Q. 63 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 63 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

A, B and C were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their books are closed on March 31st every year.

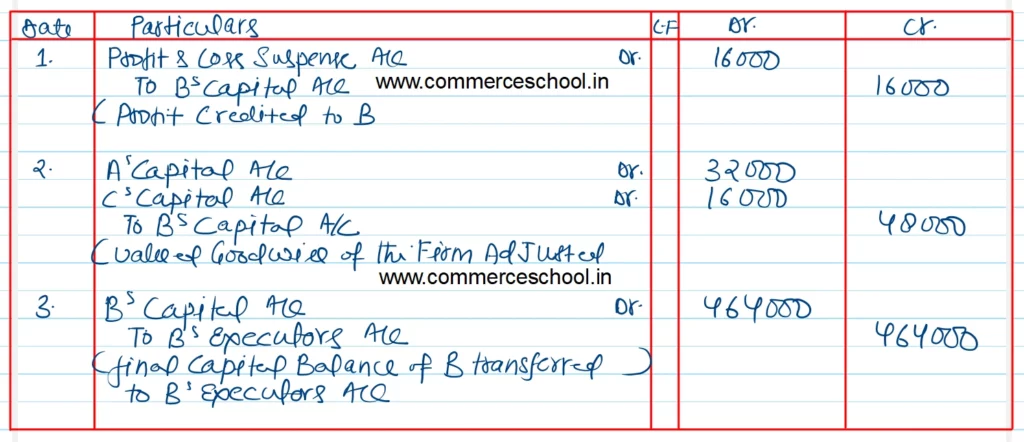

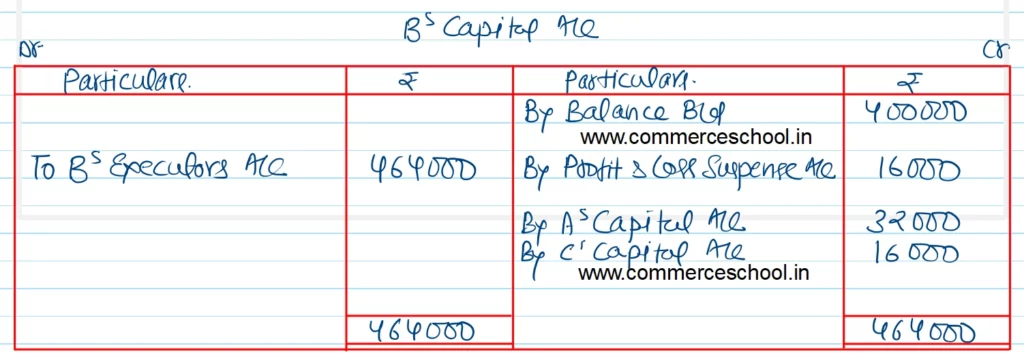

B died on 1st August, 2022. The executors of B are entitled to:

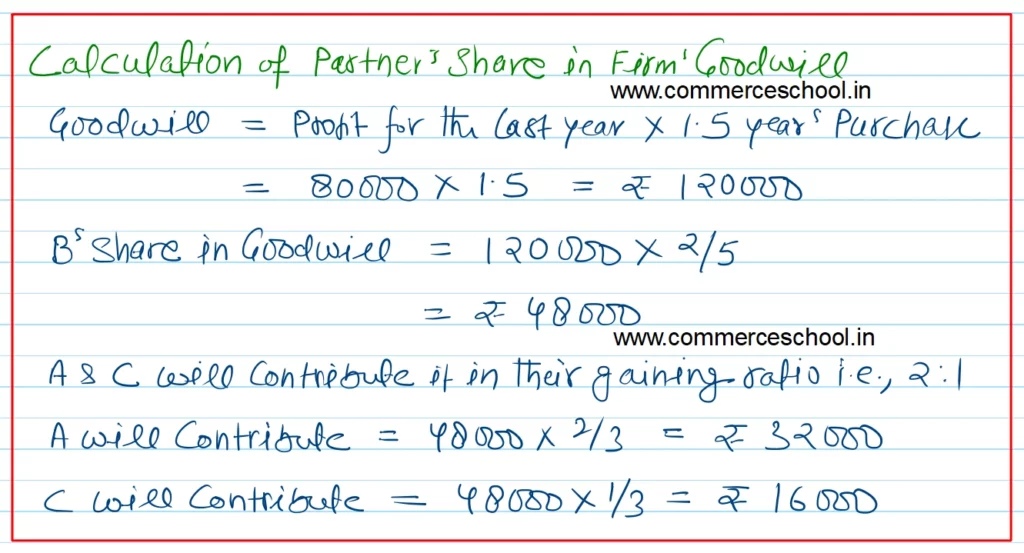

(i) His share of Capital i.e., ₹ 4,00,000 along with his share of goodwill. The total goodwill of the firm was valued at 1.5 year’s purchase of last year’s profit.

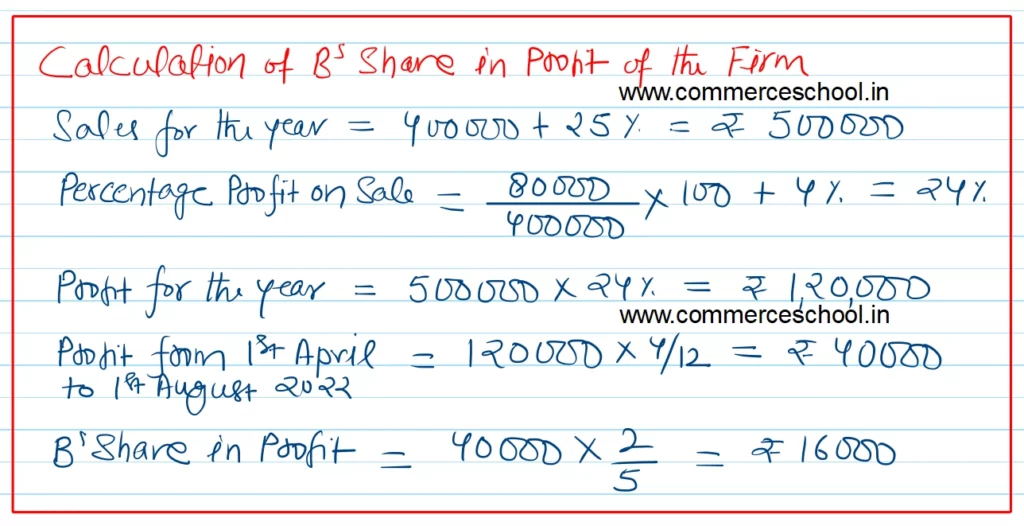

(ii) His share of profit up to his date of death on the basis of sales till date of death. Sales for the year ended March 31, 2022 was ₹ 4,00,000 and profit for the same year was ₹ 80,000. Sales shows a growth trend of 25% and percentage of profit earning is by 4%.

(iii) Amount payable to B was transferred to his executors.

Pass necessary Journal Entries and show the workings clearly.

[Ans. Amount payable to B’s Executors ₹ 4,64,000.]

Hints: B’s share of Goodwill ₹ 48,000; B’s share of profit ₹ 16,000.

Solution:-