Q. 32 DK Goel Cash Flow Statement Solutions Class 12 CBSE (2024-25)

Solution of question number 32 of Cash Flow Statement chapter 7 of DK Goel Class 12 CBSE (2024-25)

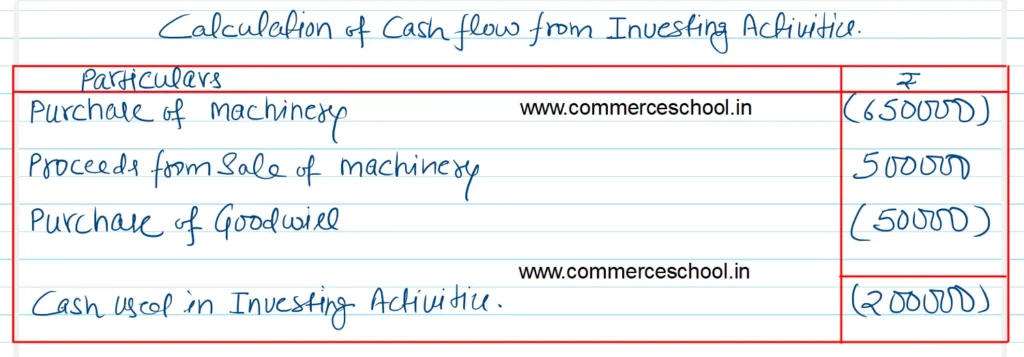

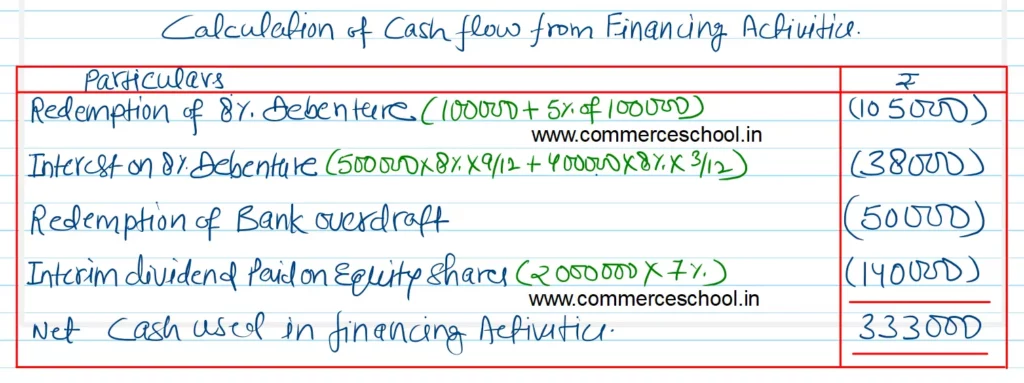

From the figures given in the Balance Sheet and additional information, calculate ‘Cash Flows from Investing Activities’ and ‘Cash Flows from Financing Activities’.

| Particulars | Note. No. | 31.03.2024 | 31.03.2023 |

| I. EQUITY AND LIABILITIES: | |||

| (1) Shareholder’s Funds (a) Equity Share Capital (b) Reserves and Surplus | 20,00,000 3,80,000 | 20,00,000 4,00,000 | |

| (2) Non-Current Liabilities Long-term Borrowings | 4,00,000 | 5,00,000 | |

| (3) Current Liabilities (a) Trade Payables (b) Bank Overdraft (c) Short-term Provision | 4,20,000 1,50,000 50,000 | 1,60,000 2,00,000 60,000 | |

| Total | 34,00,000 | 33,20,000 | |

| II. ASSETS: | |||

| (1) Non-Current Assets Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment (ii) Intangible Assets | 20,40,000 2,00,000 | 20,00,000 1,50,000 | |

| (2) Current Assets (a) Inventories (b) Trade Receivables (c) Cash and Cash Equivalents | 7,00,000 3,10,000 1,50,000 | 8,00,000 1,60,000 2,10,000 | |

| Total | 34,00,000 | 33,20,000 |

Notes to Accounts:

| Particulars | 31.3.2024 | 31.3.2023 |

| Reserves and Surplus: Surplus i.e., Balance in Statement of Profit and Loss | 3,80,000 | 4,00,000 |

| Short-term Provisions: Provision for Tax | 50,000 | 60,000 |

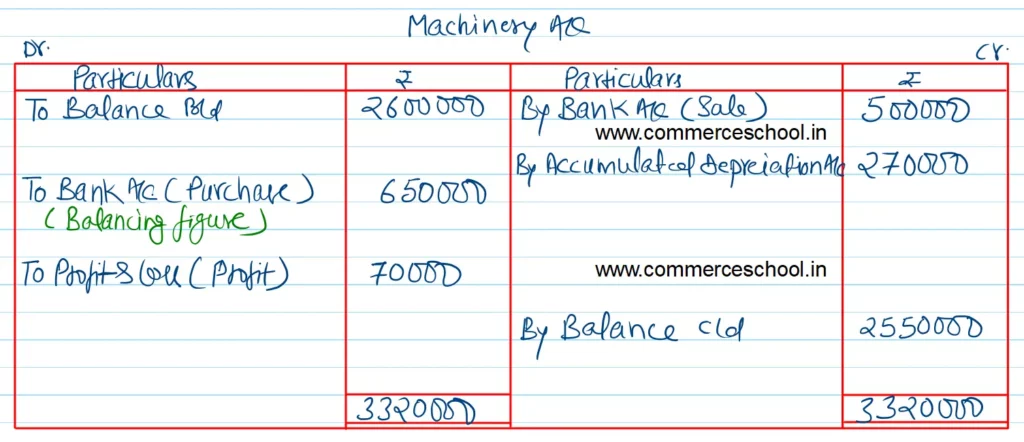

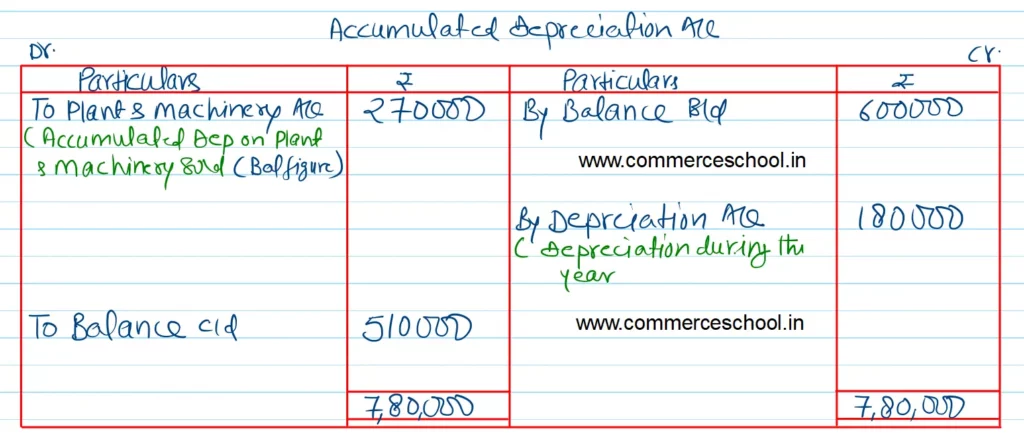

| Property, Plant and Equipment Machinery Less: Accumulated Depreciation | 25,50,000 (5,10,000) | 26,00,000 (6,00,000) |

| 20,40,000 | 20,00,000 | |

| Intangible Assets: Goodwill | 2,00,000 | 1,50,000 |

Additional Information:-

(i) A piece of machinery costing ₹ 7,00,000 was sold for ₹ 5,00,000. Depreciation charged during the year amounted to ₹ 1,80,000.

(ii) 8% Debentures were redeemed at a premium of 5% on 1st January, 2024.

(iii) Interim Dividend on equity share capital was paid @ 7%.

[Ans. Net Cash used in Investing Activities ₹ 2,00,000.

Net Cash used in Financing Activities ₹ 3,33,000.]

Solution:-

List of all Solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |