Q. 25 solution of Fundamentals of Partnership Firms TS Grewal Book 2021-22 Edition

Are you looking for the solution to Question number 25 page 2.86 of the Fundamentals of partnership firm chapter TS Grewal Book 2021 Edition for 2021-22 session

Question number 25 at the page number 2.86 of Accounting for Partnership Firms – Fundamentals is of a theoretical one.

Solution of Question number 25 of Accounting for Partnership Firms – Fundamentals TS Grewal Book 2021 Edition

Here is the solution of it.

When interest on capital is considered as appropriation and total interest on capital is more than the available profit. In this case interest on capital is allowed upto the profit only in the ratio of partners interest on capital amount.

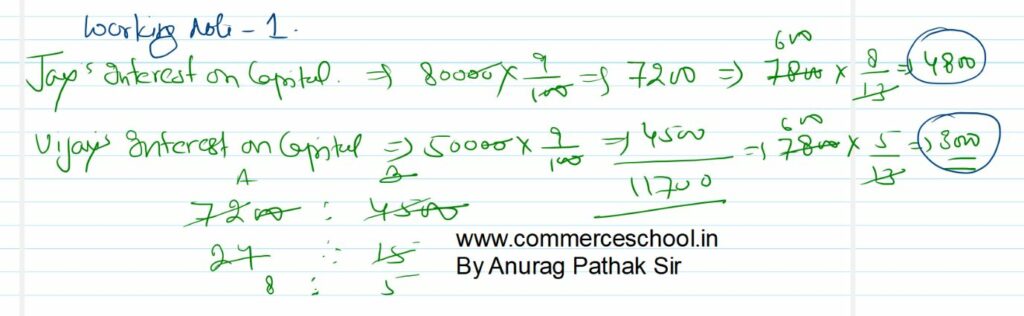

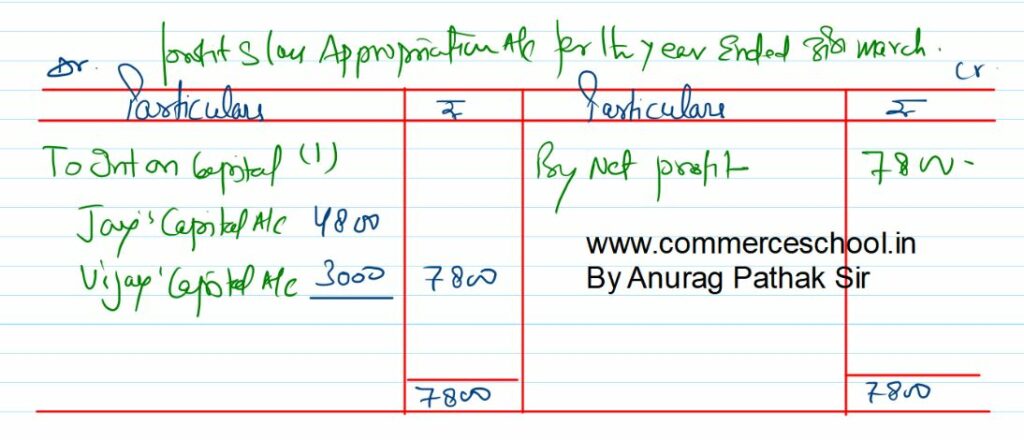

In this question, total interest on capital is ₹ 11700, that is more than the available profit ₹ 7800.

Hence Interest on partners capital can not be given more than ₹ 7800.

Thus, ₹ 7800 profit would be distributed among partners as interest on their capital in their interest on capital amount ratio that is 8 : 5.

For More clarity of this concept read this lecture.

Read Here:- Accounting treatment when appropriation is more than the available profit

| S.N | Questions | Link to Solution |

| 1. | Question – 1 | Solution |

| 2. | Question – 2 | Solution |

| 3. | Question – 3 | Solution |

| 4. | Question – 4 | Solution |

| 5. | Question – 5 | Solution |

| 6. | Question – 6 | Solution |

| 7. | Question – 7 | Solution |

| 8. | Question – 8 | Solution |

| 9. | Question – 9 | Solution |

| 10. | Question – 10 | Solution |

| S.N | Questions | Link to Solution |

| 11. | Question – 11 | Solution |

| 12. | Question – 12 | Solution |

| 13. | Question – 13 | Solution |

| 14. | Question – 14 | Solution |

| 15. | Question – 15 | Solution |

| 16. | Question – 16 | Solution |

| 17. | Question – 17 | Solution |

| 18. | Question – 18 | Solution |

| 19. | Question – 19 | Solution |

| 20. | Question – 20 | Solution |

| S.N | Questions | Link to Solution |

| 21. | Question – 21 | Solution |

| 22. | Question – 22 | Solution |

| 23. | Question – 23 | Solution |

| 24. | Question – 24 | Solution |

| 25. | Question – 25 | Solution |

| 26. | Question – 26 | Solution |

| 27. | Question – 27 | Solution |

| 28. | Question – 28 | Solution |

| 29. | Question – 29 | Solution |

| 30. | Question – 30 | Solution |

| S.N | Questions | Link to Solution |

| 31. | Question – 31 | Solution |

| 32. | Question – 32 | Solution |

| 33. | Question – 33 | Solution |

| 34. | Question – 34 | Solution |

| 35. | Question – 35 | Solution |

| 36. | Question – 36 | Solution |

| 37. | Question – 37 | Solution |

| 38. | Question – 38 | Solution |

| 39. | Question – 39 | Solution |

| 40. | Question – 40 | Solution |

| S.N | Questions | Link to Solution |

| 41. | Question – 41 | Solution |

| 42. | Question – 42 | Solution |

| 43. | Question – 43 | Solution |

| 44. | Question – 44 | Solution |

| 45. | Question – 45 | Solution |

| 46. | Question – 46 | Solution |

| 47. | Question – 47 | Solution |

| 48. | Question – 48 | Solution |

| 49. | Question – 49 | Solution |

| 50. | Question – 50 | Solution |

| S.N | Questions | Link to Solution |

| 51. | Question – 51 | Solution |

| 52. | Question – 52 | Solution |

| 53. | Question – 53 | Solution |

| 54. | Question – 54 | Solution |

| 55. | Question – 55 | Solution |

| 56. | Question – 56 | Solution |

| 57. | Question – 57 | Solution |

| 58. | Question – 58 | Solution |

| 59. | Question – 59 | Solution |

| 60 | Question – 60 | Solution |

| S.N | Questions | Link to Solution |

| 61. | Question – 61 | Solution |

| 62. | Question – 62 | Solution |

| 63. | Question – 63 | Solution |

| 64. | Question – 64 | Solution |

| 65. | Question – 65 | Solution |

| 66. | Question – 66 | Solution |

| 67. | Question – 67 | Solution |

| 68. | Question – 68 | Solution |

| 69. | Question – 69 | Solution |

| 70 | Question – 70 | Solution |