Q. 97 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 97 Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Krish, Vrish and Peter are partners sharing profits in the ratio of 3 : 2 : 1. Vrish retired from the firm. On that date the balance Sheet of the firm was as follows:

Balance Sheet as at 31st March, 2020

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 15,000 | Bank | 7,600 |

| General Reserve | 12,000 | Furniture | 41,000 |

| Bills Payable | 12,000 | Stock | 9,000 |

| Outstanding Salary | 2,200 | Premises | 80,000 |

| Provision for Legal Damages | 6,000 | Debtors 6,000 Less; Provision for Doubtful Debts 400 | 5,600 |

| Capitals: Krish Vrish Peter | 46,000 30,000 20,000 | ||

| 1,43,200 | 1,43,200 |

Additional Information:

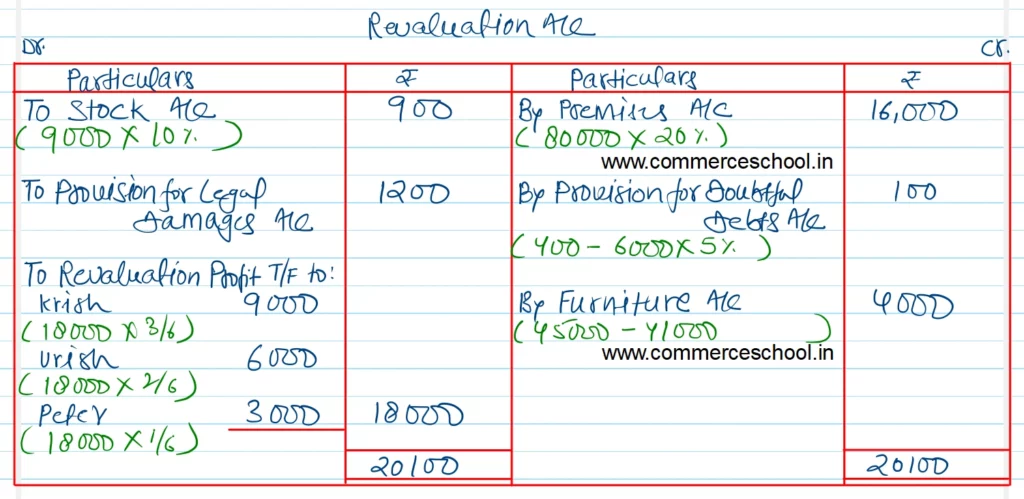

(i) Premises to be appreciated by 20%, Stock to be depreciated by 10% and Provision for doubtful debts was to be maintained @ 5% on Debtors. Further, provision for legal damages is to be increased by 1,200 and furniture to be brought up to ₹ 45,000.

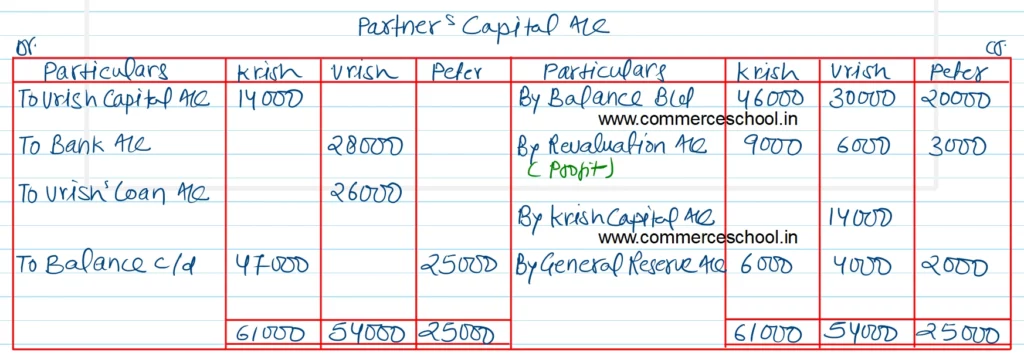

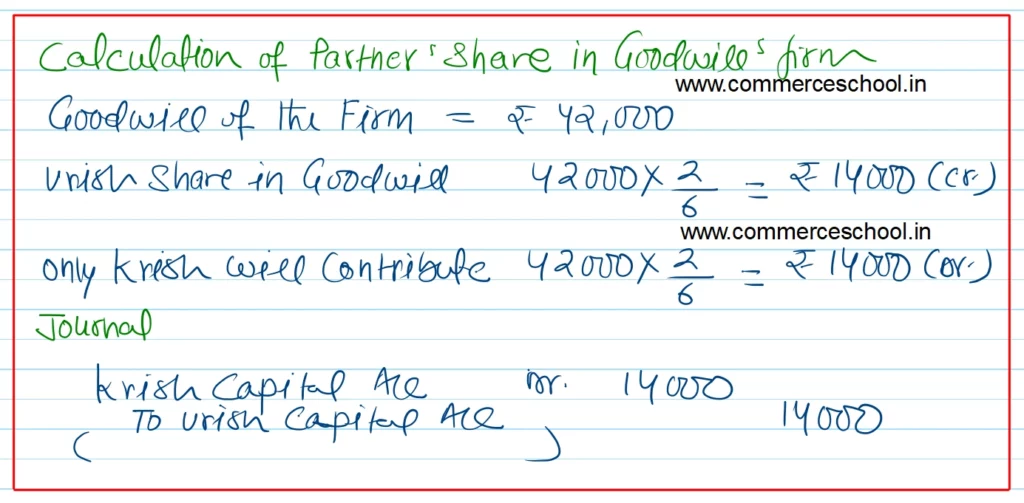

(ii) Goodwill of the firm is valued at ₹ 42,000.

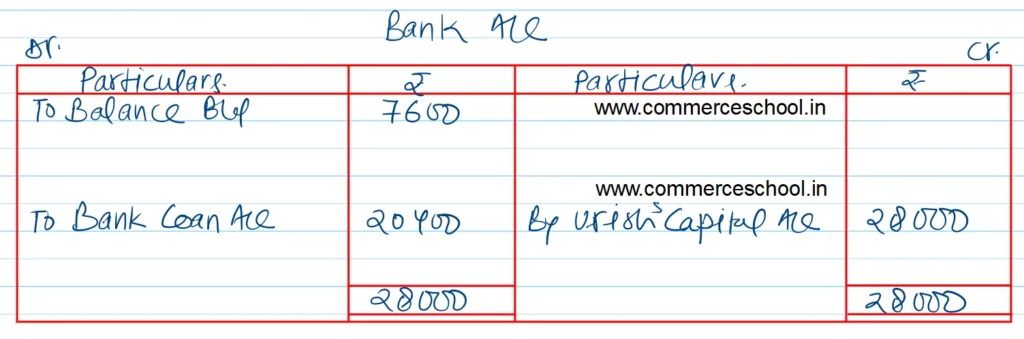

(iii) ₹ 26,000 from Vrish’s Capital Account be treansferred to his loan account and balance to be paid through bank; if required, necessary loan may be obtained from bank.

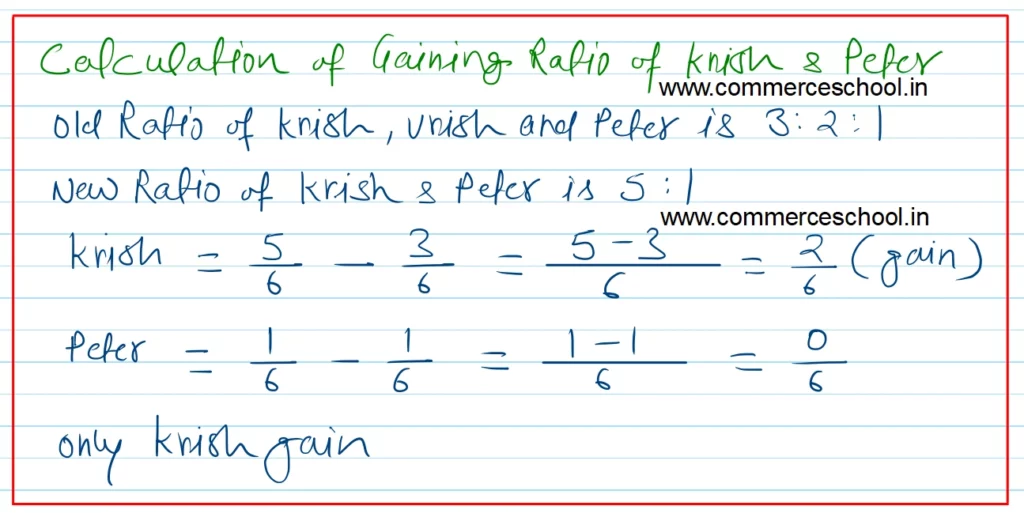

(iv) New profit sharing ratio of Krish and Peter is decided to be 5 : 1.

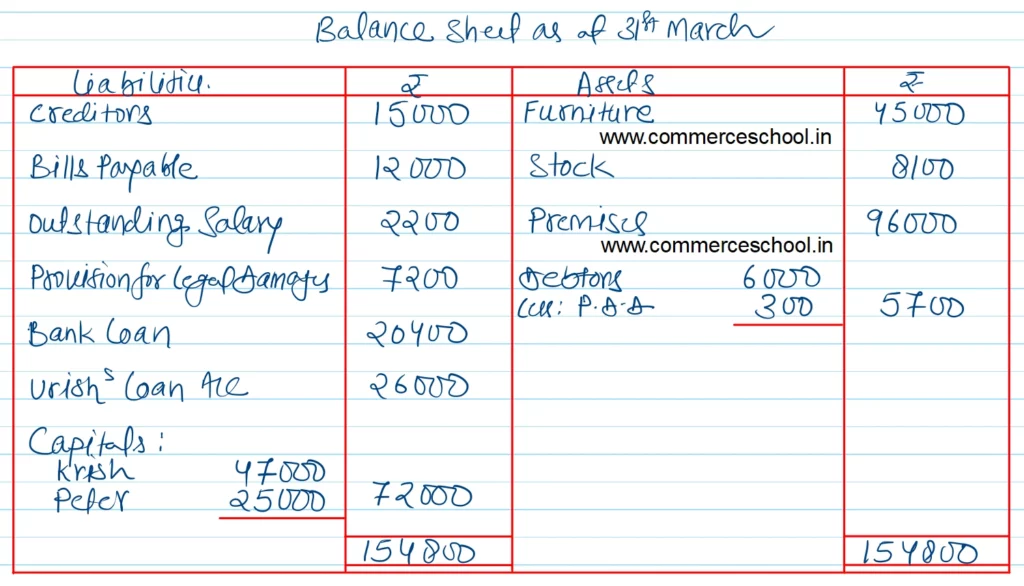

Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet.

[Ans. Gain on Revaluation ₹ 18,000; Net amount paid to Vrish ₹ 28,000; Balance of Capital A/cs : Krish ₹ 47,000 and Peter ₹ 25,000; Balance Sheet Total ₹ 1,54,800.]

Solution:-