Q. 49 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 49 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

R, S and T were partners in a firm sharing profits in 2 : 2 : 1 ratio. On 1-4-2021 their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Bank Loan | 12,800 | Cash | 51,300 |

| Sundry Creditors | 25,000 | Bills Receivable | 10,800 |

| Capitals: R S T | 80,000 50,000 40,000 | Debtors | 35,600 |

| Profit and Loss A/c | 9,000 | Stock | 44,600 |

| Furniture | 7,000 | ||

| Plant and Machinery | 19,500 | ||

| Building | 48,000 | ||

| 2,16,800 | 2,16,800 |

S retired from the firm on 1.4.2021 and his share was ascertined on the revaluation of assets as follows:

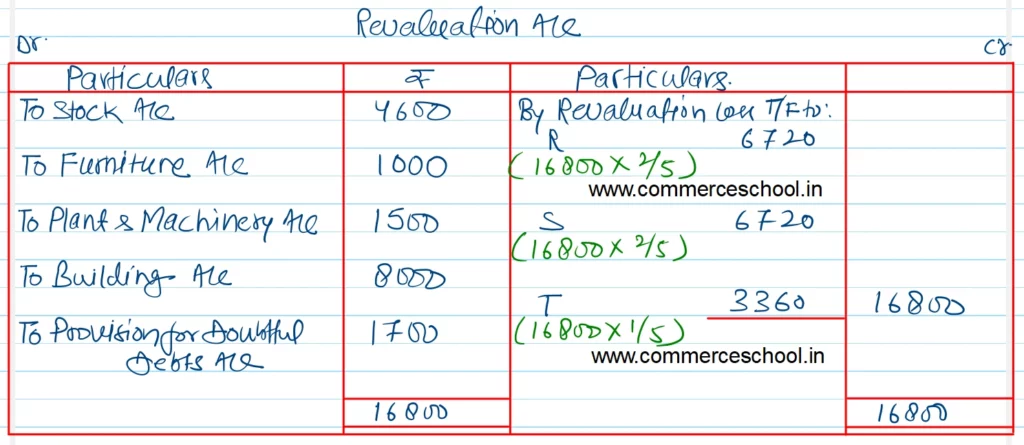

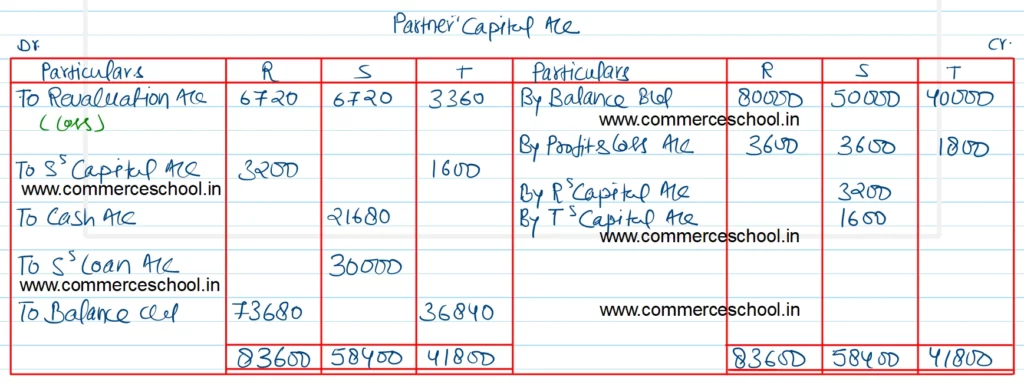

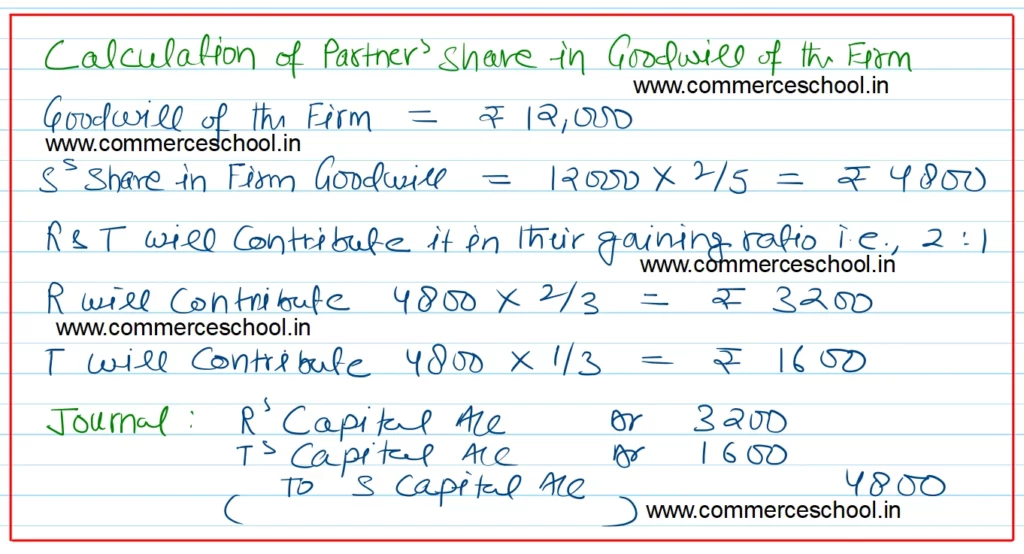

Stock ₹ 40,000; Furniture ₹ 6,000; Plant and Machinery ₹ 18,000; Building ₹ 40,000; ₹ 1,700 were to be provided for doubtful debts. The goodwill of the firm was valued at ₹ 12,000.

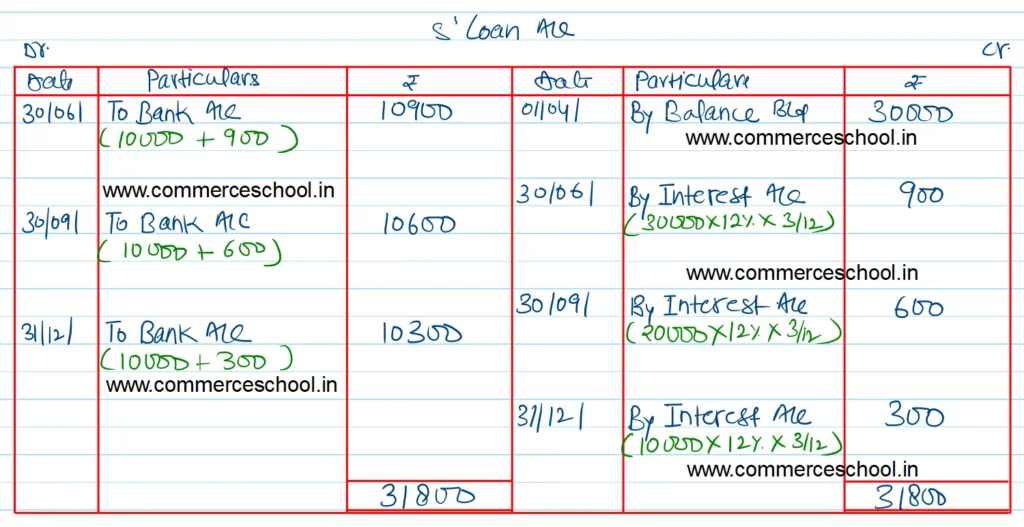

S was to be paid ₹ 21,680 in cash on retirement and the balance in three equal quarterly instalments (Starting from 30th June 2021) along with interest @ 12% p.a.

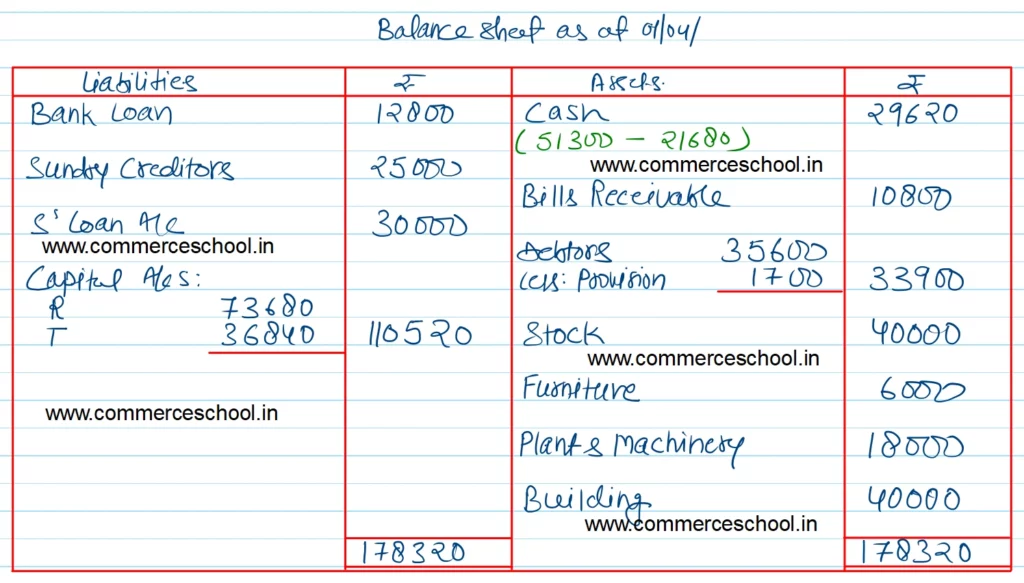

Prepare Revaluation Account, Partner’s Capital Accounts, S’s Loan Account and Balance Sheet on 1.4.2021.

[Ans. Loss on Revaluation ₹ 16,800; S’s Loan A/c ₹ 30,000; Capital A/cs : R ₹ 73,680 and T ₹ 36,840; Balance Sheet Total ₹ 1,78,320.]

Hint: Payment of S’s Loan A/c : ₹ 10,900 on 30th June 2021; ₹ 10,600 on 30th Sept. 2021 and ₹ 10,300 on 31st Dec. 2021.

Solution:-