Q. 34 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 34 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

P, Q and R were partners in a firm sharing profits in the ratio of 2 : 3 : 5. On 31-3-2024 their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 70,000 | Bank | 45,000 |

| Capital Accounts: P Q R | 80,000 70,000 60,000 | Debtors 40,000 Less: Provision for Doubtful Debts 5,000 | 35,000 |

| Stock | 50,000 | ||

| Building | 1,40,000 | ||

| Profit and Loss A/c | 10,000 | ||

| 2,80,000 | 2,80,000 |

On the above date R retired from the firm due to his illness on the following terms:

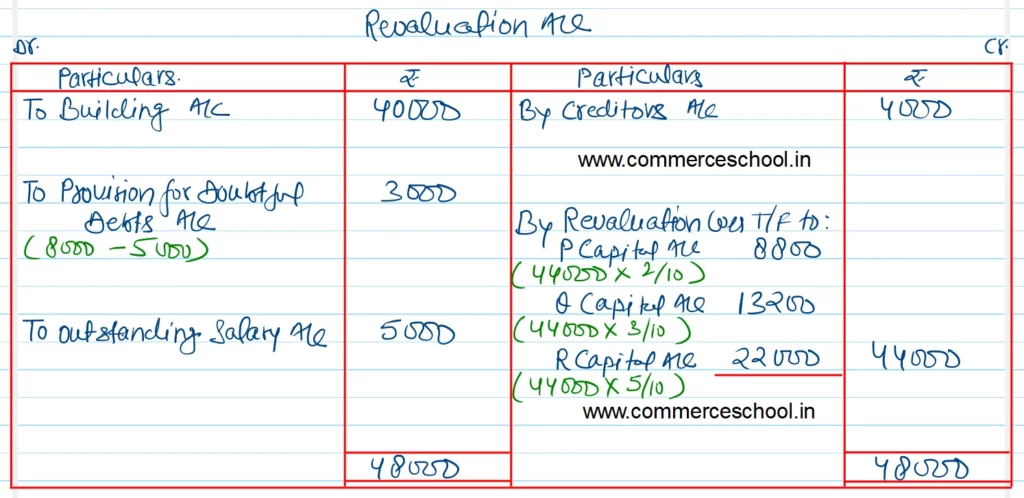

(i) Building was to be depreciated by ₹ 40,000.

(ii) Provision for doubtful debts was to be maintained at 20% on debtors.

(iii) Salary outstanding ₹ 5,000 was to be recorded and creditors ₹ 4,000 will not be claimed.

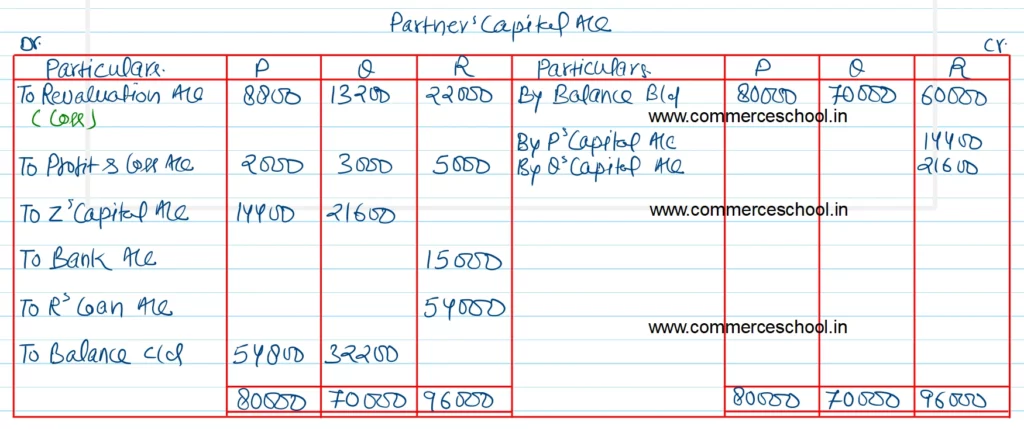

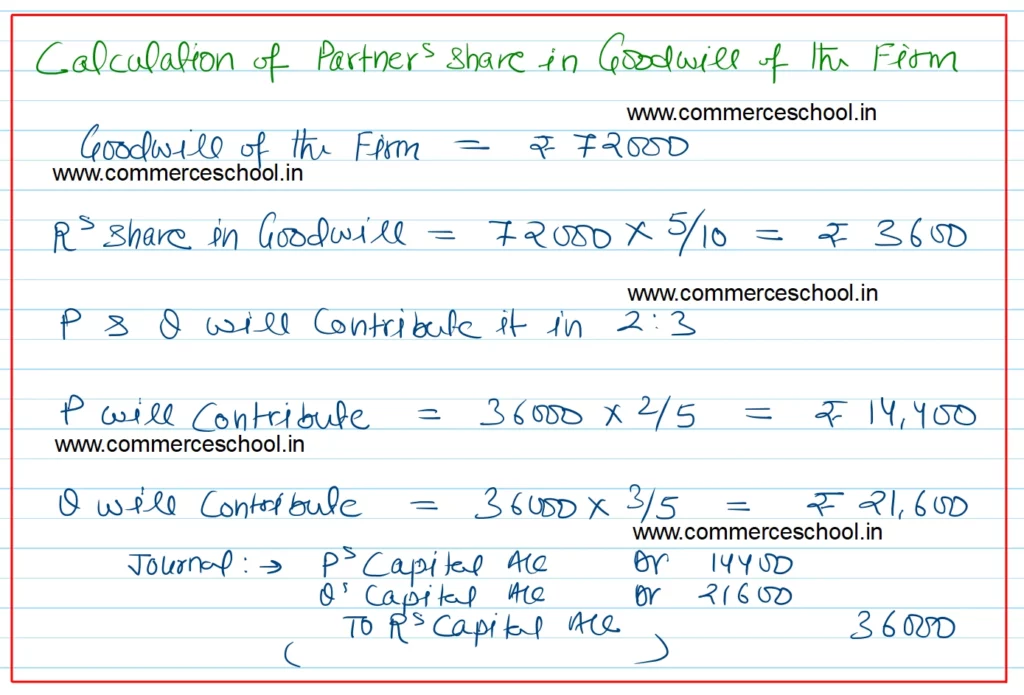

(iv) Goodwill of the firm was valued at ₹ 72,000.

(v) R was to be paid ₹ 15,000 in cash, through bank and the balance was to be transferred to his loan account.

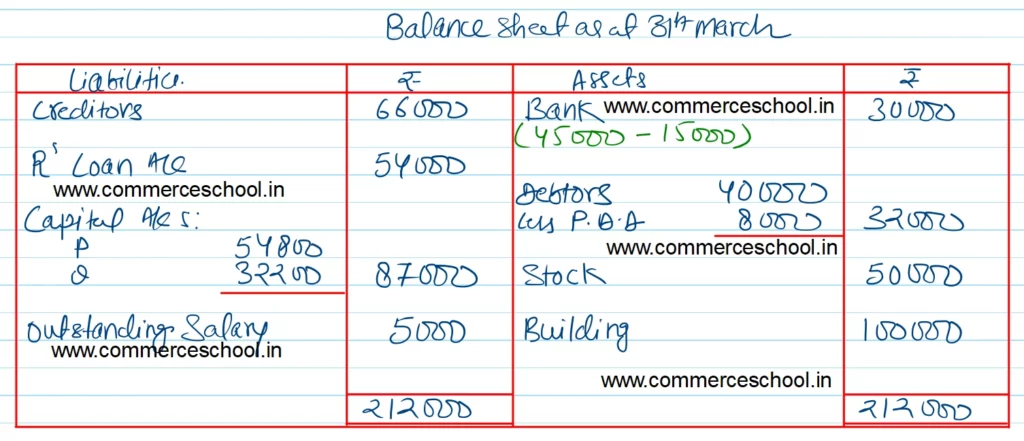

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of P and Q after R’s retirement.

[Ans. Loss on Revaluation ₹ 44,000; R’s Loan A/c ₹ 54,000; Capital Accounts: P ₹ 54,800 and Q ₹ 32,200; B/S Total ₹ 2,12,000.]

Solution:-