Q. 98 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 98 Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Kavya, Manya and Navita were partners sharing profits as 50%, 30% and 20% respectively. On 31-3-2016, their Balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,40,000 | Fixed Assets | 8,90,000 |

| General Reserve | 1,00,000 | Investments | 2,00,000 |

| Capitals: Kavya Manya Navita | 6,00,000 5,00,000 4,00,000 | Stock | 1,30,000 |

| Debtors 4,00,000 Less: Provision for Bad Debts 30,000 | 3,70,000 | ||

| Bank | 1,50,000 | ||

| 17,40,000 | 17,40,000 |

On the above date, Kavya retired and Manya and Navita agreed to continue the business on the following terms:

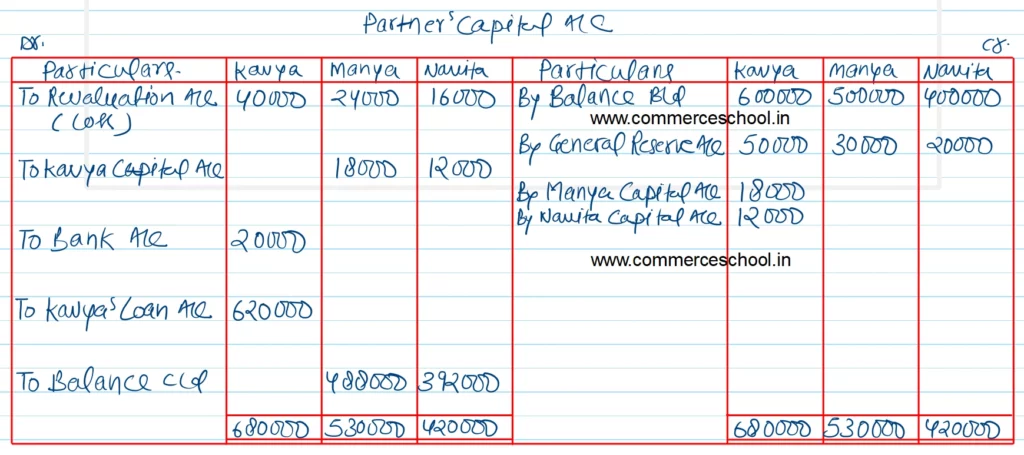

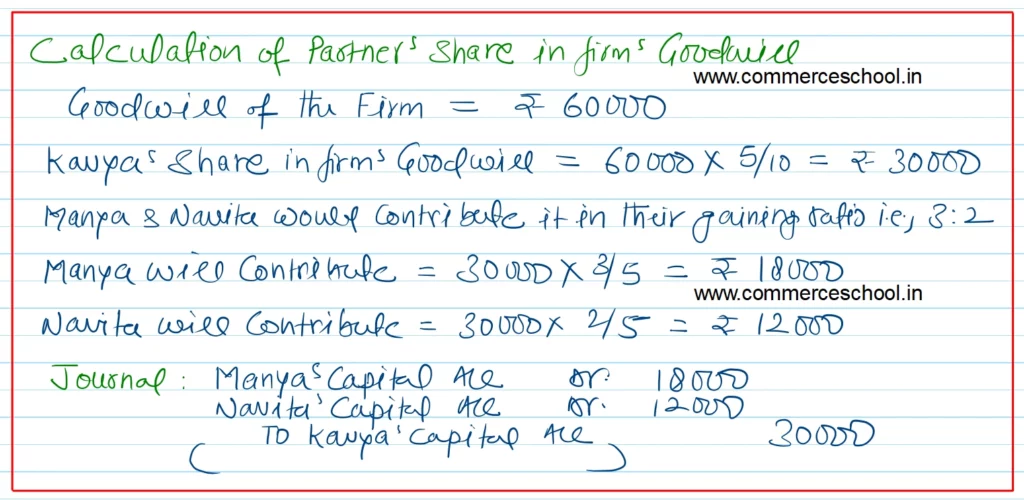

(a0 Firm’s goodwill was valued at ₹ 60,000 and it was decided to adjust Kavya’s share of goodwill in the capital accounts of continuing partners.

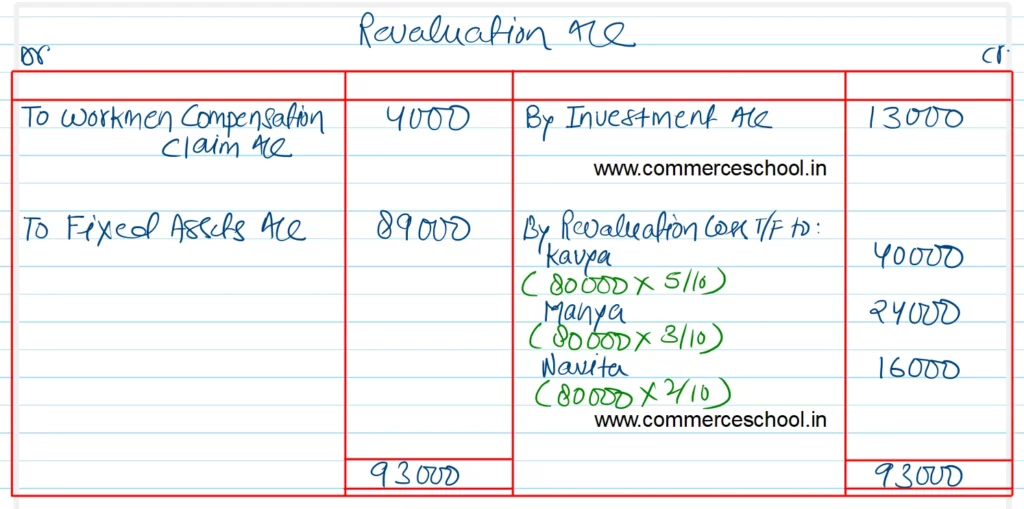

(b) There was a claim for workmen’s compensation to the extent of ₹ 4,000.

(c) Investments were revalued at ₹ 2,13,000.

(d) Fixed Assets were to be depreciated by 10%.

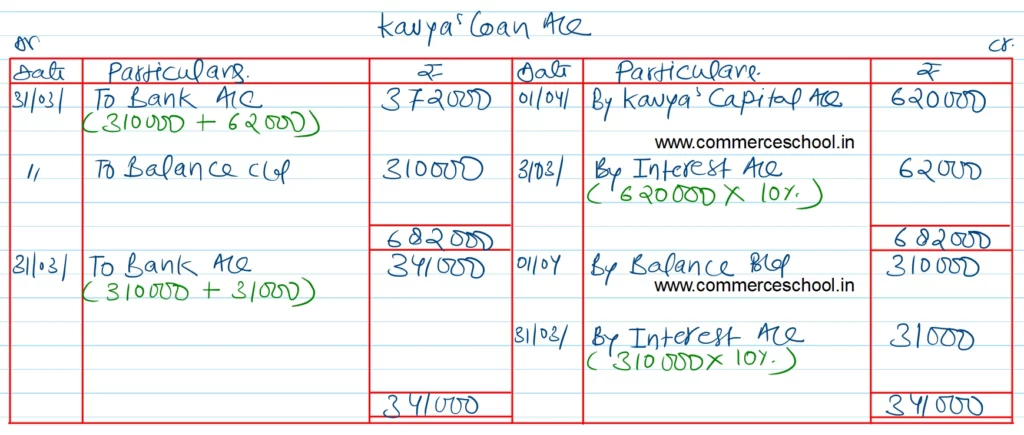

(e) Kavya was to be paid ₹ 20,000 through a bank draft and the balance was transferred to her loan account which will be paid in two equal annual instalments together with interest @ 10% p.a.

Prepare Revaluation A/c, Partner’s Capital Accounts and Kavya’s Loan Account till it is finally paid.

[Ans. Loss on Revaluation ₹ 80,000; Kavya’s Loan ₹ 6,20,000; Capital A/cs : Manya ₹ 4,88,000 and Navita ₹ 3,92,000.

Amount paid on 31st March 2017 : ₹ 3,10,000 + Interest ₹ 62,000.

Amount paid on 31st March 2018 : ₹ 3,10,000 + Interest ₹ 31,000]

Solution:-