Q. 64 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 64 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

The Balance Sheet of Sindhu, Rahul and Kamlesh, who were sharing profits in the ratio of 3 : 3 : 4 respectively, as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| General Reserve | 10,000 | Cash | 32,000 |

| Bills Payable | 20,000 | Stock | 88,000 |

| Loan | 24,000 | Investments | 94,000 |

| Capitals: Sindhu Rahul Kamlesh | 1,20,000 1,00,000 80,000 | Land & Building | 1,20,000 |

| Sindhu’s Loan | 20,000 | ||

| 3,54,000 | 3,54,000 |

Sindhu died on 31st July 2023. The Partnership deed provided for the following on the death of a partner:

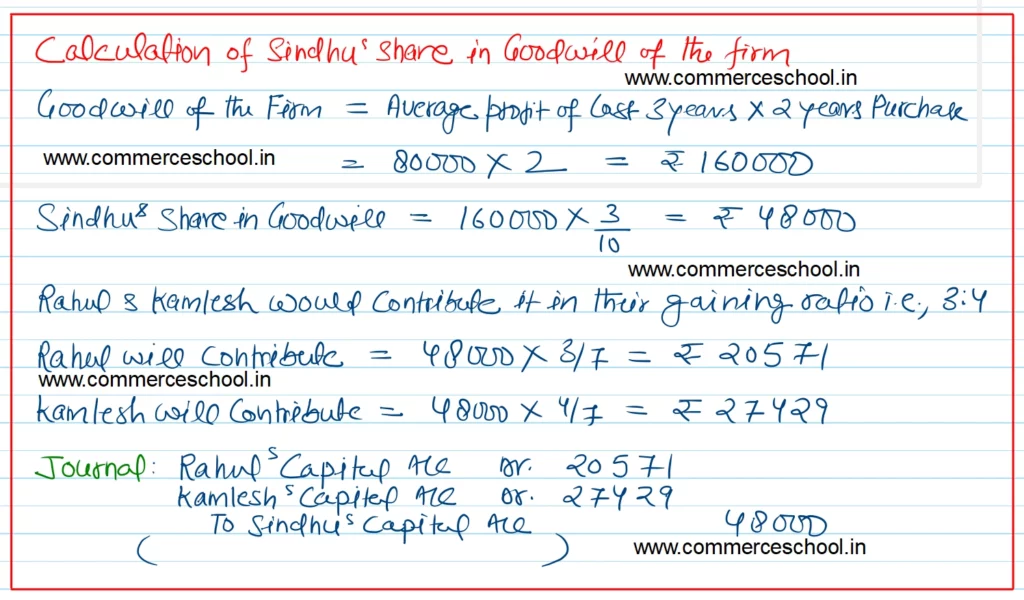

(a) Goodwill of the firm be valued at two year’s purchase of average profits for the last three years which were ₹ 80,000.

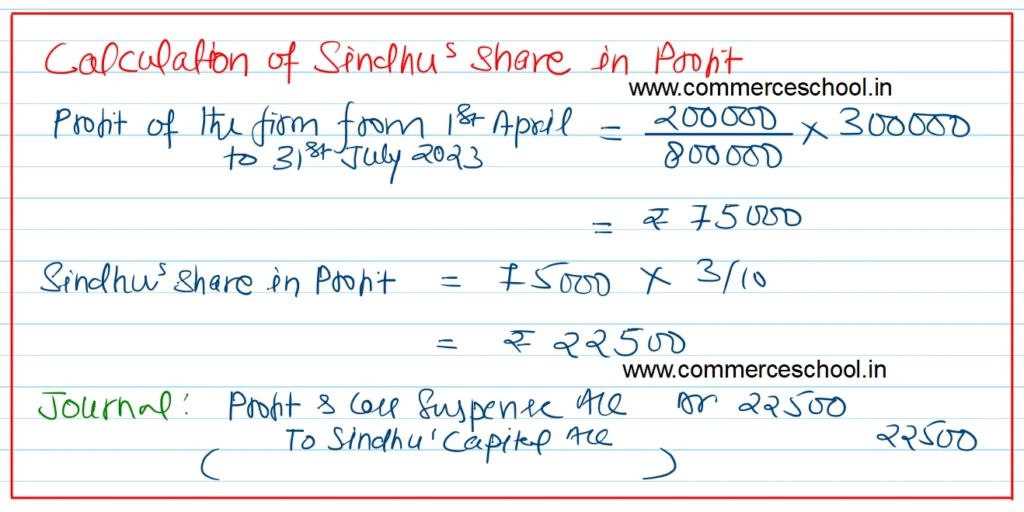

(b) Sindhu’s share of profit till the date of his death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2023 amounted to ₹ 8,00,000 and that from 1st April to 31st Julyy 2023 ₹ 3,00,000. The profit for the year ended 31st March, 2023 was ₹ 2,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

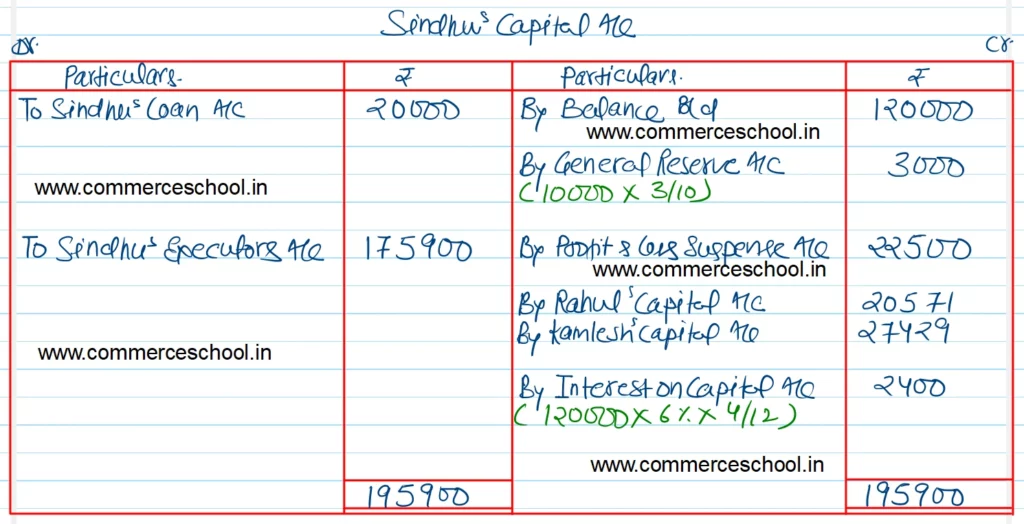

Prepare Sindhu’s Capital Account to be rendered to his executor.

[Ans. Balance due to Sindhu’s Executor ₹ 1,75,900.]

Solution:-