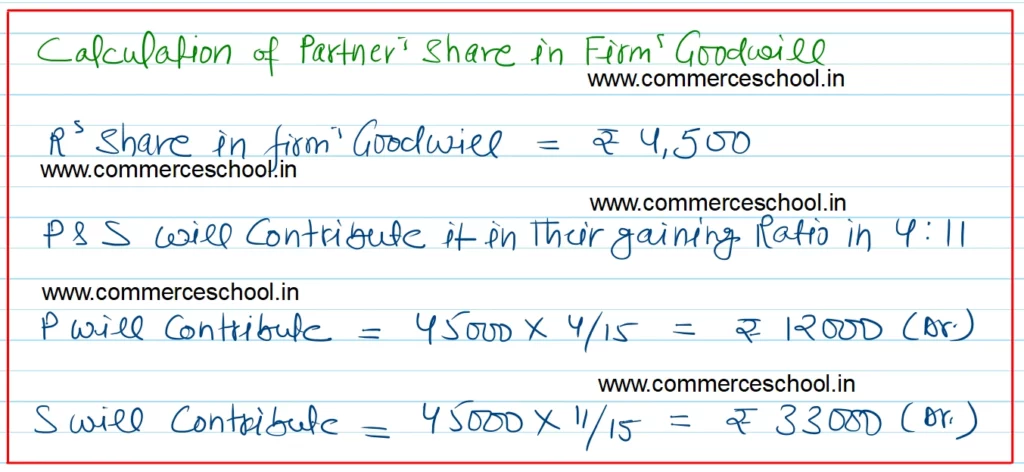

R died on 1st April, 2022. The firm’s profits for the last 4 years were as follows: 2019 (Profits ₹ 1,20,000); 2020 (Profits ₹ 60,000); 2021 (Losses ₹ 20,000) and 2022 (Profits ₹ 80,000).

- Determine the amount that should be credited to R in respect of his share of goodwill.

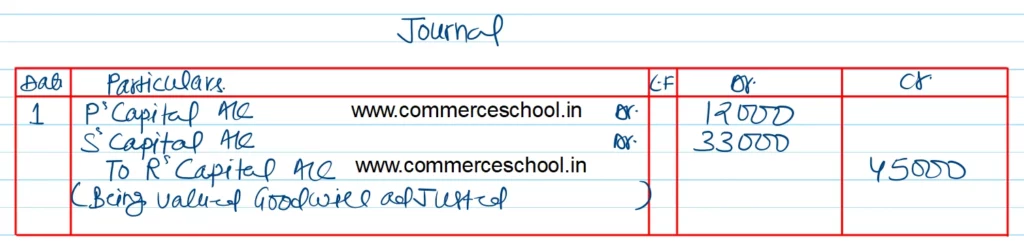

- Pass journal entry for the adjustment of goodwill, assuming that profit sharing ratio between P and S in future will be 3 : 2. Show your working clearly.

[Ans. R’s share of goodwill ₹ 45,000; to be debited to P and S in the ratio of 4 : 11.]

Solution:-

Case – (1)

Case – (2)

Working Notes:-

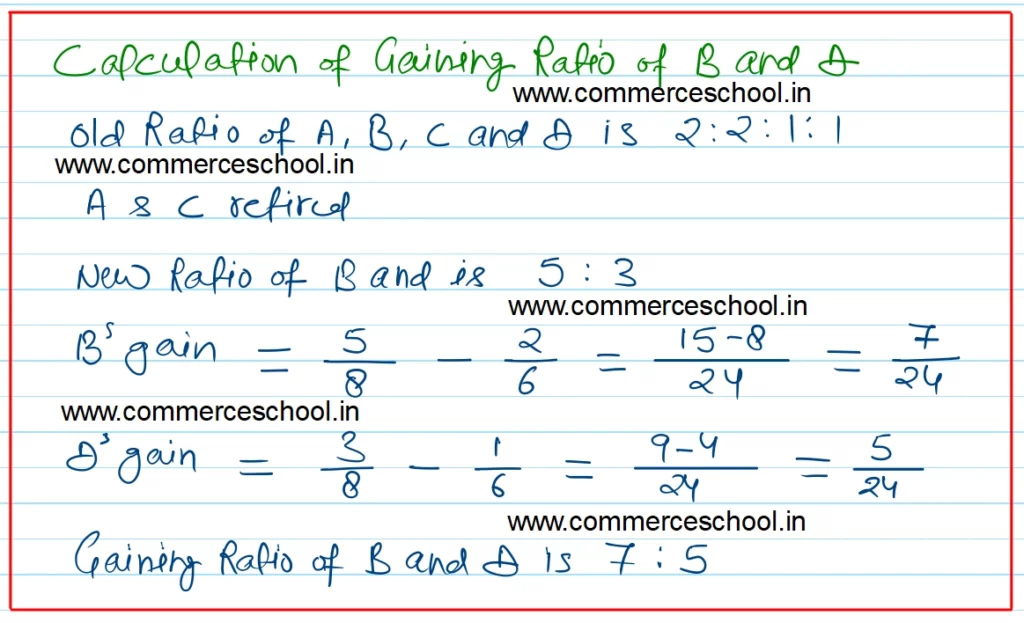

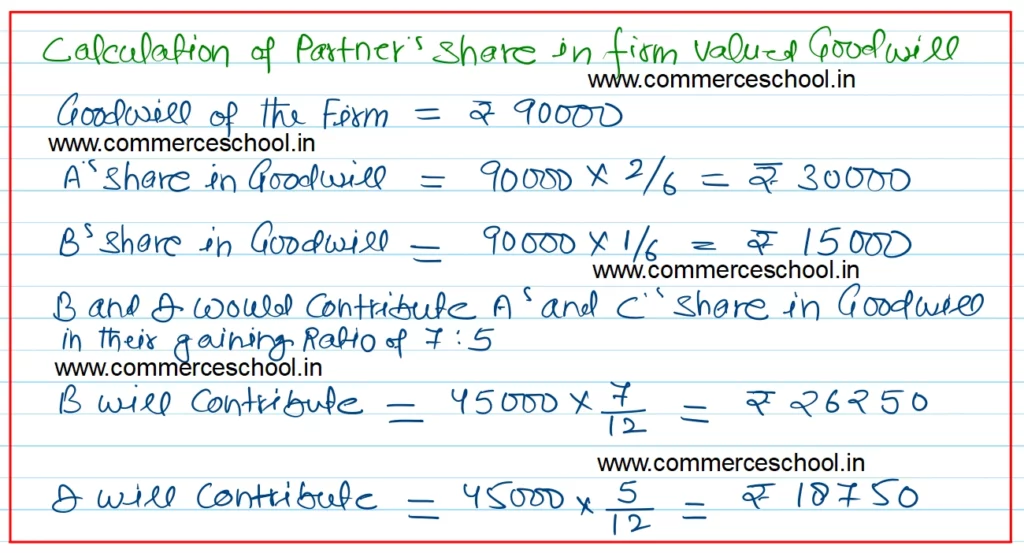

Q. 21 (B). A, B, C and D are partners in a firm sharing profits and losses in the ratio o 2 : 2 : 1 : 1. A and C decided to retire from the firm. The goodwill of the firm was valued at ₹ 90,000. B and D decided to share future profits in the ratio of 5 : 3.

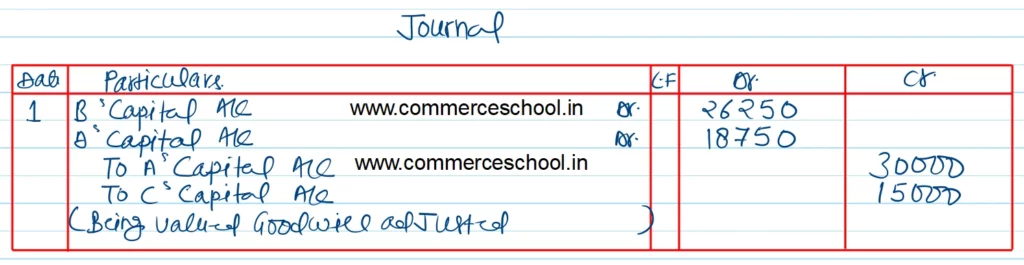

Pass necessary journal entry for the treatment of goodwill.

[Ans. Debit B by ₹ 26,250 and D by ₹ 18,750; and Credit A by ₹ 30,000 and C by ₹ 15,000.]

Solution:-