Q. 45 DK Goel Accounting Ratios Solutions Class 12 CBSE (2024-25)

the solutions of Question number 45 of Accounting Ratios chapter 5 of DK Goel Class 12 CBSE (2024-25)

The following particulars are given to you:

| ₹ | |

| Share Capital | 1,00,000 |

| Reserve and Surplus | 1,50,000 |

| Current Liabilities | 4,00,000 |

| Current Assets | 5.50,000 |

| Property, Plant and Equipment | 7,00,000 |

| Loans @ 10% | 4,00,000 |

| 12% Debentures | 2,00,000 |

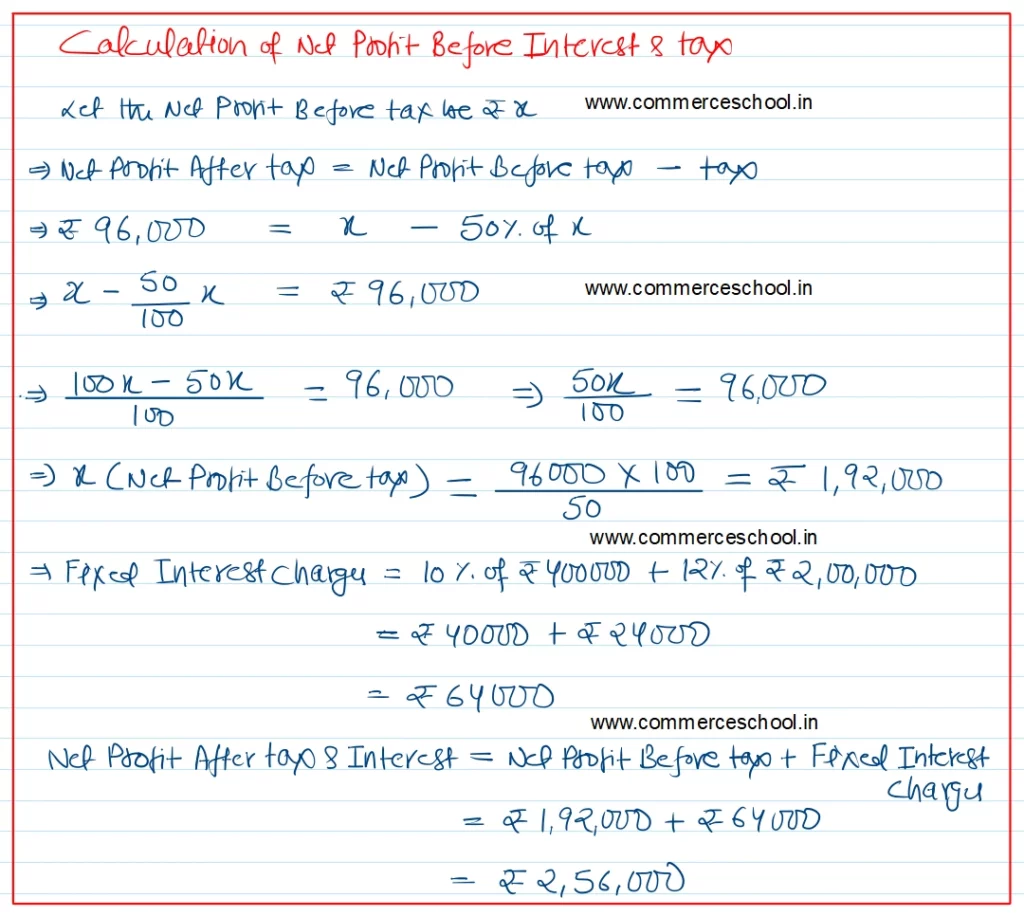

Net Profit for the year after interest and tax was ₹ 96,000. Rate of Income Tax was 50%.

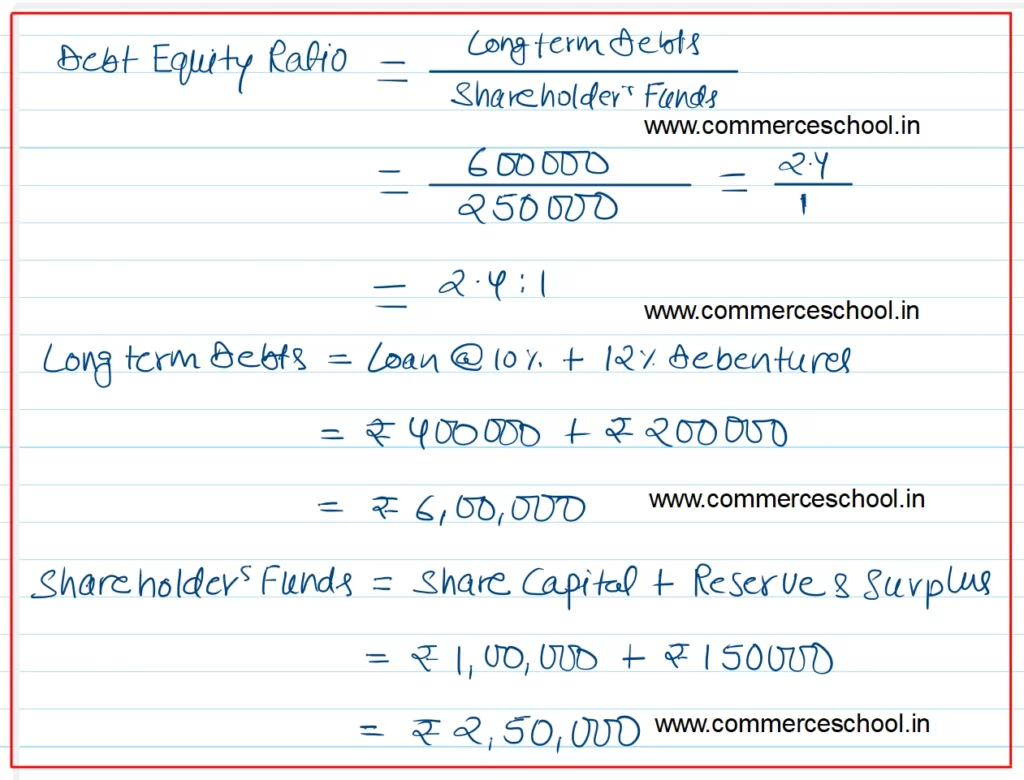

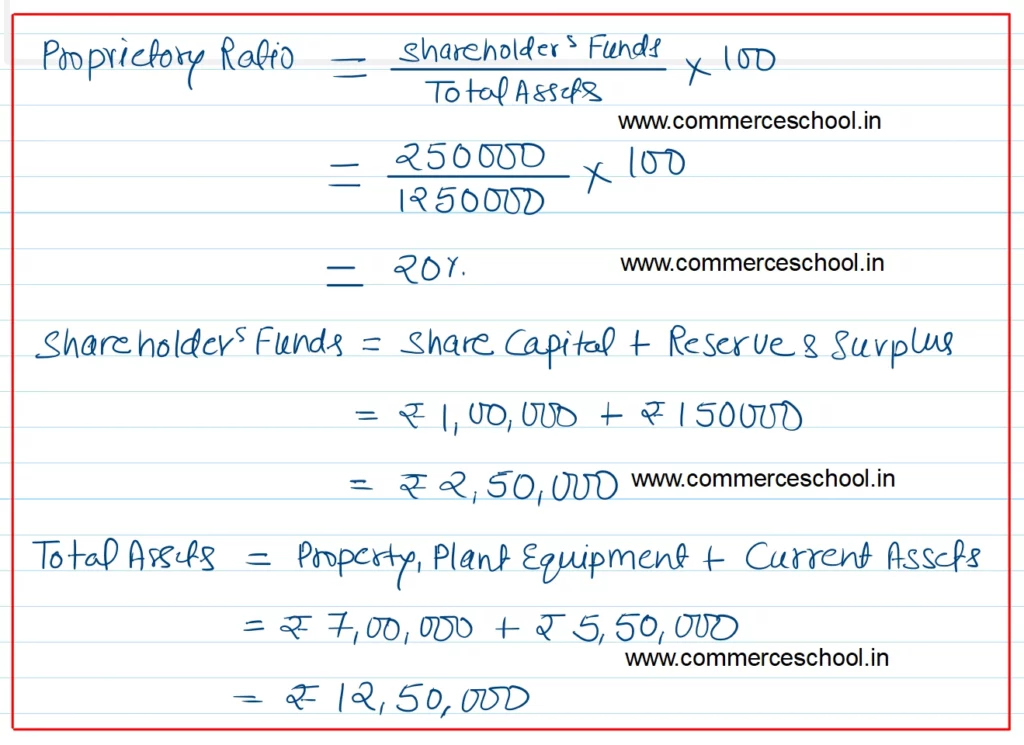

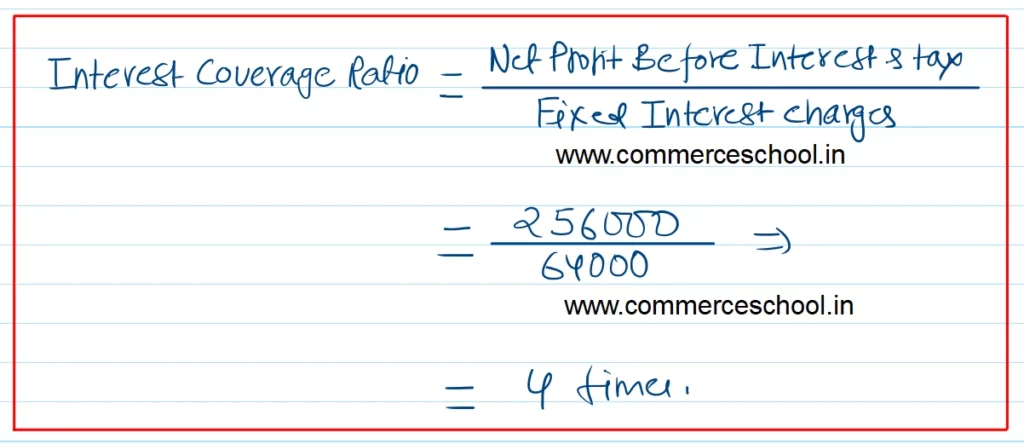

Calculate (i) Debt Equity Ratio; (ii) Proprietary Ratio; and (iii) Interest Coverage Ratio.

Also give your Comments.

[Ans. (i) Debt-Equity Ratio 2.4 : 1; (ii) Proprietary Ratio 20%; (iii) Interest coverage Ratio = 4 times.

Solution:-

Comments:

(i) Debt-Equity Ratio of the company is not satisfactory because it is more than the acceptable norms of 2 : 1. It shows risky financial positions from the long-term point of view.

(ii) Proprietary Ratio is only 20% which means that the long-term financial position of the Company is not satisfactory because only 20% of the total assets of the company are funded by equity.

(iii) Normally acceptable interest-coverage ratio is 6 or 7 times, whereas the actual ratio for this company is 4. It means that the company may face difficulty in paying the interest on long-term loans regularly in case of fall of profits.

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Solutions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Solutions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Solutions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |

| S.N | Solutions |

| 111 | Question – 111 |

| 112 | Question – 112 |

| 113 | Question – 113 |

| 114 | Question – 114 |

| 115 | Question – 115 |

| 116 | Question – 116 |

| 117 | Question – 117 |

| 118 | Question – 118 |

| 119 | Question – 119 |

| 120 | Question – 120 |

| S.N | Solutions |

| 121 | Question – 121 |

| 122 | Question – 122 |

| 123 | Question – 123 |

| 124 | Question – 124 |

| 125 | Question – 125 |

| 126 | Question – 126 |

| 127 | Question – 127 |

| 128 | Question – 128 |

| 129 | Question – 129 |

| 130 | Question – 130 |

| S.N | Solutions |

| 131 | Question – 131 |

| 132 | Question – 132 |

| 133 | Question – 133 |

| 134 | Question – 134 |

| 135 | Question – 135 |

| 136 | Question – 136 |

| 137 | Question – 137 |

| 138 | Question – 138 |

| 139 | Question – 139 |

| 140 | Question – 140 |

| S.N | Solutions |

| 141 | Question – 141 |

| 142 | Question – 142 |

| 143 | Question – 143 |

| 144 | Question – 144 |

| 145 | Question – 145 |

| 146 | Question – 146 |

| 147 | Question – 147 |

| 148 | Question – 148 |

| 149 | Question – 149 |

| 150 | Question – 150 |

| S.N | Solutions |

| 151 | Question – 151 |

| 152 | Question – 152 |

| 153 | Question – 153 |

| 154 | Question – 154 |

| 155 | Question – 155 |

| 156 | Question – 156 |

| 157 | Question – 157 |

| 158 | Question – 158 |

| 159 | Question – 159 |

| 160 | Question – 160 |

| S.N | Solutions |

| 161 | Question – 161 |

| 162 | Question – 162 |

| 163 | Question – 163 |

| 164 | Question – 164 |

| 165 | Question – 165 |

| 166 | Question – 166 |

| 167 | Question – 167 |

| 168 | Question – 168 |

| 169 | Question – 169 |

| 170 | Question – 170 |

| S.N | Solutions |

| 171 | Question – 171 |

| 172 | Question – 172 |

| 173 | Question – 173 |

| 174 | Question – 174 |

| 175 | Question – 175 |

| 176 | Question – 176 |

| 177 | Question – 177 |

| 178 | Question – 178 |

| 179 | Question – 179 |

| 180 | Question – 180 |

| S.N | Solutions |

| 181 | Question – 181 |

| 182 | Question – 182 |

| 183 | Question – 183 |

| 184 | Question – 184 |

| 185 | Question – 185 |

| 186 | Question – 186 |

| 187 | Question – 187 |

| 188 | Question – 188 |

| 189 | Question – 189 |

| 190 | Question – 190 |

| S.N | Solutions |

| 191 | Question – 191 |

| 192 | Question – 192 |

| 193 | Question – 193 |

| 194 | Question – 194 |

| 195 | Question – 195 |

| 196 | Question – 196 |

| 197 | Question – 197 |

| 198 | Question – 198 |

| 199 | Question – 199 |

| 200 | Question – 200 |

| S.N | Solutions |

| 201 | Question – 201 |

| 202 | Question – 202 |

| 203 | Question – 203 |

| 204 | Question – 204 |

| 205 | Question – 205 |

| 206 | Question – 206 |

| 207 | Question – 207 |

| 208 | Question – 208 |

| 209 | Question – 209 |

| 210 | Question – 210 |

| S.N | Solutions |

| 211 | Question – 211 |

| 212 | Question – 212 |

| 213 | Question – 213 |

| 214 | Question – 214 |

| 215 | Question – 215 |

| 216 | Question – 216 |

| 217 | Question – 217 |

| 218 | Question – 218 |

| 219 | Question – 219 |

| 220 | Question – 220 |

| S.N | Solutions |

| 221 | Question – 221 |

| 222 | Question – 222 |

| 223 | Question – 223 |

| 224 | Question – 224 |

| 225 | Question – 225 |

| 226 | Question – 226 |

| 227 | Question – 227 |

| 228 | Question – 228 |