Q. 99 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 99 Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Kanika, Disha and Kabir were partners sharing profits in the ratio 2 : 1 : 1. On 31-3-2016, their Balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors | 53,000 | Bank | 60,000 |

| Employees Provident Fund | 47,000 | Debtors | 60,000 |

| Kanika’s Capital | 2,00,000 | Stock | 1,00,000 |

| Disha’s Capital | 1,00,000 | Fixed Assets | 2,40,000 |

| Kabir’s Capital | 80,000 | Profit & Loss A/c | 20,000 |

| 4,80,000 | 4,80,000 |

Kanika retires on 1-4-2016. For this purpose, the following adjustments were agreed upon:

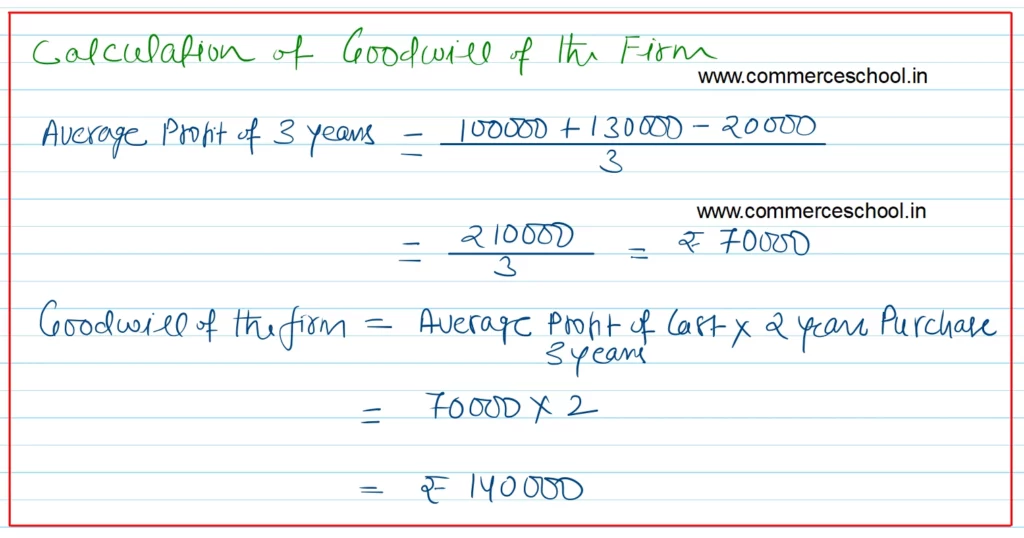

(a) Goodwill of the firm was valued at 2 year’s purchase of average profits of three completed years preceding the date of retirement. The profits for the year:

2013-14 were ₹ 1,00,000 and for 2014-15 were ₹ 1,30,000.

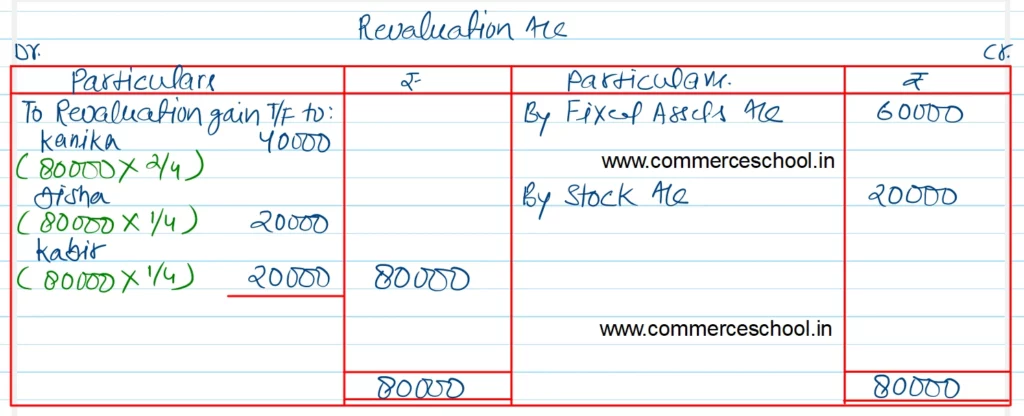

(b) Fixed Assets were to be increased to ₹ 3,00,000.

(c) Stock was to be valued at 120%.

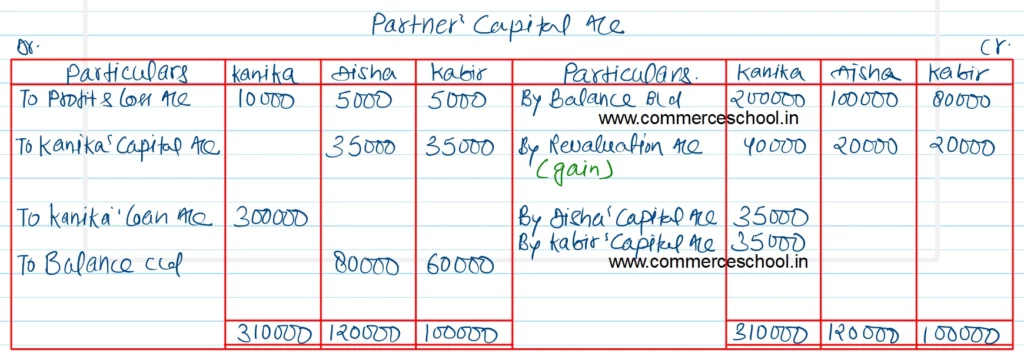

(d) The amount payable to Kanika was transferred to her loan account.

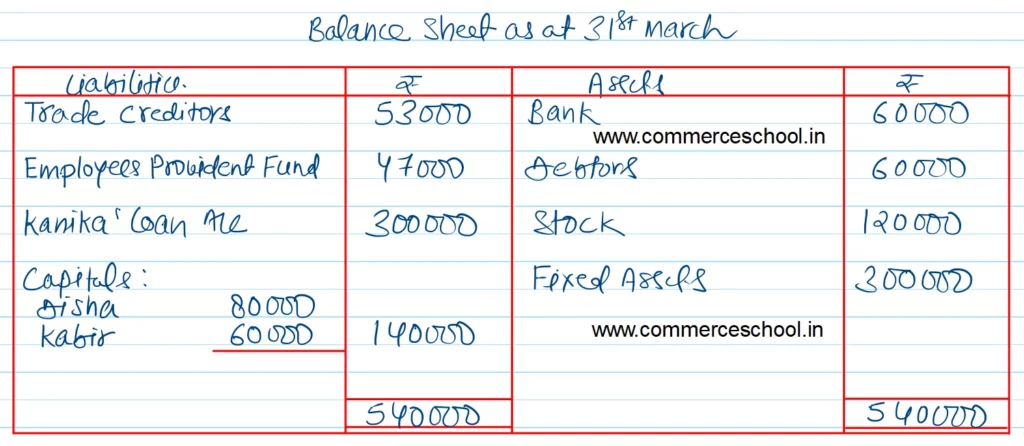

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of the reconstituted firm.

[Ans. Gain on Revaluation ₹ 80,000; Kanika’s Loan A/c ₹ 3,00,000; Capital A/cs Disha ₹ 80,000 and Kabir ₹ 60,000; B/S Total ₹ 5,40,000.]

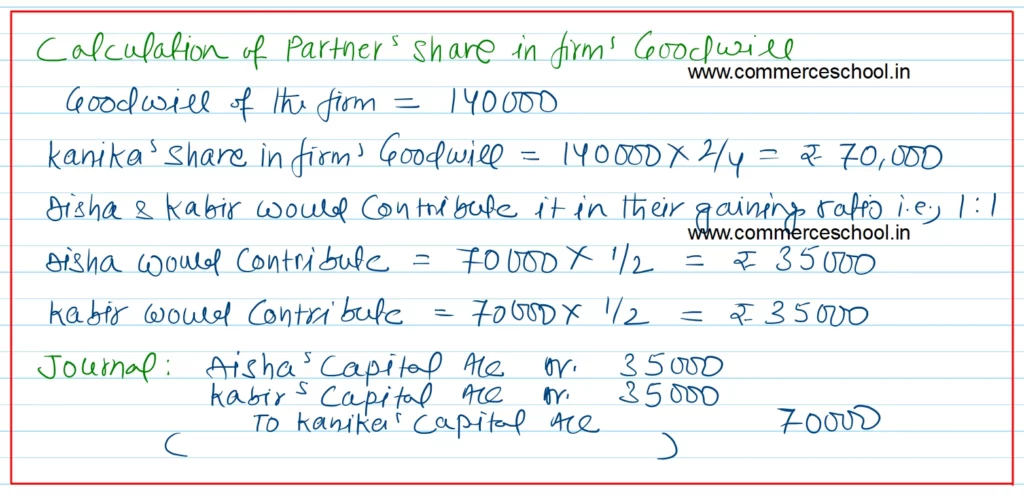

Hint: Kanika’s share of goodwill ₹ 70,000.

Solution:-