Q. 28 DK Goel Cash Flow Statement Solutions Class 12 CBSE (2024-25)

Solution of question number 28 of Cash Flow Statement chapter 7 of DK Goel Class 12 CBSE (2024-25)

From the following Balance Sheets of Enclotek Ltd. as at 31st March and the additional information provided, calculate (i) Cash from ‘Operating Activities’ and (ii) Cash from ‘Financing Activities’:

| Particulars | 31.3.2023 | 31.3.2022 | |

| I. EQUITY AND LIABILITIES: | |||

| (1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus | 1 2 | 7,00,000 3,35,000 | 7,50,000 – |

| (2) Non-Current Liabilities Long-term Borrowings | 3,00,000 | 2,00,000 | |

| (3) Current Liabilities | 70,000 | 1,10,000 | |

| Total | 14,05,000 | 10,60,000 | |

| II. ASSETS: | |||

| (1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Machinery) (ii) Intangible Assets (b) Non-Current Investments | 8,60,000 – 1,25,000 | 6,20,000 20,000 80,000 | |

| (2) Current Assets | 4,20,000 | 3,40,000 | |

| Total | 14,05,000 | 10,60,000 |

Notes:-

| 31.3.2023 | 31.3.2022 | |

| (1) Share Capital: Equity Share Capital 5% Preference Share Capital | 5,00,000 2,00,000 | 4,50,000 3,00,000 |

| 7,00,000 | 7,50,000 | |

| (2) Reserve & Surplus Capital Redemption Reserve General Reserve Profit & Loss Balance | 1,00,000 1,35,000 1,00,000 | – 1,00,000 (1,00,000) |

| 3,35,000 | 3,00,000 | |

| (3) Long-term Borrowings: 8% Debentures | – | 2,00,000 |

| (4) Intangible Assets: Gooodwill | – | 20,000 |

Additional Information:-

(i) Depreciation provided on Machinery ₹ 60,000.

(ii) Preference Shares were redeemed at a premium of 5% on 31st March, 2023.

(iii) Additional debentures were issued on 1st October, 2022.

(iv) Proposed dividend on equity share capital for previous year ended 31st March 2022 was paid @ 8%.

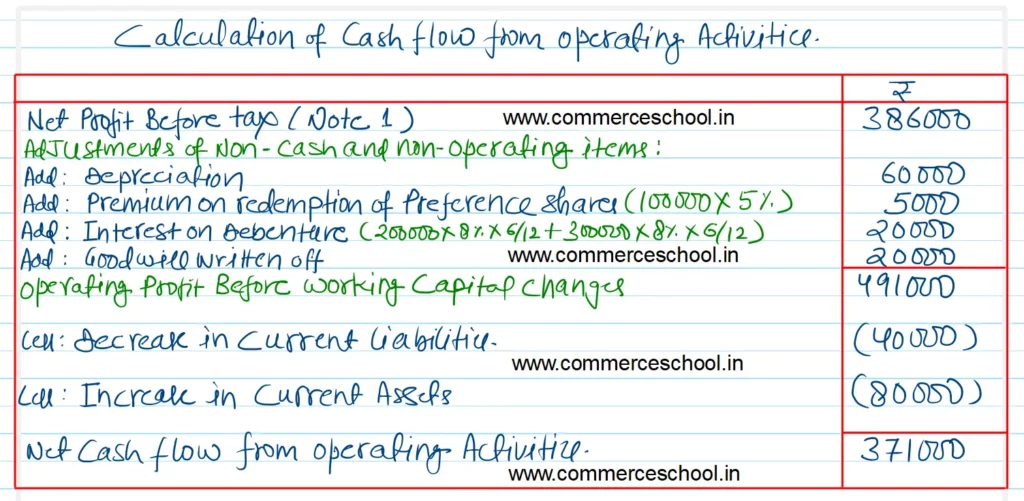

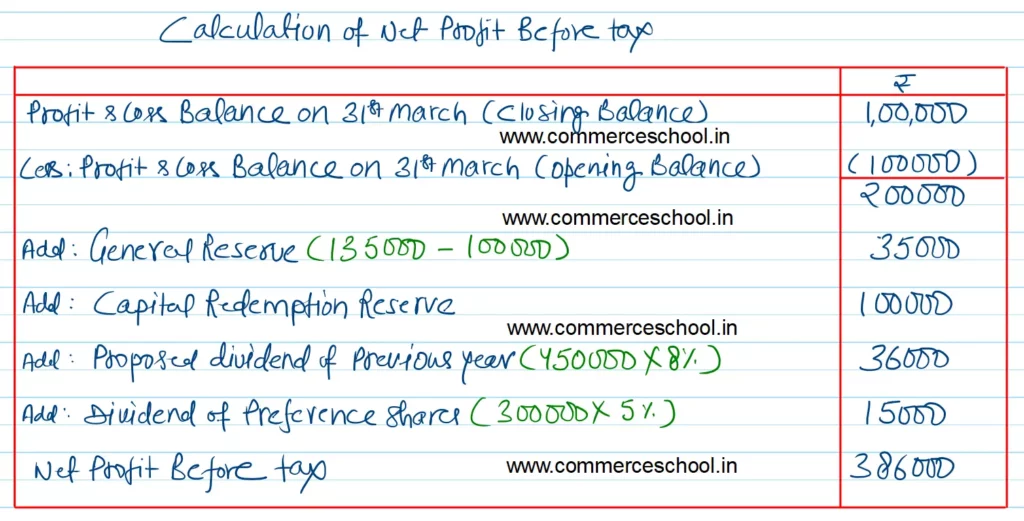

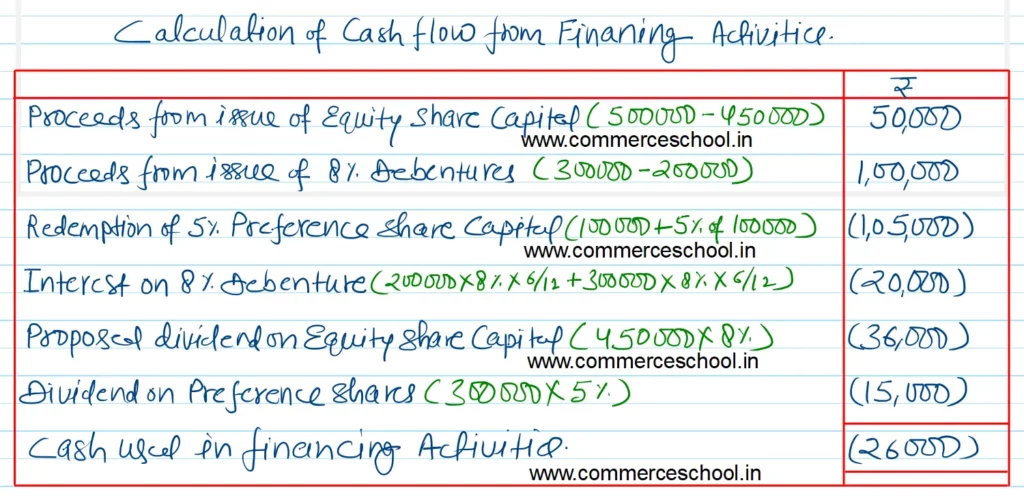

[Ans. (i) Net Cash Flows from Operating Activities ₹ 3,71,000;

(ii) Net Cash used in Financing Activities ₹ 26,000.]

Solution:-

Hint:-

(1) Dividend Paid on Preference Shares ₹ 15,000.

(2) Negative balance of Profit & Loss amounting to ₹ 1,00,000 appearing in the Balance Sheet on 31.3.2022 represents an amount of loss. In the current year (2022-23), after covering this loss of ₹ 1,00,000, the Profit and Loss shows a profit of ₹ 1,00,000. It means net profit during the current year must have been ₹ 1,00,000 + ₹ 1,00,000 = ₹ 2,00,000.

(2) Since dividend on Equity shares has been paid, dividend on Preference Shares also must have been paid prior to dividend on equity shares.

(4) Proposed Dividend paid on Equity Share Capital ₹ 36,000.

List of all Solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |