Q. 54 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 54 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Kushal, Kumar and Kavita were partners in a firm sharing profits in the ratio of 3 : 1 : 1. On 1st April, 2023 their Balance Sheet was as follows:

Balance sheet of Kushal, Kumar and Kavita as at 1st April, 2023

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,20,000 | Cash | 70,000 |

| Bills Payable | 1,80,000 | Debtors 2,00,000 Less provision 10,000 | 1,90,000 |

| General Reserve | 1,20,000 | Stock | 2,20,000 |

| Capitals: Kushal Kumar Kavita | 3,00,000 2,80,000 3,00,000 | Furniture | 1,20,000 |

| Building | 3,00,000 | ||

| Land | 4,00,000 | ||

| 13,00,000 | 13,00,000 |

On the above date Kavita retired and the following was agreed:

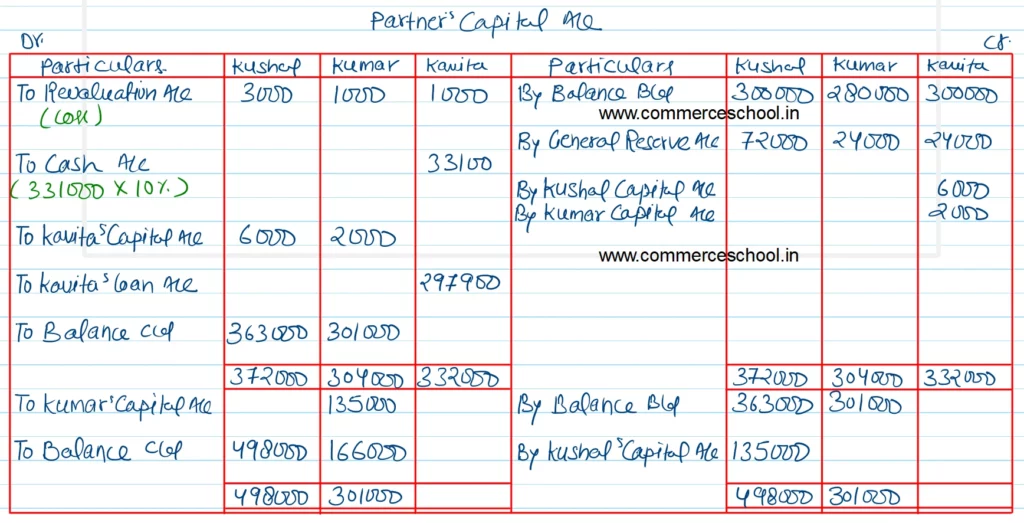

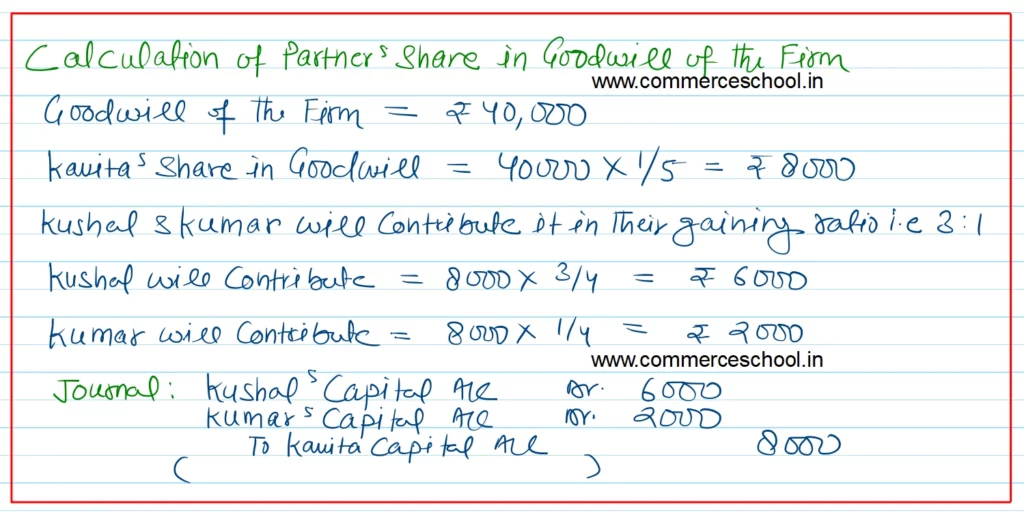

(i) Goodwill of the firm was valued at ₹ 40,000.

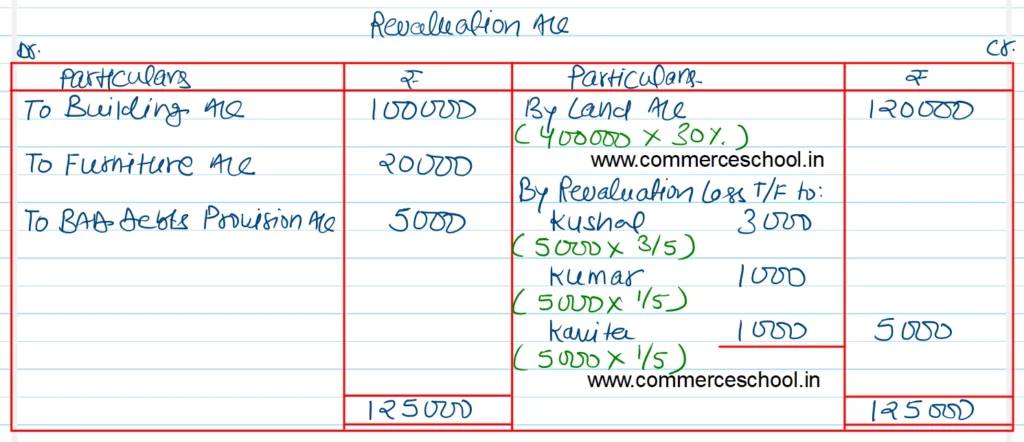

(ii) Land was to be appreciated by 30% and Building was to be depreciated by ₹ 1,00,000.

(iii) Value of furniture was to be reduced by ₹ 20,000.

(iv) Bad debts provision is to be increased to ₹ 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her Loan Account.

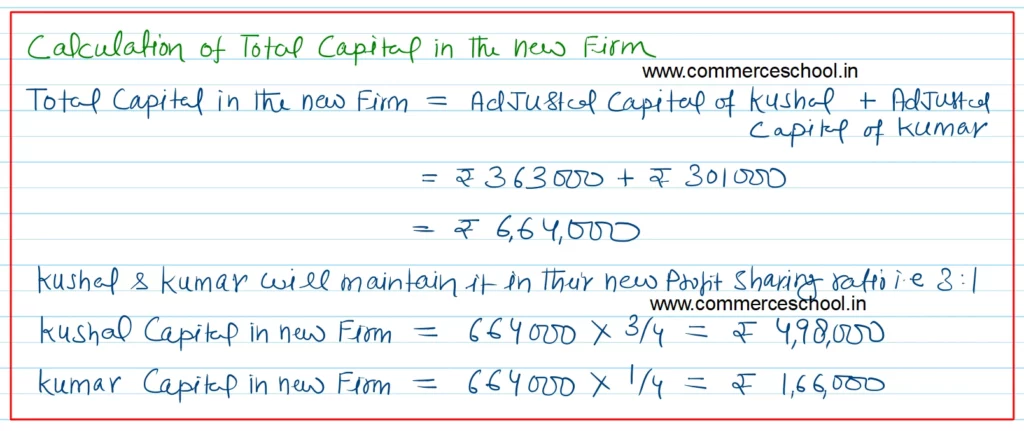

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their Capital Accounts will be adjusted through Current Accounts.

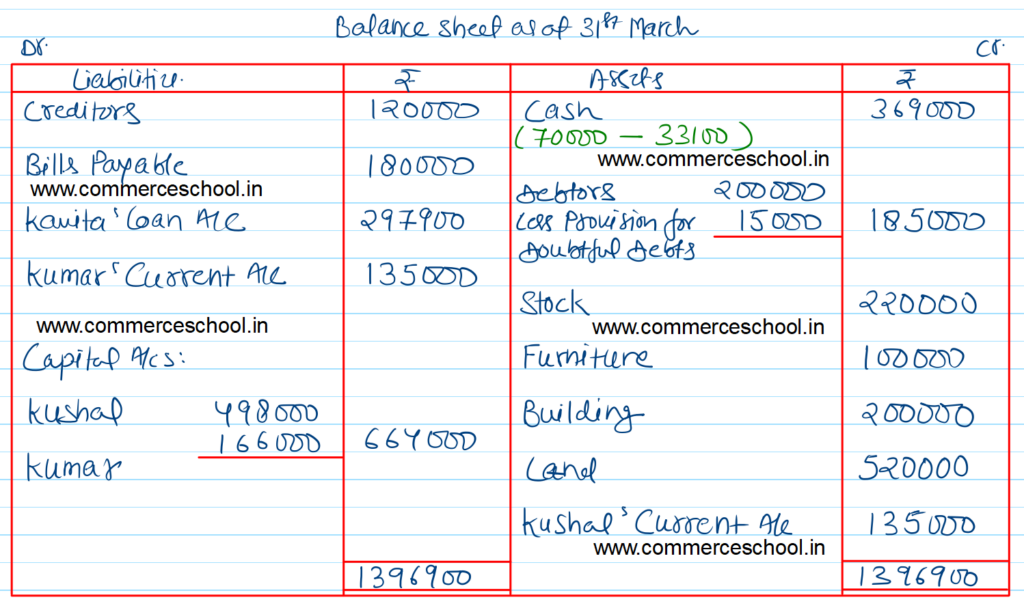

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of Kushal and Kumar after Kavita’s retirement.

[Ans. Loss on Revaluation ₹ 5,000; Kavita’s Loan Account ₹ 2,97,900; Capital A/cs: Kushal ₹ 4,98,000; Kumar ₹ 1,66,000; Current A/cs: Kushal ₹ 1,35,000 (Dr.); Kumar ₹ 1,35,000 (Cr.); Balance Sheet Total ₹ 13,96,900.]

Solution:-

good